Jonathan Zittrain discusses the role that a common breed of junk mail plays in determining the actual price of stocks.

Topic: On Spam and the Stock Market

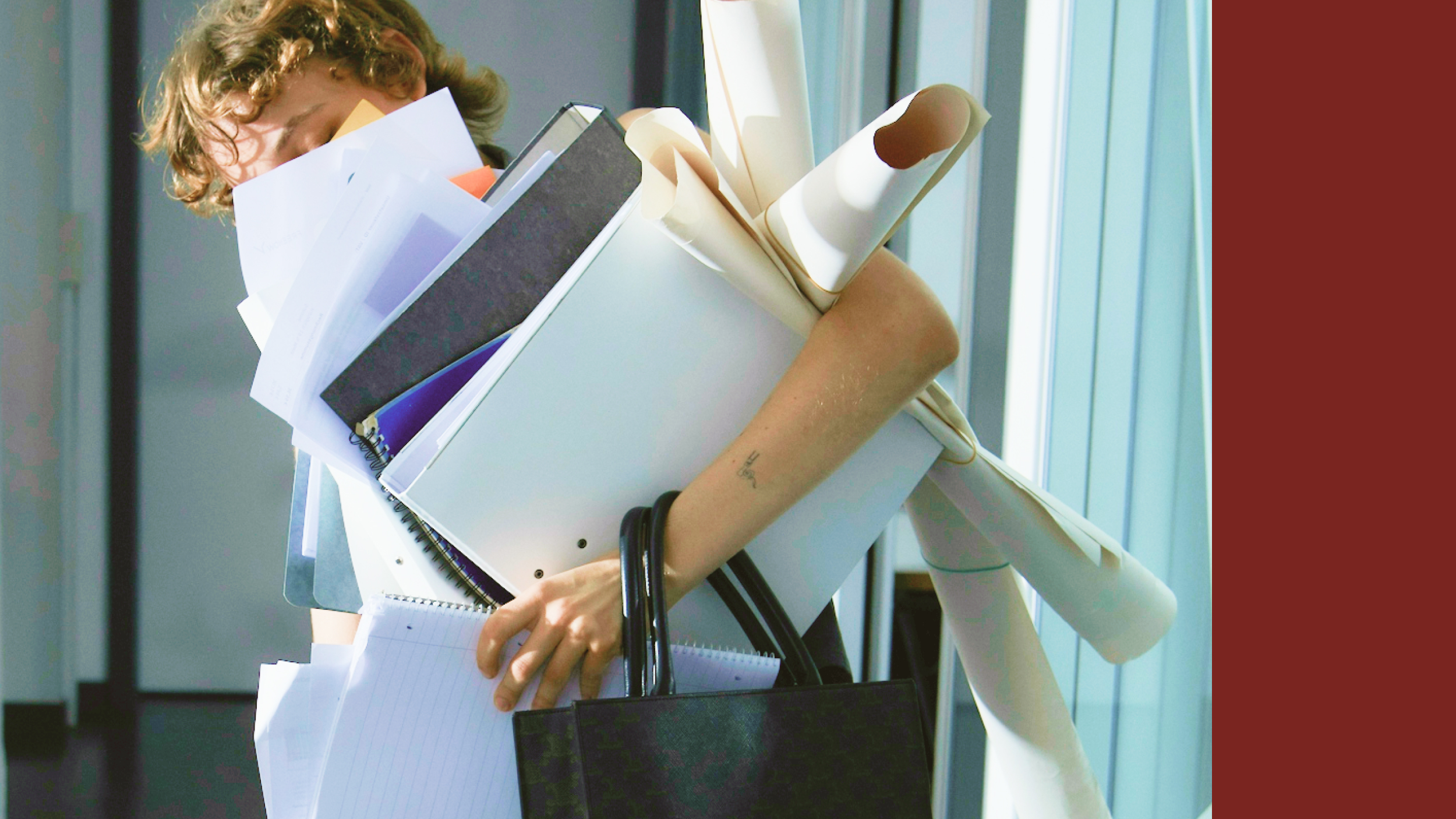

Jonathan Zittrain: With a colleague named Laura Freider, we had a big pile of spam and wanted to know something useful to do with it, and I was curious at that time, much of the spam was touting stocks. Go run out, buy this stock now, here’s your free newsletter. It’s hard to imagine anybody would go out and buy stock on the basis of a piece of spam they got and I was curious then, why are they still sending it?

So we actually ran a study to see, with the cooperation of Pink Sheets, which tracks many of these penny stocks in volume and price over the course of a day, whether we saw a correlation between the sending of these emails, we ending up accruing a pretty big database of them, and the movement of the stock price. And what we basically found was, yes, there is a correlation and if you buy the stock around the time that the email is sent, bad news, it’s already too late, the price is going to go down after you get it. But if you had had the foresight to buy it beforehand, i.e., you were the spammer, probably a pretty good idea, enough people will get it, either because they believed the stock newsletter, that this is a good buy, or because they believe enough other idiots will believe it that they just want to ride the wave, then you do well.

Now, I’ve anecdotally seen less stock spam lately, so perhaps those orchestrating it have moved on to a different business, but it does show that something like spam actually can have an affect, there’s still people out there reading it and perhaps acting upon it.

Recorded on August 18, 2009