Our big bank failed us during COVID. This small bank was there to help.

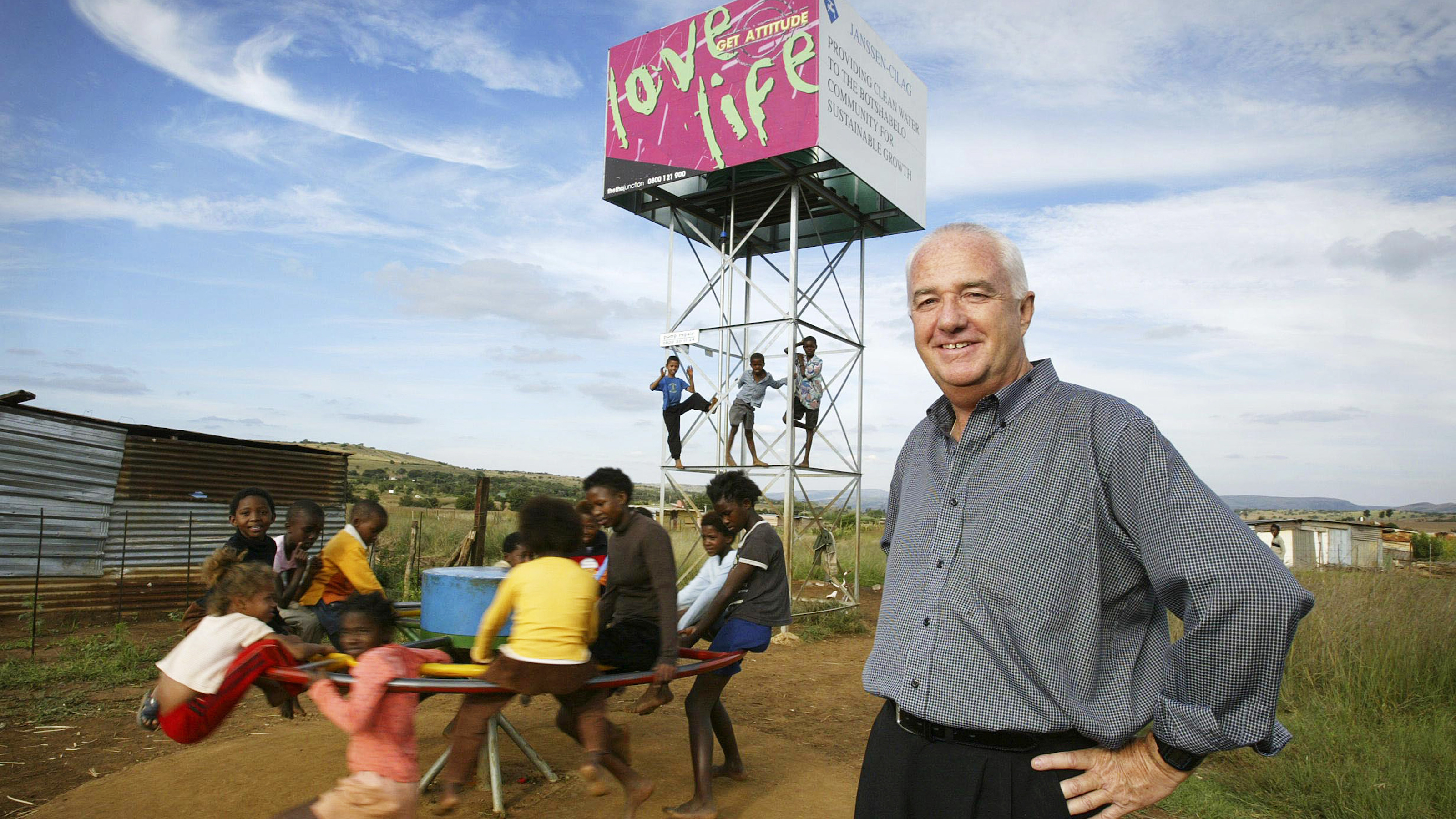

Photo: Victoria Montgomery-Brown / Big Think

- Victoria Montgomery-Brown, CEO of Big Think, explains what it took for Big Think to get approved for the COVID-19 Paycheck Protection Program (PPP).

