7 great economists and how their ideas still affect us today

Economics has a reputation as “the dismal science” — but at its most elegant and foundational, the discipline can be invaluable, revelatory even. Here, we look at some of the all-time great economists and how their genius uncovered the societal mechanisms that connect all of us.

Adam Smith

Adam Smith was an 18th century Scottish economist and philosopher. Widely considered “The Father of Economics,” his book An Inquiry into the Nature and Causes of the Wealth of Nations is arguably the most influential book in the field’s history. Former British Prime Minister Margaret Thatcher was rumored to have kept a copy in her handbag.

Smith’s ideas are now so widely accepted in economics that it is difficult to understand how revolutionary they were at their inception. For example, he saw the division of labor as the key driver of productivity, which was in turn driven by competition.

While he was skeptical of the virtues of self-interest, he did maintain that in a market system, the so-called “invisible hand” would tend to direct the pursuit of selfish ends toward the common good. He also touched on the cornerstone notions of supply and demand, the tendency of markets to move toward equilibrium, and the labor theory of value.

For many economists Smith is the OG — his hugely influential work remains among the foundational works of capitalism and our understanding of how it functions.

David Ricardo

David Ricardo was a British political economist and Member of Parliament who picked up where Adam Smith left off. He supplemented Smith’s notion that the value of a product was closely related to the amount of labor that went into producing it by highlighting the importance of other factors, such as the difficulty of the labor involved and the tools required to do the work. However, he broke with Smith on the question of central banking and instead argued that central banks could benefit economies.

His most famous idea is a theory of international trade exploring comparative advantage — the situations in which goods can be made at a lower opportunity cost than in other countries. He argued that countries should maximize production in industries where they have certain advantages — say, a large supply of a given natural resource — and trade for the other things they need, famously illustrating his theory with an example of the trade of cloth and wine between England and Portugal.

This argument has been refined, critiqued, and reinterpreted over the last two centuries. Nevertheless, the basic idea — that trade is generally good even when the two countries involved are not very similar — is widely accepted.

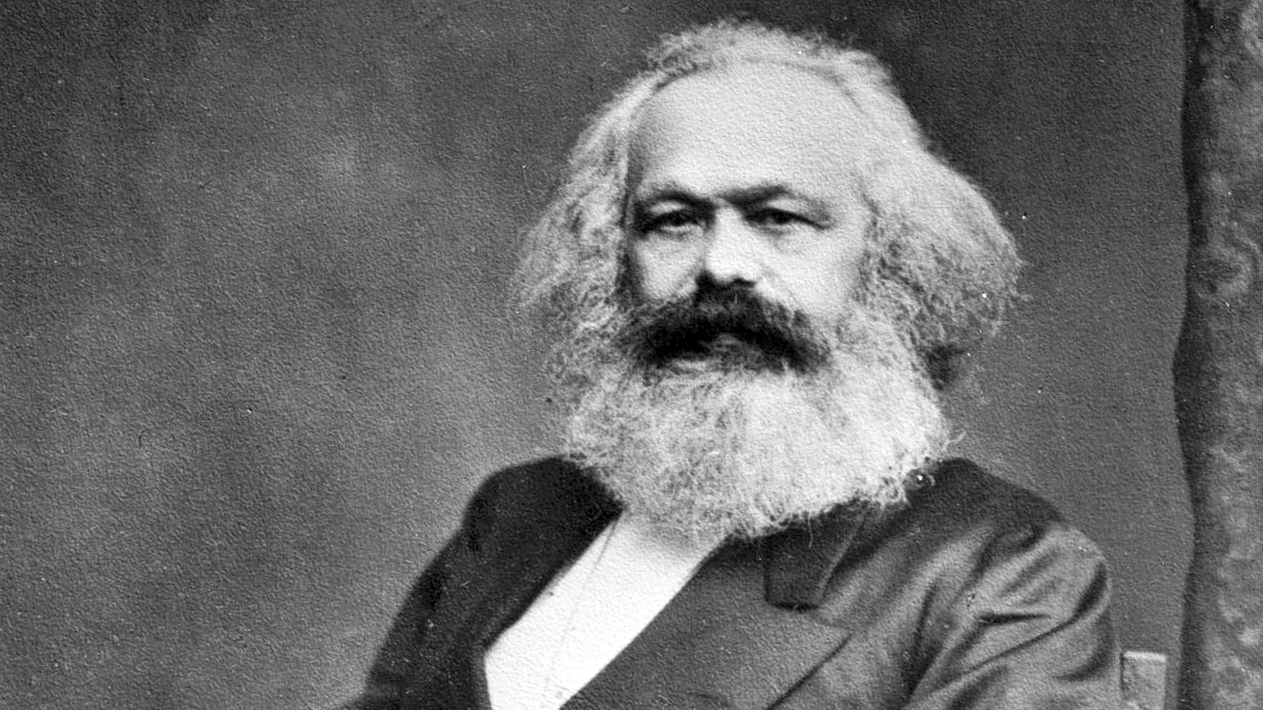

Karl Marx

The father of communism was a philosopher, economist, journalist, historian, and revolutionary. In his economic thinking — crowned in print by his magnum opus, Capital: A Critique of Political Economy — Marx focused primarily on capitalist economies.

