China accounts for a growing percentage of the world economy and a substantial share of global economic growth. But do its currency and trade practices keep other countries from growing faster than they would?

Parag Khanna: Welcome to the Global Roundtable. This series focuses on the Future of the Economic Competition. I’m Parag Khanna joined by a distinguished panel including: Dambisa Moyo, Daniel Altman, and Anand Giridharadas. The topic we’re focusing on right now is China. Is it just the dragon of global growth or is it a drag on global growth? And I think this is a very worthwhile question to be asking because even though China represents a huge percentage of the global economic growth and a growing share of the global economy, it’s not necessarily doing it in all fair ways.

Daniel Altman: Well, there’s fairness and there are just economic impacts. I think China has had one big impact on poor countries around the world, which is, it’s very hard to climb the economic ladder the way you used to, which is by moving from agriculture into low cost manufacturing because China dominates that in a way no other country can. You have to look for much more niche industries now. But China is also investing a lot in countries around the world. The question is are its investments having sustainable long-term benefits for the communities where they do business? And a lot of people would say that they’re not.

Anand Giridharadas: The other thing its doing in a lot of developing countries whether we like it or now, is creating a competition of models, political models that hasn’t really existed in a very serious way for hundreds of years where in a number of countries in the world, in Africa, Latin America, etc., people are genuinely asking whether the Chinese system or the something like the American system is better for their country.

Parag Khanna: Still, aren’t some of these same emerging markets saying China is actually becoming a problem for us because they subsidize their industries and they manipulate their currency, and therefore, even though we are growing, Africa is growing, Latin America is growing, they could actually be growing even more if it weren’t for China actually out competing them.

