Two Kinds of Success, An Unnamed Natural Law

There are two kinds of success. One kind damages or destroys what it depends on, the other doesn’t. History and theater teach that distinction about the ambitious, evolution and religion apply it to the masses. This logic is inescapable, especially in economics.

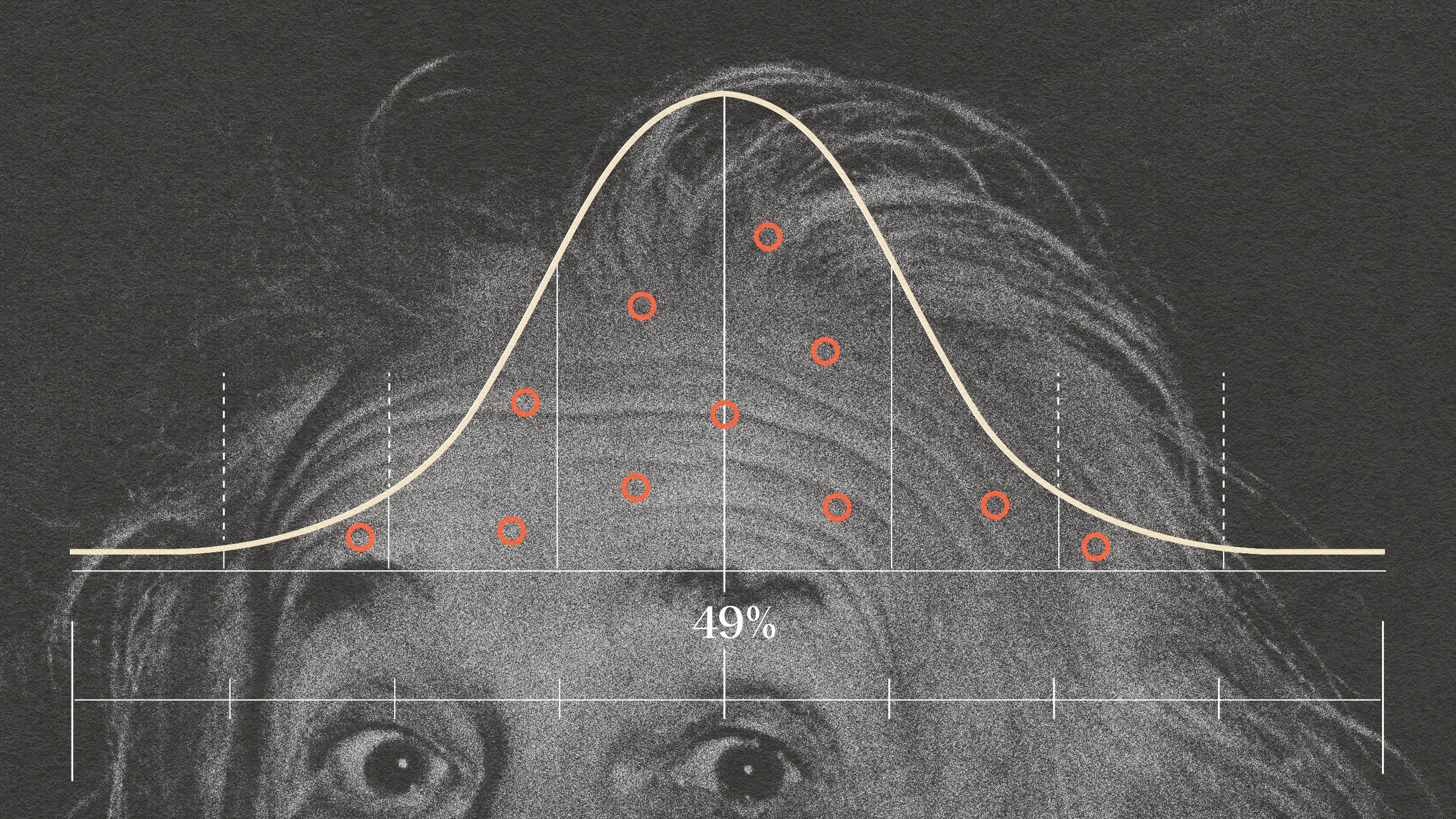

An as yet unnamed natural law, as powerful as “survival of the fittest,” eliminates anything that destroys whatever supplies its needs. We’re the first species that can know, or do anything about, this. Other species are bound by their genetic fate but we’re the least hard-wired species ever. We alone choose how we organize ourselves.

Economists increasingly organize us, typically using ideas about mindless market “mechanisms” automatically solving our problems. Their faith in the organizing power of (often unenlightened) self-interest is misplaced. Here’s 12 ways free markets “fail.” But even when they don’t fail, they can’t cure “spontaneous disorders” (see also Darwin’s Wedge). Only central coordination can.

A useful idea from evolution distinguishes things that survive (genes) from their vehicles (bodies they’re in). No gene survives without cooperating with other genes in its vehicle. And genes that damage their vehicle weaken themselves. Vehicles extend beyond bodies by “inclusive fitness”: Helping relatives helps shared genes. Economists could usefully apply similar ideas:

1. Markets = vehicles: Division of labor creates dense dynamic webs of dependence. Not damaging vehicle-mates is crucial. Limiting success strategies or gains that weaken your vehicle(s) is wise.

2. Caesar’s error: How elites seek status is critical. Shakespeare’s Julius Caesar was ambitious for himself ahead of Rome (his success endangered his city). Societies or economies that permit or promote such ambition undermine themselves.

4. Structural sin: That’s what Christian philosophers call unintended harms caused by the structures in which individuals act. Unguided markets organize the masses to create (often indirect) harms (e.g. climate change).

5. Do no self-harm: Even those who’d happily harm others, can’t escape. It’s irrational to ignore the health of what supplies your needs. That only works if you free ride on the efforts of others who maintain your markets, community, economy, country, and planet.

6. Me-only market myopia: We must be governed by the logic of the health of the whole and prevent detrimental success-seeking. Chasing any growth (increasingly captured by corporate Caesars) isn’t a cure.

7. Needism: Here’s a fifteen word fix—Know your needs. Don’t damage what supplies them. Don’t let others, either. Or you’re doomed.

Ensuring that success doesn’t damage what we all depend on is as important as what President Obama calls “the defining challenge of our times” An ethos of unbalanced self-maximizing in markets not only creates economic inequality, it can be self-undermining and risks undermining our collective future.

Illustration by Julia Suits, The New Yorker Cartoonist & author of The Extraordinary Catalog of Peculiar Inventions.