“Move fast and break things”? Slow down and go long

- Silicon Valley’s seductive mantra of disruption — “move fast and break things” — is facing a challenge.

- We live in a maelstrom of short-term thinking, but a long-term mindset is starting to emerge.

- The next era of business will not be defined by how quickly companies rise, but by how well they endure.

Over the last couple of decades, a particular ideology — based around speed of execution — began to insinuate itself into modern business culture. Silicon Valley “disruptors” like Mark Zuckerberg and Travis Kalanick enticed a new generation of entrepreneurs and executives with a seductive premise for success: move fast and break things.

This brash approach to business certainly works. In the short-term, at least. It’s a take-no-prisoners attitude where transactions are a zero-sum game: I win, you lose. Growth at any and all costs. But what happens over time? If the foundation of these businesses are built on chaos, what are the chances they could survive over the long-term? It’s an open question — and a timely one, too. Survival is top of mind for executives around the world. The rise of artificial intelligence is eviscerating certain business models, seemingly overnight.

Consider the case of Chegg, a publicly-traded online education company. The company’s stock is down nearly 90% this year alone because free AI tools like ChatGPT have upended its model for growth. On an investor call last year, Chegg’s CFO admitted: “We believe this is an existential change.”

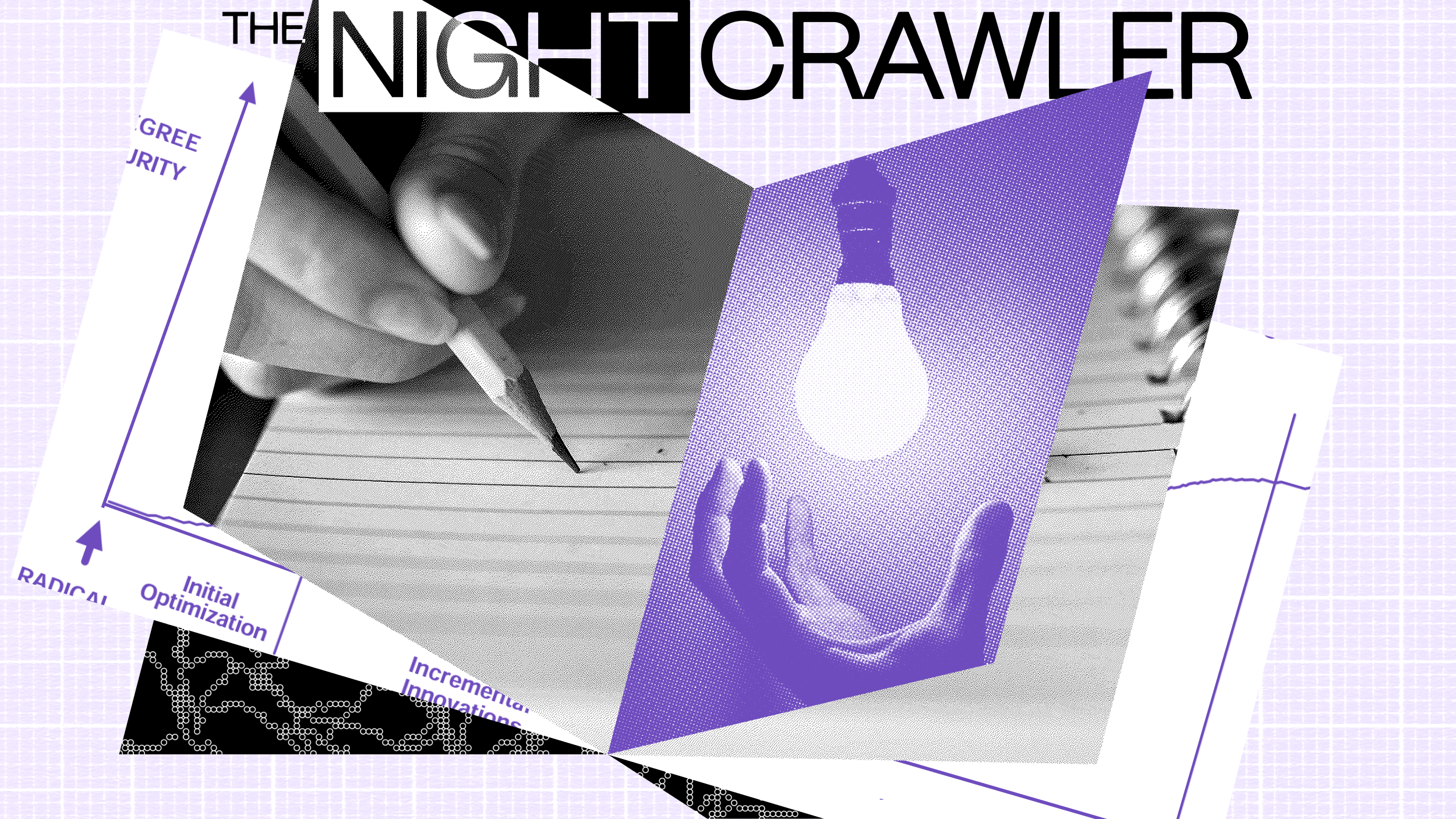

This is, of course, just one example. And I’m not making a call on Chegg’s future — perhaps they will rebound just fine. But I believe we’re going to see many more examples like this over the next few years, and it will necessitate a rewiring of our collective approach to building businesses — and investing for the long-term. This is, ultimately, a positive development. Emerging out of this period of entropy — and in direct opposition to the short-term-oriented, move fast and break things approach — a new mentality appears to be emerging that seeks to ensure long-term stability.

Its mantra goes something like this: slow down and build things that last.

Over the last few months, I have been speaking with executives and entrepreneurs about this specific idea. And I am hearing the same things over and over again. We share a mentality of building businesses based around a long-term approach with solid foundations. Strategies that don’t chase the latest trend. A dedication to craft, precision, and focus. Patience and quality. A mindset that champions long-term survival tactics over short-term bursts of growth.