He wrote around 10,000 pages on economics but, as a result of his often haphazard working methods and unfinished projects, only a fraction of his ideas have survived on paper.

He expanded on the labor theory of value in ways that went beyond the ideas of Ricardo and Smith, and his explorations of the concept would later fuel its replacement. He argued that some of the problems then affecting capitalism — like the concentration of wealth, low wages, major recessions following booms, and terrible workplace conditions — were features rather than bugs in the system.

Some of his ideas, such as his takes on the business cycle, have been revised and are seen as useful descriptors of how capitalism functions, even if card-carrying Marxist economists are currently in low demand.

John Maynard Keynes

It is impossible to talk about modern capitalist economics without discussing John Maynard Keynes. Active during the Great Depression, he sought to explain what had gone wrong with the global economy and how to address it. As a result, the “Keynesian Revolution” in economics would be credited with helping to end the depression and driving the decades-long post-war boom.

Keynes turned economics on its head when he argued that aggregate demand — the whole of spending on goods and services in a society — was the primary force that moved an economy. Before Keynes, most economists worried about supply, with the idea that increasing supply would lower prices and stimulate demand as goods became cheaper. He argued that in some cases (particularly rapid shocks, like the Great Depression), this wouldn’t happen. In those moments, the government could step in and create demand through increased spending.

Famously, he focused almost exclusively on short-run economics. He illustrated his concerns for the short-term when he reminded us, “In the long run, we are all dead.”

Some of these ideas were already floating around, but Keynes coalesced them into one general theory of how the economy works. While interpretations of that theory vary, his influence on mainstream economics endures. The current economic orthodoxy rests on a fusion of ideas from the Keynesian school and the neoclassical school, the latter placing a high value on modeling how rational, well-informed individuals inside a market system will try to maximize their gains and minimize their losses.

Paul Samuelson

Paul Samuelson was an American economist who won the 1970 Nobel Prize in Economics. Samuelson helped establish modern mathematical foundations for economics and wrote the canonical textbook Economics: An Introductory Analysis. His work was instrumental in co-establishing the Neo-Keynesian school of thought, alongside that of John Hicks and Franco Modigliani.

His mathematical approach to economics helped raise the bar for analysis by introducing ways to represent theories and problems. It is similar to how physics textbooks use mathematical formulas to explain how objects move, and it allows for much stronger estimates of how an economy will be affected by change than was previously possible. He also boosted and enhanced the idea of the Phillips curve —the observation that inflation and unemployment rates tend to move in opposite directions.

The Neo-Keynesian school of thought was eventually fused with various neoclassical ideas to become the leading theory of economics today.

