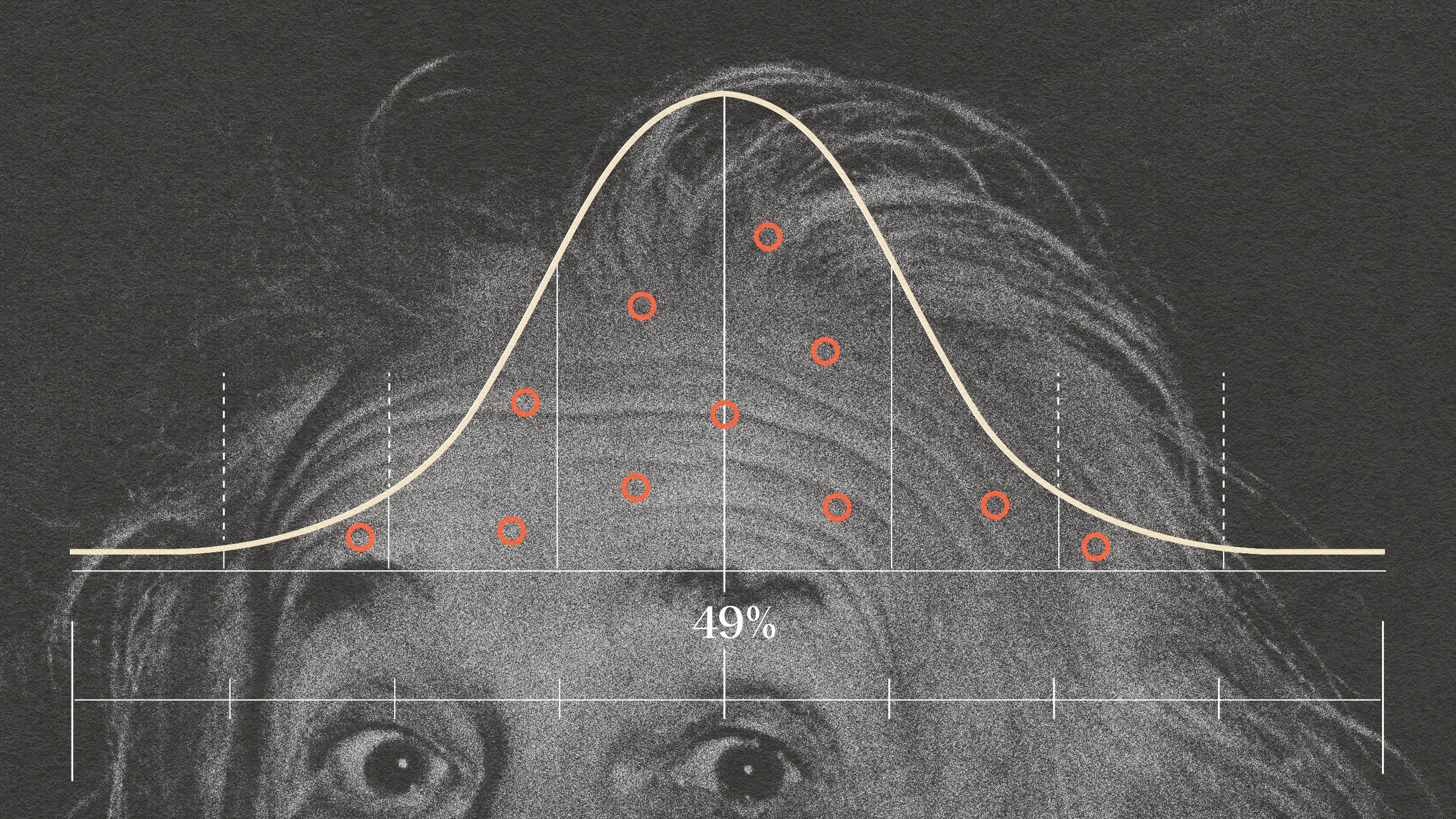

What does 28% of the average person’s income mean?

A Different Way of Looking at the Sub-Prime Mortgage Crisis

rnDan Ariely: So the first thing is, you know, I think the world would be a better place if I was a benevolent dictator. I think there’s a lot of these things that we just don’t see – that we’re unaware of. I think it is one of the wonderful things about behavioral science in general is that it can reveal facts about ourselves that we don’t usually understand or comprehend, and the force that really shapes us. That’s the first step, right? It’s just a journey to discover and find out things about ourselves. But the most important one is what do you do with these findings, and how do you shape policies to take them into account. And the first step is we need to recognize that we make this mistake. And I mean it’s amazing to me that we don’t recognize it more. In fact you can say what is more amazing about rationality is that we are . . . or this book, or irrationality? Is it the fact that we’re irrational? Is that more amazing? Or the fact that we’re irrational but at the same time believe that we are rational? And in some sense, the surprising thing is how much economics is still driving policy. Let’s reflect for a second on the sub prime mortgage crisis. Think about the following issue. What we want people to do is to figure out for themselves how much money they can borrow. Frankly I’m a relatively educated guy. If I had to sit down and calculate what is the optimal amount of money for me to borrow, that’s an incredibly difficult exercise. I don’t know how to do it. You know I can think about my current salary, my future salary, the fluctuation in the stock market, the housing market – what’s the right answer for me? I don’t . . . I don’t know. Now the banks tell me it’s 28 percent of salary. That I understand. Now 28 percent of your salary is an average answer across a lot of people. It can’t possibly be the right answer for everybody. But I can’t calculate it, and now the bank tells me it’s on my shoulder to repay the loan, but I don’t have the tools to figure out how much I can borrow. So even if I wanted to be rational, the first ingredient, which is to figure how much I can borrow, is missing. Now form the behavioral economics perspective, we should change the role of the banks a little bit and mandate that they help people figure out how much they could really borrow, okay? So this suggests a different responsibility on the individual and on the establishment. If you don’t help me to figure out how much money I can borrow, why should I be responsible for ...? And here is another kind of interesting perspective. You know when we make products for people, we take into account their physical abilities. Nobody is ever saying let’s design a laptop, a pen, an iPod or something for Superman; for like somebody with ultimate strength, and power, and ability, and no limitations. Everything we do we say let’s figure out people’s limitations and think about the products we can do. People are weak here and weak there. And their keyboard has to be like (34:19) this, and like that, and so on. Why don’t we do the same thing about products for the mind? Why all of a sudden when we talk about products for the mind – healthcare, retirement, insurance, mortgages – we all of a sudden assume that everybody in terms of their mind is Superman? That there is no limitations? Once we make this analogy clear, I think it’s actually quite self-evident that you need to take the same approach and design products for the mind that take our limitations into account.

rnRecorded on: Feb 19 2008

rn