Conformity be damned: How to crack the “black sheep paradox”

- The “black sheep paradox” holds that — to achieve success — one must resist the temptation to follow the successful herd.

- Throughout history, some of the most successful individuals, companies, and technologies began as black sheep.

- A few simple practices can help you become an independent thinker: Deep learning, diverse learning, and writing.

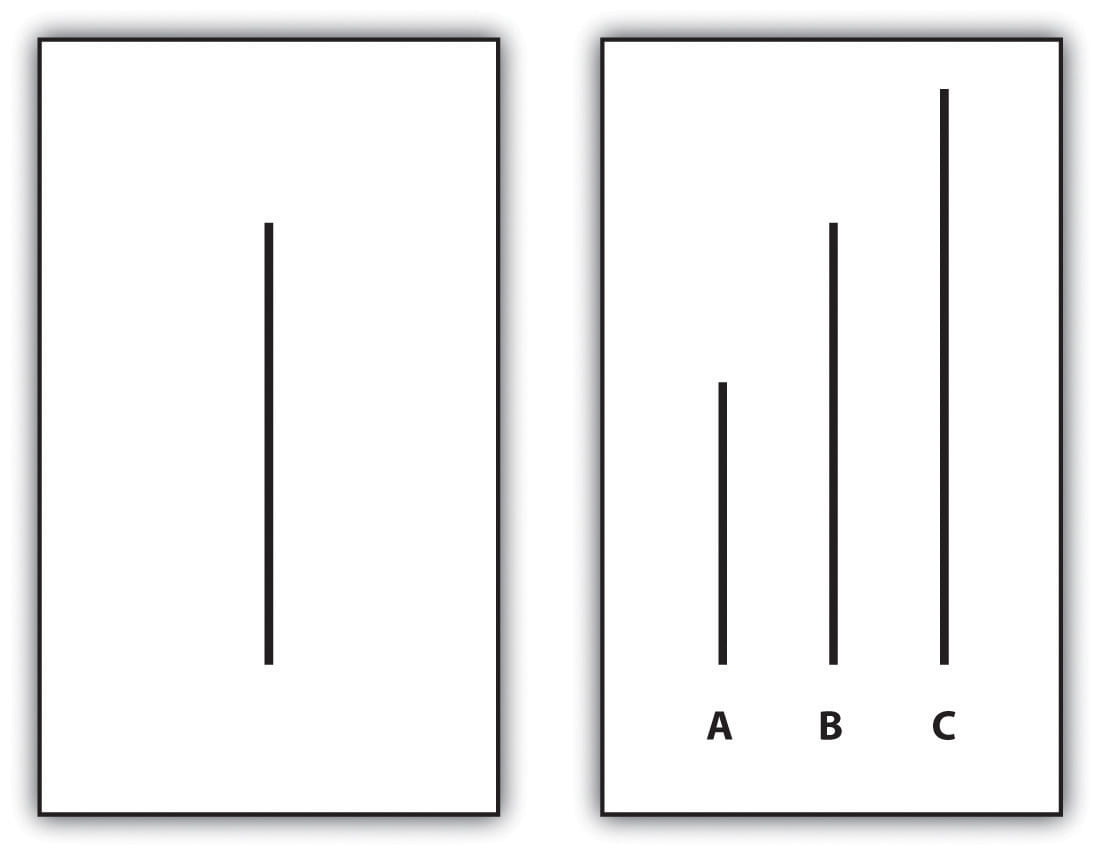

In 1951, Solomon Asch, a social psychologist from Poland, set out to understand our uniquely human desire to fit in among the crowd. In his first “conformity study” at Swarthmore College, he assembled groups of eight young men and presented each group with two simple pictures. The images looked something like this:

Next, he’d go around the room and ask the participants which of the three lines on the right — A, B, or C — matched the single line on the left. Easy, right?

Yes, but there was a catch: Seven of the young men were “actors,” who would deliberately and confidently offer the wrong answer. When it came time for the subject (aka “the stooge”) to answer the question, Asch made a startling discovery: despite knowing the obvious correct choice, most of the young men would answer incorrectly to conform to the group.

Over several replications of the study, Asch found that a breathtaking 75% of participants would conform at least once. Later, Asch remarked: “That intelligent, well-meaning young people are willing to call white black is a matter of concern.”

The Asch experiment is an instructive metaphor for life: independent thinking is a critical skill set in an environment that’s increasingly noisy and filled with misinformation. Following the herd often feels like safety — but it often leads us to danger. To thrive over the long-term, then, one must develop specific skills to be willing to stand out.

