The Recovery Could Take Ten Years

Ezra Klein calls our attention in his regular Wonkbook feature—which is a must-read, by the way—to a paper by economists Carmen and Vincent Reinhart looking at how long it takes economies to recover from major economic crises. Their answer: a decade.

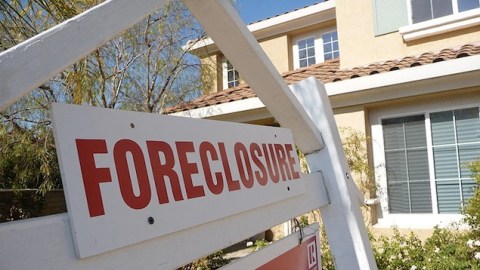

In their paper, Reinhart and Reinhart looked at fifteen severe national economic crises since World War II, and at three occasions when the global economy shrunk—the 1929 stock market crash, the 1973 oil shock, and the collapse in 2007 of the subprime market. They find that for ten years after a severe financial crisis growth rates and housing prices are lower than they were and unemployment is higher than it was before the crisis. Among other things it takes years for credit to loosen again after the increase in borrowing that precedes financial crises. The most recent crisis fits the pattern of previous crises, with per capita income 2% lower in advanced economies than it was in 2007. If anything, they argue, the current crisis is been deeper and more widespread than many of the others.

Since we are only three years into the current economic slowdown, their analysis suggests that the economy will suffer slow growth and high unemployment for another seven years. Carmen Reinhart told Bloomberg that the U.S. has a more than even chance of experiencing a lost decade of growth like Japan’s after the collapse of the asset price bubble in 1991, and that based on previous crises an unemployment rate of 8 or 9 percent for the next seven years is not out of the question.

Every economic crisis, of course, is unique. But it may be wishful thinking to imagine that this one will be any different. Anyone who follows the economy knows that growth is sluggish and private-sector jobs are coming back slowly. More fiscal stimulus might help push the economy back toward its capacity. But even if we manage to sidestep a so-called double-dip recession, there is no reason to think that economy will return to normal any time soon.