10 life lessons from four decades in the market

- Main Story: Arne Alsin, the CIO of Nightview Capital, shares valuable insights from over four decades of investing.

- Alsin integrates behavioral psychology, game theory, and deep-dive research into his strategy.

- Also among this week’s stories: Tesla vs. Waymo, legendary entrepreneur Jim O’Shaughnessy, and the wisdom of Yvon Chouinard.

This week, Arne Alsin — the CIO of Nightview Capital and my colleague for almost a decade now — shared 10 insightful life and business lessons that he’s picked up in his 40+ year career as an investor.

I’ve seen many of these lessons firsthand. Arne — who began his career as a forensic accountant — perceives the market as the world’s most intricate (and ever-evolving) puzzle to be solved. I’ve also come to see how he integrates behavioral psychology, game theory, and extreme, deep-dive research to make decisions that often buck the “conventional” wisdom on Wall Street.

“The beauty of investing is that it’s the greatest game in the world — one where the stakes are always high, and there’s always something to improve on,” Arne writes. “I’ve gathered a few battle scars over the years, but with them, I’ve learned valuable lessons. So, for those of you looking to beat the market, here are my top 10 strategies learned from decades of navigating the ups and downs.”

Key quote: “I’ve worn a lot of hats over the years — detective, talent scout, puzzle solver. Managing money is about more than just picking stocks. It’s about solving the puzzle of the markets, uncovering value where others don’t see it, and continuously learning. There’s always something to learn, always a new puzzle to solve. It’s not just about making money — it’s about understanding the world around you and finding ways to capitalize on the changes you see. In my view, money management is one of the most intellectually rewarding professions out there.”

What it takes to survive 500 years in business

Over the past few months, I’ve become enamored with the idea of “immortality” in business. Obviously, nothing lives forever. But there are a handful of companies in the world that seem to defy the natural order of things and just keep… surviving. This week, I wrote about a few of them in Big Think.

Specifically, I explore the art of focus in business, and how concentration in doing just one thing really well can create extreme resilience over time.

Key quote: “The fact is, most companies — as they grow — tend to diversify their interests and expand their territory. This can help them survive in the short-term, but in the long-term it can often become their biggest weakness. As companies expand, there can be a natural tendency for quality to diminish. The best investors intuitively understand this concept when it comes to their own portfolios. ‘If you want to make a lot of money, resist diversification,’ Jim Rogers, the legendary investor, once said.”

A few more links I enjoyed:

