Why Google Might Launch the World’s Largest Constellation

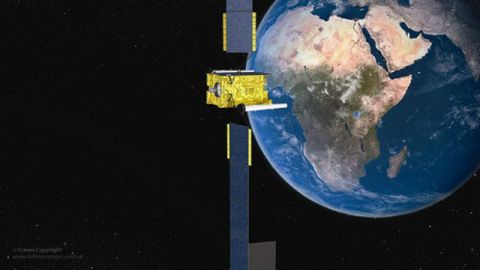

In 2011, NewSpace Global learned that some interesting players in Silicon Valley were exploring the potential of Cisco’s Internet Routing In Space (IRIS) project. (Please see “PUBLICLY TRADED COMPANIES” in the October 2012 issue of Thruster.) Apparently, the technology had been proven viable; although questions concerning the 2nd Screen remained. Thus, when NSG sources indicated this month that a Silicon Valley tech giant – perhaps Google – may soon announce plans to launch a massive constellation of satellites, we were not surprised. Although unconfirmed, sources indicate that this may result in “160 Skybox-sized” satellites launched at first, followed by hundreds more to total 1600 satellites. Yes, this would be more satellites than are currently operational. Yes, this is possibly apocryphal. No, we do not know if these satellites will be used for Earth observation or communications or both. But what we do know is that this story makes sense. On the next page are 10 reasons why NSG Analysts would not be surprised were GOOG to announce such plans.

If news of a major tech player like GOOG launching a massive constellation proves true, what impact might this have on the dozens of SmallSat companies on the NSG 100 and NSG OTB? To get some perspective, we reached out to Craig Clark, CEO of Clyde Space, a Scotland-based SmallSat company. Craig has been working with SmallSats for many years so we were curious to get his take on the rumor: “If true, this would be a step change in the market that a lot of people have been expecting for a few years now. Since 2008, I’ve been talking about this sort of thing happening.” While Clark sees a lot of innovation coming from small companies like Planet Labs and Skybox, he also sees the logic in a big tech player entering the fray but then that same company’s competitors following suit: the end result will “change the market, for example if Google or Microsoft wants to launch, they’ll have competitors wanting to do the same thing, which will result in a massive change for companies like Clyde Space.”

Clark’s point is clear: if GOOG spurs this “step change” in the 1st Vertical, it will not be there alone and this could spur competitors to join. This continued privatization of space is no surprise to Mickaëlle Leperlier, a Marketing Analyst in the Toulouse offices of the Aerospace, Defence and Railway division of theAltran Group. Leperlier told NSG “we are seeing an emergence of privatization in the satellite market. More and more small companies are launching space activities. We have more and more competitors in the market which means traditional leaders have a lot of challenges to face.”

As Leperlier points out, if the hypothetical GOOG constellation is announced, the purpose of the satellites – e.g. Earth observation, commercialization of IRIS-type technology, etc. – will have remarkably different impacts on the market. At NSG, we are particularly interested in hypothesizing the impact this kind of announcement might have on potential exits for investors. Akshay Patel, a Vice President in the New York office of Morgan Stanley, and a member of its satellite banking practice, thinks we might see a SmallSat company go public “in the next couple of years.” (Please see “LETTER FROM THE EDITOR” in the November 2013 issue of Thruster.) Patel sees such a company “using small satellites with applications where consumers don’t necessarily care if it’s based on a satellite.” In other words, in much the same way DirecTV customers don’t generally care that satellites thousands of miles away deliver the Seahawk game, Patel sees such a SmallSat company generating the end user focused kind of pre-IPO story that will excite public investment markets. (Please see “INVESTOR WATCH” in the Premiere issue of Thruster.) Finally Patel adds that such a company will likely focus on data: “in the sense that people want to move and collect data around the globe as efficiently as possible…whether images or tracking or weather data.”

One such company that is focusing on data and has certainly attracted the attention of investors in the secondary markets is SKYB. Mike Trela, VP of Engineering at SKYB, told NSG: “In general, Skybox is a daily information analysis company. We don’t see ourselves as being a satellite space company. Rather, we are positioning ourselves as being an operator and data provider that uses overhead satellite imagery as one of its products.” AJ Piplica, COO of Generation Orbit, the small payload 2nd Vertical company, echoed both Patel and Trela’s comments: what’s critical is “how quickly companies like Planet Labs and Skybox can revisit a particular point on Earth. These companies approach space as a place where they can mine data. That’s where their revenue will come from not from selling spacecraft.”

