How America’s Wealth Vanished

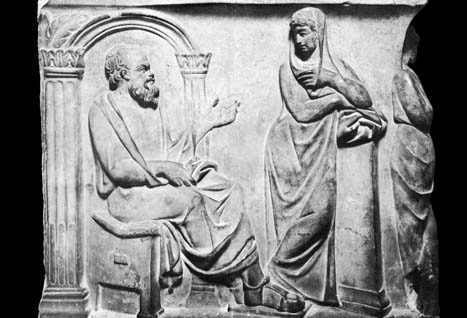

Americans aren’t worth as much as they used to be. Last week, the Federal Reserve survey of consumer finances found that the net worth of U.S. households declined 15% on average between 2007 and 2010. Because of changes in the distribution of wealth, the net worth of the median household declined even faster, falling from a peak of $126 thousand in 2007 to just $77 thousand in 2010—a drop of 39% in just three years.

That means that the median household was worth about the same in 2010 in as it was worth in 1992. The huge recent drop in household wealth is primarily due to the collapse in household prices in the recent recession. In the longer term the fall in household wealth has something to do with the rapid increase in the number of U.S. households in the early part of the decade. But the fact is that the total household net worth of the country fell sharply in the recession. In fact, it was the same at its low in 2009 as it was in 2004. The economic crisis, in other words, wiped out five full years of wealth.

As Paul Krugman says, you can’t blame this on President Obama. Household wealth began to collapse at the beginning of the recession in 2007, and started to recover just a couple of months after Obama took office. The truth is that the wealth gains of the Bush years were largely illusory. Even before the start of the recession the economy and real wages grew more slowly than in almost any period since the Great Depression. The dramatic increase in home prices during the housing bubble disguised the underlying weakness of the economy and made Americans feel richer than we ever really were.

U.S. household net worth chart from the Federal Reserve Bank of St. Louis