- Where big banks failed to assist or even acknowledge applications, a small bank and an incredible banker, Frank Terraferma, came through.

- People like Frank, and his colleagues, are the ones helping ordinary people and ordinary businesses to weather this crisis, writes Victoria.

I’m a small business owner in New York City. Until the CARES Act was passed, which offered loans to small businesses affected by the COVID-19 crisis, I’d forgotten my bank existed, except for the occasional phone call when it asked me to up my business credit limit.

Our company is not made of VC stardust, and as much as I’d like to help an international banking conglomerate by pushing my company deeper into debt, I passed on the opportunity. Passing gets easy when the bank requires you to be personally liable for business credit.

So yes, I’m in business. I have a business partner. We have employees. We rent office space in the nation’s most expensive real estate market. And we have been clients at JP Morgan Chase for 13 years.

When New York City became the epicenter of a global health pandemic, everything stopped. Our clients’ budgets froze, our budgets froze, and on down the line. Safety and saving lives were everyone’s immediate concern. There could be no disagreement on that. Eventually, we also had to make sure our company was going to meet its obligations.

In the Wild West of financial crises, you meet heroes and you meet villains.

The Paycheck Protection Program was a welcome sign, and a way we could afford our employees some stability. The reality is that this is going to be a punishing time for business. Putting employees first is the right thing to do, and payroll support is the right place to start.

We knew applying immediately was a must. On April 3, my business partner, myself, and our accountant were ready to submit our PPP application online. Our bank, which is the nation’s largest bank, did not accept loan applications until April 7. It wasn’t taking applications from us, anyway, and my emails to the bank went unanswered. Just no reply at all.

During those four days, I kept remembering news from the financial crash, when Too Big to Fail meant you were an essential business in a pejorative way. We’d really like to be rid of you, but you’ve got us by the balls. Now as a client of Too Big to Fail, we were Too Small to Matter to them.

We submitted our documents to Chase, but its website crashed, leaving us wondering if we’d even applied. An entrepreneur friend, Melissa, asked her lawyer for help, who sent us to a banker named Frank Terraferma, which is his actual name, at International Finance Bank. Based in Florida, where Frank lives, it also has a Manhattan banking center.

In the Wild West of financial crises, you meet heroes and you meet villains. Frank Terraferma didn’t want to be a hero, but that’s the hero’s lot. Between April 9 and 13, Frank called or emailed every day with updates about our application, which his bank had filed. The PPP is a loan with 1% interest, so banks aren’t getting rich by servicing them. When Frank said he cared about saving people’s jobs, I believed him.

Thanks to Frank’s help, our business got approved in the first round of PPP. On April 13, I emailed my other bank to withdraw our application, uncertain if we’d even filed one. And wouldn’t you know it, this got their attention. I finally got an email reply. Whatever.

During two weeks of back and forth with the Small Business Administration, Frank became a tireless advocate for a business he didn’t know and employees he’d never met. He delivered high-touch, personal service. He showed the good in people, and how helping in times of need is a renewing force. By the time our loan was ready to be processed, and because we’re all living out scenes from a Russian war novel right now, I was staying in a friend’s garage in St. Petersburg, Florida.

So on a late Friday morning, I met Frank, and a traveling notary, in a St. Petersburg parking lot where I signed the final loan documents on the hood of his car. Standing six feet apart from each other at all times, he helped give our business a life line, and I’m grateful for his gesture, his energy, and his caring.

People like Frank, and his colleagues, are the ones helping ordinary people and ordinary businesses to weather this crisis. We always need more of them.