According to Trela, SKYB is not interested in being in the business of mass manufacturing of SmallSats. This is likely what motivated the recent transaction between SKYB and SS/L, where SKYB has tasked SS/L with manufacturing a fleet of 13 SmallSats. “We’re all really excited about it. This is the first and best demonstration of why the combination of SS/L and MDA is going to be so valuable,” David Lackner, a Vice President Business Development at SS/L, explained to NSG. (Please see “MERGERS & AQUISITIONS” in the March 2013 issue of Thruster.) The SKYB deal “would not have happened without SS/L’s commercial manufacturing capability added to the MDA information systems and imaging services expertise. This demonstrates the power of the combined company.”

As both SKYB and SS/L are in the same neck of the woods as GOOG makes the timing of this announcement even more intriguing. (Please see “SMALLSAT REVIEW” in the February 2014 issue of Thruster.)

As David Bullock explores in this month’s SmallCap Review, while most are focusing on the SmallSat companies in and of themselves, the impact these new players are having on the Launch Vehicle Provider market is also real. Virgin Galactic, Firefly, Generation Orbit, XCOR, Swiss Space Systems, Garvey Space Corporation, zero2infinity, Interorbital, Ventions and UP Aerospace are all gearing up to provide low cost, reliable launch to SmallSat companies. Piplica provided his take: “In terms of demand, that has been pent up for quite some time and we’re finally starting to realize how big that demand is.” Piplica believes this demand stems from an increase in secondary launch activity: According to Piplica, “In 2013, there were nearly a 100 spacecraft between 1 and 50 kilograms launched, but that is almost double from 2012.” He also sees the work of companies like “NanoRacks, ISIS, Tyvak, and Spaceflight Inc. providing a plethora of launch services to the SmallSat Sector,” reflecting the changing tides of this sub-sector. While Planet Labs is a potential disruptor in Earth observation markets, “now we’re starting to see more disruption in other established space-based markets like communications, ship tracking, AIS.” (Please see “PUBLICLY TRADED COMPANIES” in this issue of Thruster.)

Having spent some time with Tom Mueller, VP of Propulsion at SET, last week in California, it seems obvious that SET could join the crop of companies in dedicated small payload launch. The typical debate between Russia, Europe, ULA and SpaceX centers around experience and EELVs. If SET revolutionizes launch with reusability, will we see a new player in Europe emerge to match this level of innovation? (This is particularly interesting when our hypothetical 1600 satellite constellation looks for a LVP.) Leperlier of ALTdoesn’t think so: “In Europe we have a lot of restrictions around space, which means the traditional players have difficulties to do a lot of activities, so I don’t see the emergence of traditional players doing what SpaceX is doing today. However, I think a company could evolve in the same way. For example, at Altran, we proposed a cost design initiative to help our clients to decrease their costs. We provide this because European players must emerge too to compete with SpaceX and so on.”

As we explore throughout our 2014 “Satellite” issue of Thruster, whether GOOG or some other “tech titan” listed on the NSG PTC, announces plans to launch a 1600 SmallSat constellation to orbit, or does not disclose this, what is certain is that SmallSats are here. Thus, in this month’s issue we are particularly interested in potential disruption in the 1st Vertical.

Some questions/issues our writers address this issue:

• What specific markets within the 1st Vertical are ripe for disruption?

• What impact will expected reductions in launch costs have on markets of the 1st Vertical?

• Small satellites (“SmallSats”) have seen tremendous growth in the past 2 years. Who are the primary customers? Are there new customers on the horizon?

• With respect to the 3rd Screen, why are investors betting on these SmallSat companies?

• Has the time come for dedicated small payload vehicles? I.e. is there enough demand by small payload companies to support smaller launch vehicles?

• Who are the key executives leading disruption in the 1st Vertical?

• How are ancillary services – e.g. insurance, law, accounting, etc. – addressing some of the potential disruption in the 1st Vertical? For instance, are there insurance companies focusing on the underwriting of small spacecraft?

As you can see, we explore changes and potential disruption within the 1st Vertical from multiple perspectives: e.g. from Russia/Eastern Europe to Canada, from SmallCaps to PTCs. Thruster Editor, David Bullock, also provides some insights from the legal and insurance fields in this month’s “LARGECAP REVIEW.”

In closing, perhaps this rumored massive constellation will cause the “step change” in the market as Craig Clark describes it; perhaps it will never come to be; either way, at NSG we see the evolution and revolution of the miniaturization of payloads producing exciting outcomes within the 1st Vertical.

That said, don’t be surprised if using your favorite search engine you trip over a headline that reads something like this: “Google Buys Fleet of Reusable SpaceX Falcon-9Rs to Launch World’s Largest Constellation.”