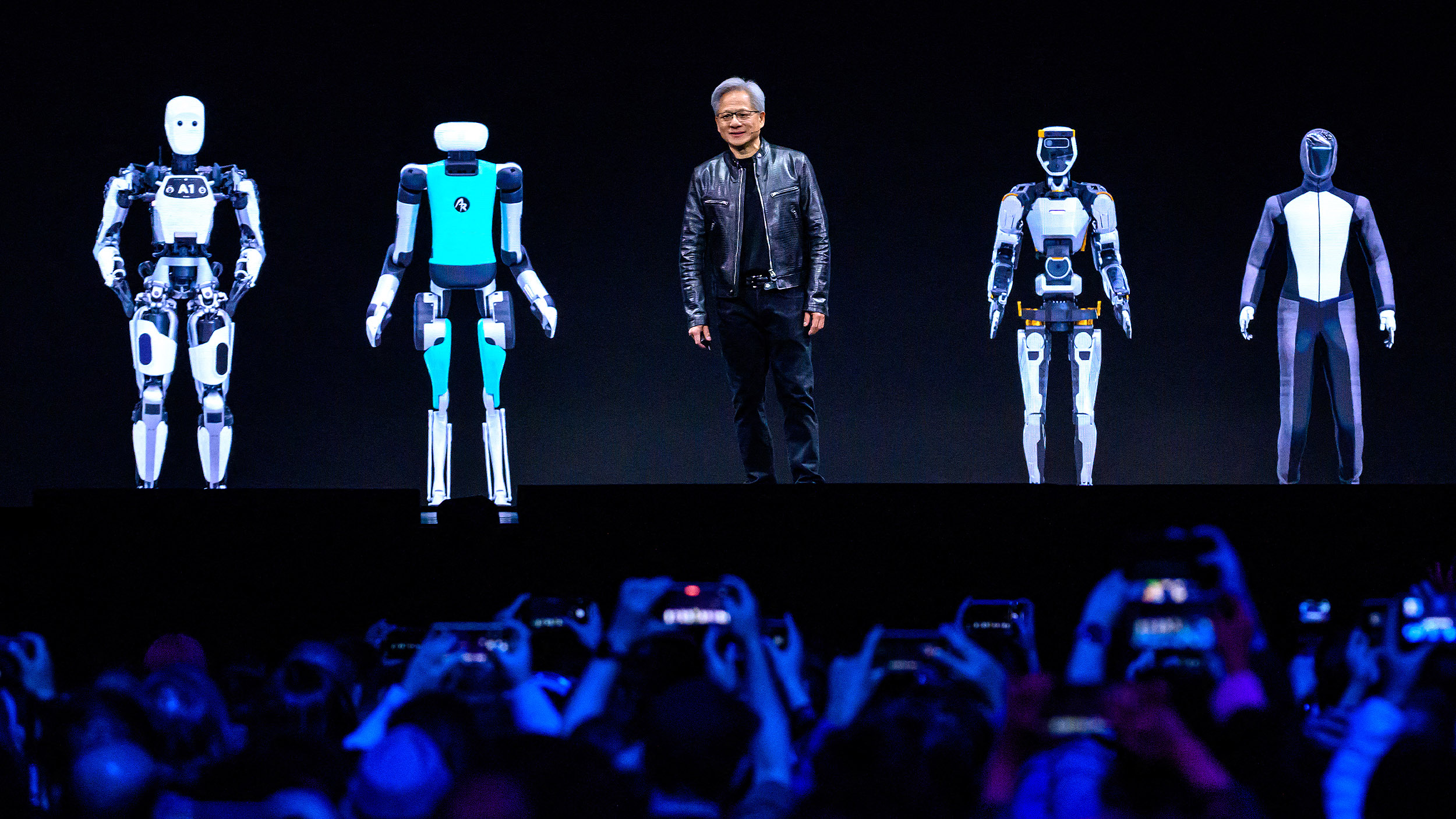

Andrej Karpathy from OpenAI and Tesla – via No Priors

Key quote: “Andrej, who was a founding team member of OpenAI and the former Tesla Autopilot leader, needs no introduction. In this episode, Andrej discusses the evolution of self-driving cars, comparing Tesla’s and Waymo’s approaches, and the technical challenges ahead. They also cover Tesla’s Optimus humanoid robot, the bottlenecks of AI development today, and how AI capabilities could be further integrated with human cognition. Andrej shares more about his new mission Eureka Labs and his insights into AI-driven education and what young people should study to prepare for the reality ahead.”

The Intentional Investor: Jim O’Shaughnessy – via Epsilon Theory / Matt Zeigler

Key quote: “On this episode of the Intentional Investor, Matt Zeigler welcomes legendary investor and entrepreneur Jim O’Shaughnessy. Jim shares fascinating stories from his childhood, including memories of his influential grandfather, his early interest in magic, and how rejection shaped his mindset. The discussion covers Jim’s journey into investing, his thoughts on education and critical thinking, and his experiences on Wall Street. Jim offers insights on topics like the power of journaling, the importance of empiricism, and his excitement for AI and new technologies.”

What China’s Electric Vehicle Boom Looks Like on the Ground – via Big Technology

Key quote: “But by focusing solely on subsidies, it’s easy to miss the biggest reason why China’s electric vehicle industry has been so successful: It’s incredibly innovative. One way to look at it is that Chinese companies took their knowledge [of] manufacturing smartphones and simply scaled it up. In fact, two of China’s top smartphone makers, Huawei and Xiaomi, have already unveiled their own EVs. (Apple, meanwhile, canceled its car project.)”

Vertical Integrators: Part II – via Packy McCormick

Key quote: “Vertical integration is typically the dominant strategy when industries are in their early stages or undergoing significant transformation, when market structures are unclear, supply chains are underdeveloped, and new technologies are emerging. Companies that can control more of the value chain can introduce new products that the market needs faster and more efficiently.”

From the archives:

Let My People Go Surfing – via Yvon Chouinard, founder of Patagonia (2005)

Key quote: “I’ve been a businessman for almost 50 years. It’s as difficult for me to say those words as it is for someone to admit to being an alcoholic or a lawyer. I’ve never respected the profession. It’s business that has to take the majority of the blame for being the enemy of nature, for destroying native cultures, for taking from the poor and giving to the rich, and for poisoning the earth with the effluent from its factories. Yet business can produce food, cure disease, control population, employ people, and generally enrich our lives. And it can do these good things and make a profit without losing its soul.”