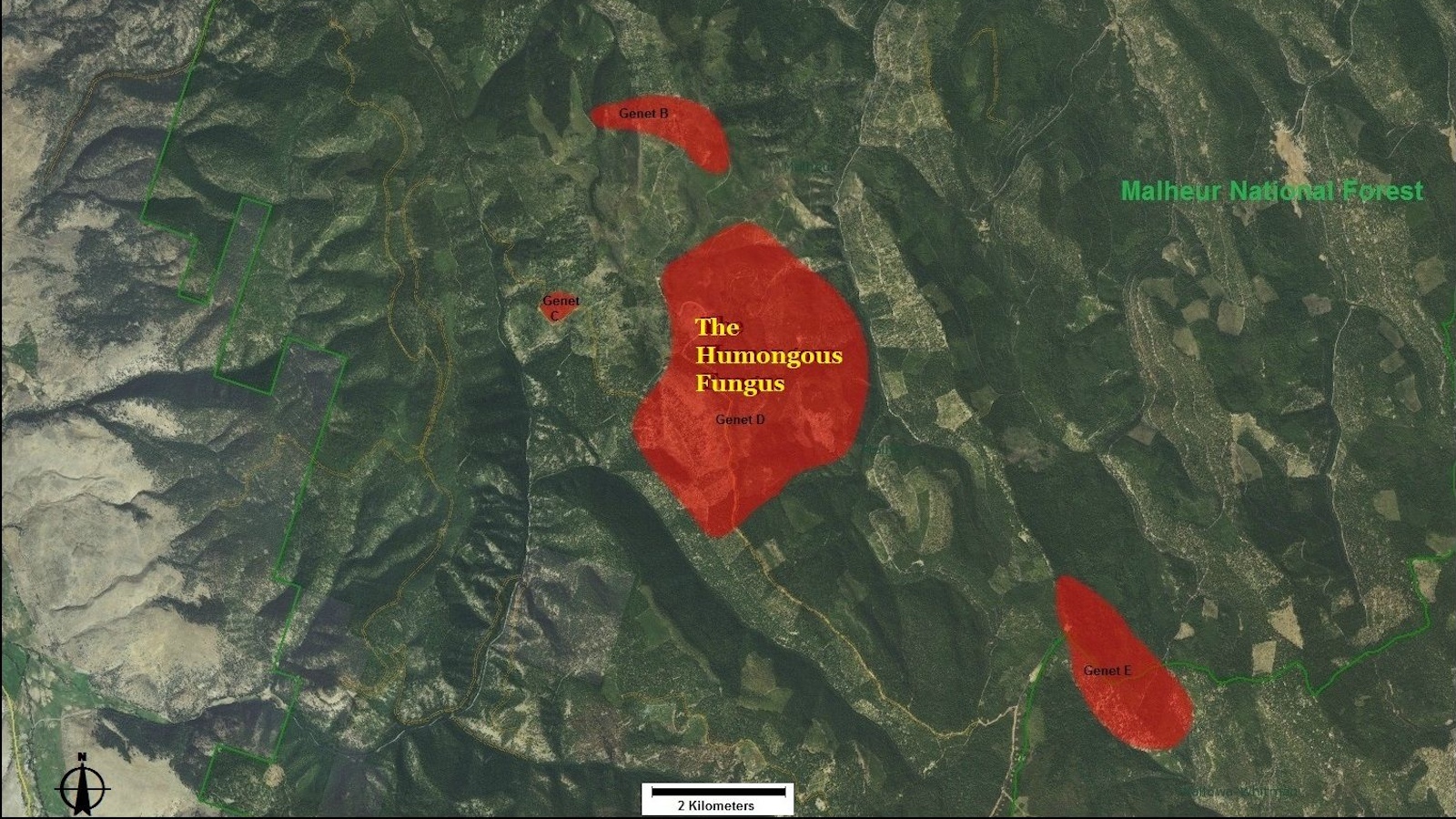

Dambisa Moyo: Well, I think that’s much more of a developed country argument against China. I mean, certainly there are issues. You think of China and Africa, there are certainly issues around labor laws, around environmental concerns, but fundamentally the amount of investment that has gone into Africa and into South America, even into Australia, which is the largest foreign direct investment recipient from China, it is clearly beneficial. You know, you look at a place like Africa, which is a billion people, represents just 2% of the world trade, it’s less than the trade of Spain. I mean the fact that now China desperately needs to purchase African agricultural goods is a real opportunity for economic growth with these economies, something we haven’t seen in a long time.

Anand Giridharadas: But this can put them into trouble too because if China starts handing out billion dollar checks to buy farms or other resources in poor countries that don’t have very good governments, that money is going to disappear and then what happens when there is a food shortage. The people in that country are going to turn around and say, “We’re not going to let the Chinese march with off all of our resources when we didn’t receive any benefit in return. We’re going to renegotiate these deals; we’re going to take it back.” And that’s going to create a new risk both for that country and for China.

Parag Khanna: And so there could be blow back, which could be very interesting. Because China is really come center stage as a world super power, but it hasn’t experienced blow back in any of these interventions or any of these roles.

Dambisa Moyo: Absolutely. And what you’re talking about essentially is, one of the most brilliant strategies the Chinese have implemented, which is this idea of symbiosis. It’s not just in the emerging world; they’ve done exactly the something in the United States. They’ve lent money to the United States and in return have gotten access to precisely what America does in terms of resources, which is the American consumer.

Anand Giridharadas: I think there is something very patronizing in a way about a lot of the way that we talk about China in this country, which is a complete amnesia about what we were like when we were a country at China’s level of GDP trying to kind of flex our muscles on the world stage for the first time, being a little maladroit about that, doing a lot of shady deals, having a lot of corrupt people in our country. And then you clean it up as development goes on, hopefully. I sometimes think we are very unempathetic about what a lot of the countries who are on a fairly similar road are going through.