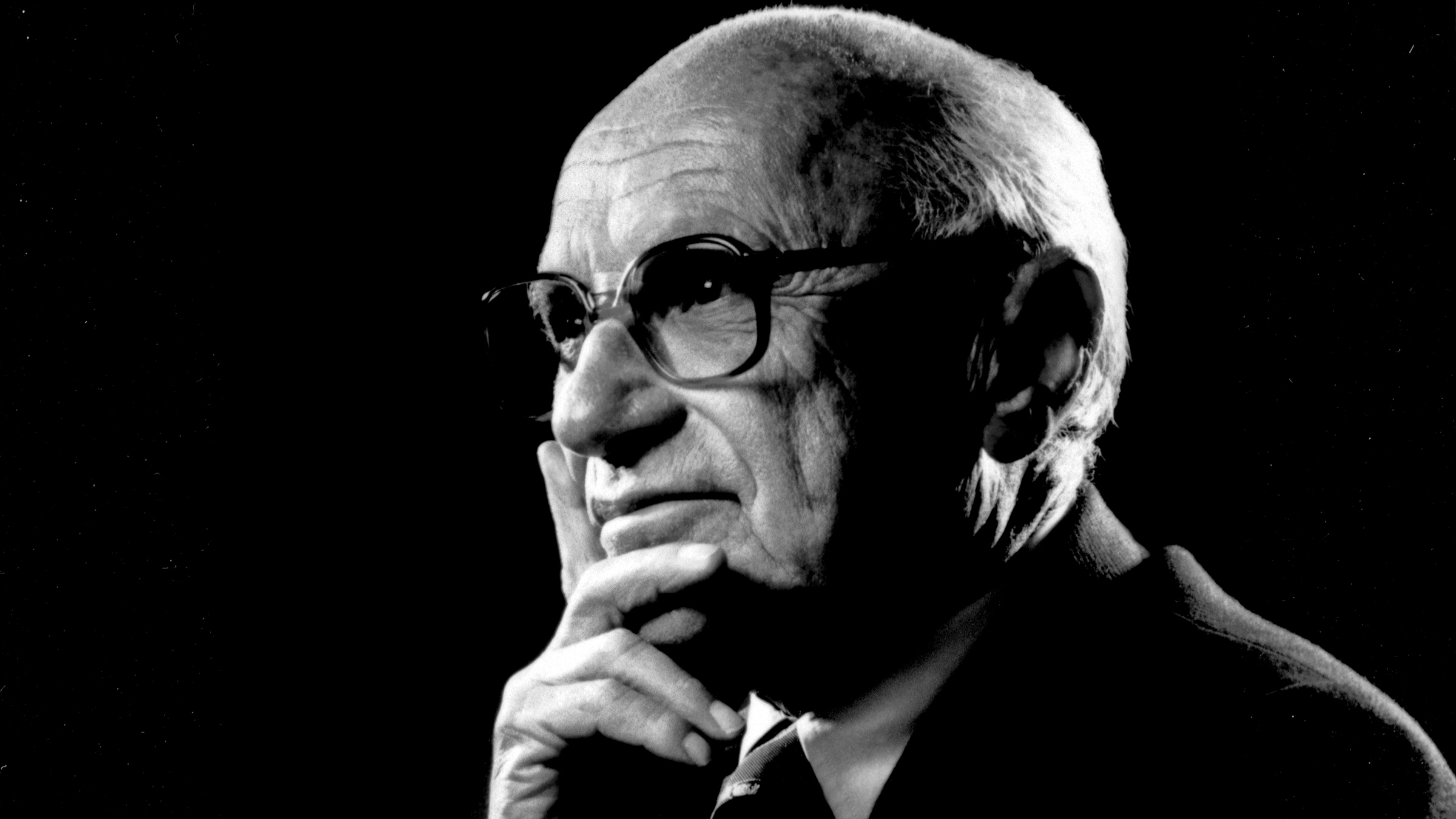

Milton Friedman

Co-winner of the 1976 Nobel Prize in Economics, advisor to two presidents and a prime minister, and leading proponent of the Chicago School of Economics, Milton Friedman is most famous for his Monetarist thinking.

He and those associated with this school argue that the size of the money supply is the most important aspect affecting the rate of inflation and aggregate demand. Working with others, he posited there was a “natural rate of unemployment” below which high inflation was all but inevitable. He also offered an explanation for stagflation (the supposedly impossible combination of high inflation and unemployment).

While it took some time, Friedman and his supporters gained mainstream acceptance following the failure of the orthodox economists to explain the economic problems of the 1970s. While the pendulum has swung back toward Keynesian thought over the last decade, his ideas remain influential. Friedman also proposed his own version of a guaranteed income plan.

Amartya Sen

Amartya Sen is an Indian economist and philosopher. Born in West Bengal, India in 1933, he is currently working at Harvard University. Sen co-created the Capability Approach to economics with philosopher Martha Nussbaum. This method examines not only how money moves in an economy but what the people in that economy can actually do with it. In this way, the idea shifts the focus of economics from resources to people.

To illustrate, consider Sen’s example of two individuals making the same amount of money, but with two different levels of physical ability. While they might be equal in some ways, their society might make them unequal in others — by failing to provide, for example, wheelchair ramps. In a way, Sen’s thinking is about what kind of life a person can hope to live rather than just how much income they report.

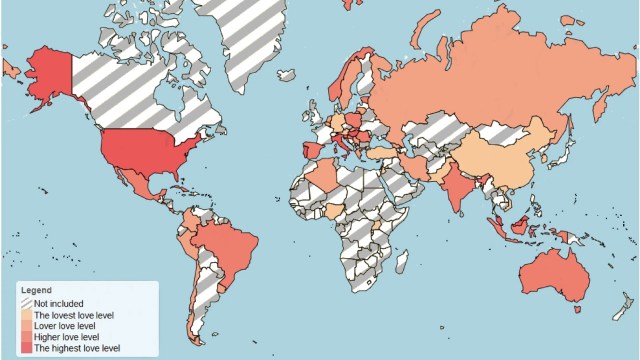

This theory is the foundation of the Human Development Index, co-written by Sen and Mahbub ul Ha, which is used by the United Nations to rate countries on characteristics such as life expectancy, education, and standard of living. It takes the central idea of the Capability Approach — that there is more to how well a person is doing than how much they earn — and applies it to the scale of nations.