Taxation Is Not Slavery

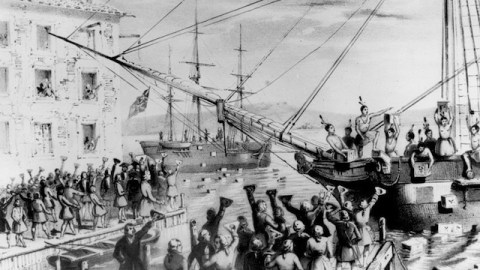

“Taxation without representation,” as James Otis said, “is tyranny.” But taxation with representation is just democratic government.

After I argued earlier this week that if anything we should pay more in taxes, a Facebook commenter wondered if Big Think ever came down against government coercion. I don’t speak for Big Think, of course, and I’m sure that the other bloggers here disagree with me about much of what I write. But it certainly is true that if we don’t pay the taxes we’re asked to pay the government will fine us or even throw us in jail. Some even compare the time we spend working to pay our taxes to slavery.

It’s not slavery. While it the government does force us to pay our taxes, portraying taxes simply as a form of government coercion is a bit strange. It’s a little like comparing having to pay your share of the rent to slavery. People who live in the U.S. don’t have any choice about whether to obey U.S. laws. We may disagree with how the government spends our money, and may not feel we personally receive enough tangible benefits. But the U.S. is a democracy, and we are also collectively the ones who get to decide—and who benefit from—what the government does,.

Those who complain about paying their taxes seem to want goverment to operate on a take-a-penny-leave-a-penny model. But if we were each allowed to pay as little taxes as we wanted—or to pay only for those programs we happen to like—most of us wouldn’t do our share. With the success of the Tea Party, it’s certainly not as if the people who want smaller government and lower taxes are underrepresented in Congress. But those people still have to compromise with those of us who don’t share their views, and abide by the decisions of majority.

While we may not personally use government services that much, or receive much in the way of government handouts, the truth is that most of us benefit from what the government does more than we realize. Just because you didn’t call the police today, doesn’t mean you didn’t benefit from having them there. The U.S. is such a nice place to live not just because Americans are great people, but also because we have used government policy—by investing in infrastructure and education, enforcing contracts, regulating business, protecting our borders, providing social services, and so on—to make it that way. It is our system of government as much as anything that makes the U.S. a better place to live than Somalia.

Obviously, there are serious, difficult questions about what share of our collective expenses each of us should have to pay. I have argued that the rich should bear a larger share of burden, both because they can more easily afford to and because they prosper the most under our system. The rich do, of course, pay proportionally more federal income tax than the rest of us. But payroll taxes and sales taxes fall more heavily on the rest of us, so that we all end up paying roughly the same share of our income in taxes.

But whatever you think about who should bear the burden of paying for government, it doesn’t make sense to say we shouldn’t have to pay for it at all. People who think should taxes should be lower in general should campaign against the things we actually spend our money on, not object to the fact that they are forced to contribute their share. If they want to demand that we reduce defense spending or cut Medicare benefits, that’s totally understandable. They just shouldn’t complain that they are asked to do their part to pay for those programs.