I call this the “black sheep paradox” (not be confused with the “black sheep effect” which concerns likability): In order to achieve success — be it as an investor, entrepreneur, writer, intellectual, artist, or really any creative field — one must resist the temptation to conform, often when it is the most painful to do so.

Going with the crowd all the time will result in — at best — average results.

Of course, there is certainly wisdom to crowds, and being overly contrarian can be equally dangerous. But going with the crowd all the time will result in — at best — average results. Index investing is a good example of this dynamic: If you’re comfortable with being average in your investment returns, then it’s a perfectly acceptable approach. But if you strive to achieve anything above average, the only way to consistently outperform is to be willing to go against the grain.

This is a paradox because success is the result, typically, of some sort of contradiction: a willingness to underperform (or be ridiculed) in the short-term that will create the necessary platform on which to succeed in the long-term.

Throughout history, some of the most successful individuals, companies, and technologies began as black sheep. They were outsiders who were either dismissed (or detested) by the mainstream, only to achieve extraordinary success years later. For instance, shortly after Alexander Graham Bell introduced the telephone in 1875, Sir William Preece, chief engineer of the British Post Office, remarked: “The Americans have need of the telephone, but we do not. We have plenty of messenger boys.”

So what makes a black sheep? I don’t think there’s any singular trait, but I do think there’s an element of biochemistry — or even neurodiversity — to it. This is something we’ve all probably witnessed to some degree or another in our lives: some people are simply born with an ability to ignore what others might think of their actions and behavior, which can create leverage to pursue ideas that others might not dare touch.

The famed investor Bill Gross, for instance, once said that his Asperger’s likely made him a better investor because he could “compartmentalize” better than most. People with Asperger’s, he said, “can operate in different universes without the other universes affecting them as much.”

So what makes a black sheep? I don’t think there’s any singular trait, but I do think there’s an element of biochemistry — or even neurodiversity — to it.

He continued: “It’s allowed me to stay at 30,000 feet as opposed to being on the ground. People think you’re angry or an asshole or whatever. But it helps you to focus on the longer-term things without getting mixed up in the details.”

This type of compartmentalization has its drawbacks, of course (see above regarding Gross being considered a selfish “asshole” by many of his peers.) But those who possess an intensity of focus are more likely to be able to outperform. As the writer Frederik Gieschen recently recalled, “when Warren Buffett and Bill Gates first met over dinner, they were asked what factor had been most important in their success. ‘And I said, ‘Focus,’” Buffett recounted. ‘And Bill said the same thing.’”

Even if you’re not born with the biogenetic makeup of a black sheep, there are a few simple practices that can help you become an independent thinker: Deep learning, diverse learning, and writing.

Deep learning, as its name implies, suggests choosing a topic — likely within your professional field — and pursuing an in-depth exploration of that subject, far beyond what your competitors might be pursuing. You’d be surprised at how quickly you can gain an edge, simply by doing marginally more work than your opponent. It may sound obvious, but developing a deep expertise in a single subject will help you make better decisions when you’re invariably confronted with a decision to make.

Diverse learning, on the other hand, involves pursuing a topic outside your professional field. In my experience, the cost of expertise is the potential to become myopic: we become siloed in our professional environments, and we stagnate in our understanding of the world. A commitment to diverse learning, on the other hand, ensures you will possess independent viewpoints and be able to think laterally across multiple fields.

As Morgan Housel wrote earlier this year, “If you’re in business, you’ll be shocked at how much you can learn about moats and competitive advantages from biology. If you’re in biology, you’ll be shocked at how much you can learn about growth limits and evolution from business.”

Finally, writing. Writing is the simplest tool you have in your arsenal. You can use writing to see if you understand something — or if something even makes sense in the first place. By learning to write, we’re able to see the world more clearly. If you want to stand any chance at making independent choices and avoiding the conformity of the crowds over the long-term, writing is your ally.

That’s because writing has a funny way of letting your mind wander into exploring what it really believes. After decades of studying human behavior, Solomon Asch concluded that it was enormously difficult to remain independent-minded.

“The pressure to conform is so powerful that we are often willing to suppress our own perceptions and judgments in order to gain the acceptance and approval of others,” he said.

And that’s why it’s so imperative to be willing to embody the role of the black sheep — to be willing to be comfortably different, and to do the hard things necessary to remain independent.