Athlete vs. grandmaster: The psychology of decision-making

- The partnership between the psychologists Daniel Kahneman and Amos Tversky made a great impact on behavioral economics.

- In behavioral economics, information is a resource and decision making is costly.

- Kahneman and Tversky examined how the presentation of information affects decisions.

In thinking about the economy, two heads are almost always better than one. Great ideas tend to emerge from teamwork. Even so, the partnership between the psychologists Daniel Kahneman and Amos Tversky was exceptional. First, it endured, lasting for more than 25 years and only ending with Tversky’s death in 1996. Secondly, it was immensely productive in establishing modern behavioral economics. Their work won Kahneman the Nobel Memorial Prize in 2002. Had Tversky lived, he would undoubtedly have shared the award. The working relationship had been so close that, rather like Lennon and McCartney, it was not always clear who had done what.

In behavioral economics, information is a resource and decision making is costly. Its explanation of decision making has much in common with Herbert Simon’s understanding that behavior is rational when it follows a standardized process and economizes on the use of information. But behavioral economics has diverged from Simon’s thinking by arguing that people systematically fail to apply mental processes correctly because of the short-cuts which they take when they process information.

As psychologists, Tversky and Kahneman knew that while our brains are wonderful in many ways, they are still imperfect. We might think of them as having evolved to be very effective in engaging with the environment which our ancestors faced, but much less effective when we start dealing with the typical problems of a modern society. The weaknesses in decision making which psychologists and behavioral economists have identified result from people over-estimating the importance of whatever they can recall or recognize immediately.

When Kahneman and Tversky found evidence that the presentation of information affected decisions, they did not claim to have found evidence that we are irrational. They simply concluded that they had found still more evidence of widespread information-processing biases. Kahneman explained how these biases could arise in his intellectual autobiography, Thinking, Fast and Slow. He suggested that we make most decisions using System 1 processes, which are ‘always on’, and so used by default, but make some using an alternative System 2, in which decision making involves conscious thought.

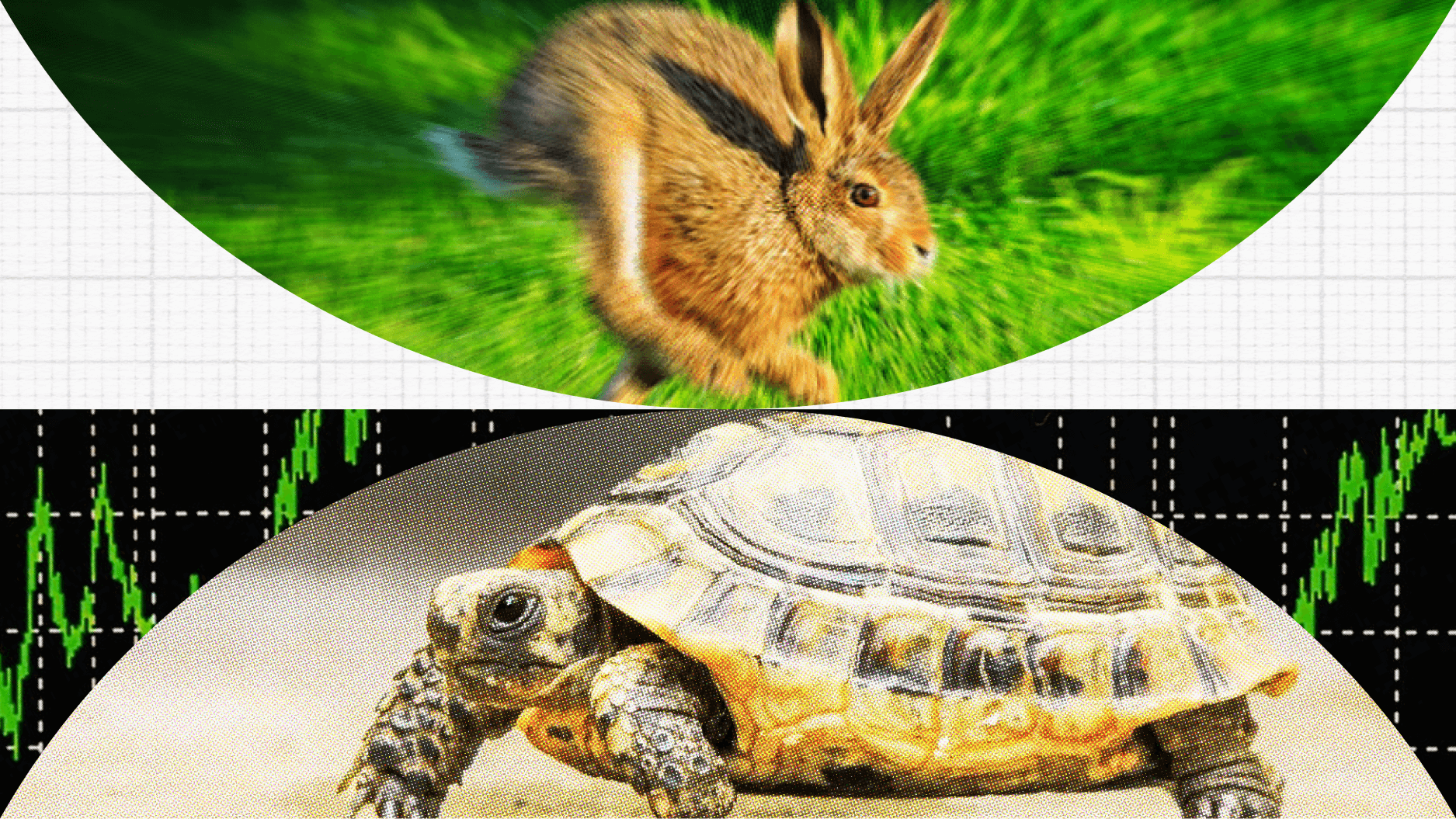

System 1 thinking is fast, intuitive and uses very little information. It means going with our instincts. This system manages unconscious responses to our environment, like spitting out very hot food which is scalding our mouths, and routine activities such as parking a car. For elite sports players, letting System 2 get involved in their decision making can damage their performance badly. It is too slow, and too demanding of mental resources to be effective in a highly competitive context where speed of decision making is critical. System 2 is much better for a grandmaster playing chess or an engineer calculating the load which a beam will need to bear. That makes System 2 an important part of what it means to be human. But usually, it sits in reserve, and we decide to switch it on when we are alerted to something novel in the decision which we are trying to make which makes us think that it will outperform System 1.

The weaknesses in decision making which psychologists and behavioral economists have identified result from people over-estimating the importance of whatever they can recall or recognize immediately.

Such a dual decision-making system will have systemic weaknesses. Suppose that you are using System 1, and making quick decisions, of which you are barely conscious. Imagine that there is a subtle change in your environment, and that if you had already engaged System 2, you would now use it. But because you are using System 1, there might not be any cue which alerts you to use System 2, and so you carry on using System 1. That gives us a way of understanding Kahneman and Tversky’s early work.

From the early 1970s, they started to use the term ‘heuristic’ for the decision-making rules which they assumed that people would need to use. Their proposed heuristics were based on the belief that when people encounter information, they will try to fit it to the situation which they think that they are facing, as well as using the information which is easiest for them to use. Then they designed experiments in which using heuristics as part of System 1 thinking might mislead people. When the experiments worked, they had evidence of bias in decision making.