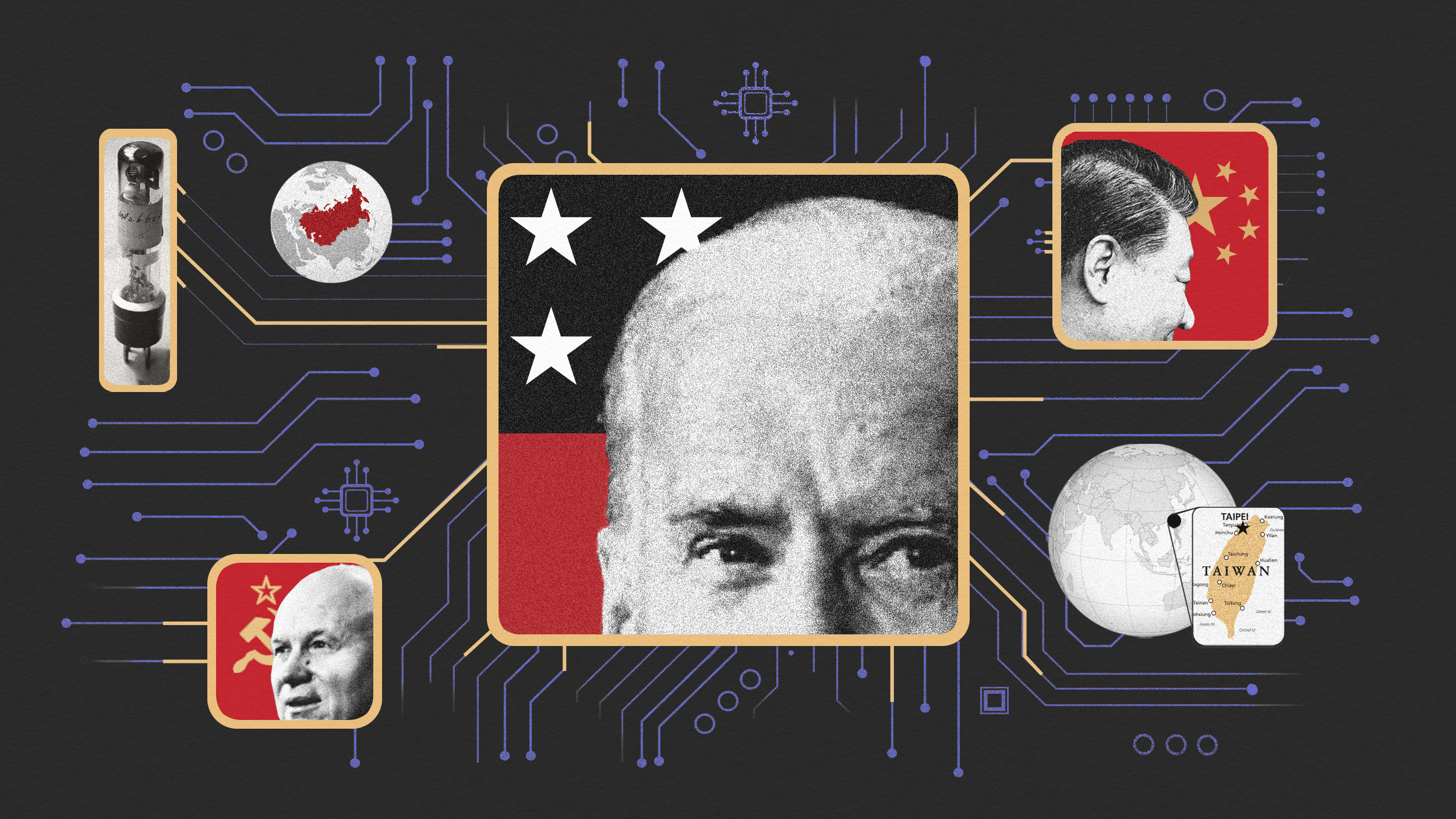

Daniel Altman: But think about a former economic superpower that used to do things very differently. And I’m thinking of the USSR. They would make big investments around the world in the countries that they hoped to cultivate as client-states, but they always built capacity because they wanted to make the sharpest and strongest possible bonds that they could with those countries. They helped those people in those countries to learn new professions, to have the capacity to grow on their own. And that’s where I think China’s falling down a little bit.

Parag Khanna: I think it’s a sign of just how central China has become to the global economy that we can have so many different perspectives on exactly what that role is going to be and how it’s going to evolve. But one thing is for sure, China is absolutely going to be central to the future of economic competition. Thanks so much for your insights. More on China, global economic competition and other topics at BigThink.com.