A new mentality appears to be emerging that seeks to ensure long-term stability.

To be clear, it’s early days. And this new cohort of innovators focused on longevity will face an uphill battle. The counterforce to this long-term behavior is obvious: markets. We live in a crisis of short-term thinking, and markets are the culprit. Markets prioritize short-term decision-making — and exert overwhelming pressure to meet the next quarter’s expectations. A long-term approach is rare, and that’s because market participants are driven by incentives that reward short-term behavior.

An example we’re all familiar with: the media.

The media is a prime example of an industry that should inherently operate with a long-term vision, as its primary mission is to educate and inform the public. And yet, over the last couple of decades, there’s ample evidence to suggest it has succumbed to short-term pressures, chasing sensational headlines and breaking news to drive immediate engagement.

This “move fast” approach prioritizes clicks and views over depth and accuracy, leading to a degradation of trust and a shallow understanding of complex issues. In contrast, a long-term strategy would focus on building credibility, delivering thoughtful analysis, and fostering a well-informed public. The problem, of course, goes back to economic incentives.

Consider this Duke University study which found that a “surprising 78%” of corporate CFOs “would destroy economic value in exchange for smooth earnings.” The report continues: “CFOs argue that the system (that is, financial market pressures and overreactions) encourages decisions that at times destroy long-term value to meet [quarterly] earnings targets.”

The silver lining to all this short-term thinking is that it creates compelling opportunities for investors who prefer to think long-term. While the majority of market participants focus on immediate gains, long-term investors who think beyond short-term fluctuations can buy high-quality, long-term oriented companies at a discount. This patience-based strategy takes advantage of the disconnect between market sentiment and a company’s true long-term value. In effect, it creates opportunities for substantial gains over time. But these opportunities are rare — and there are very few businesses that actually think and act long-term.

The silver lining to all this short-term thinking is that it creates compelling opportunities for investors who prefer to think long-term.

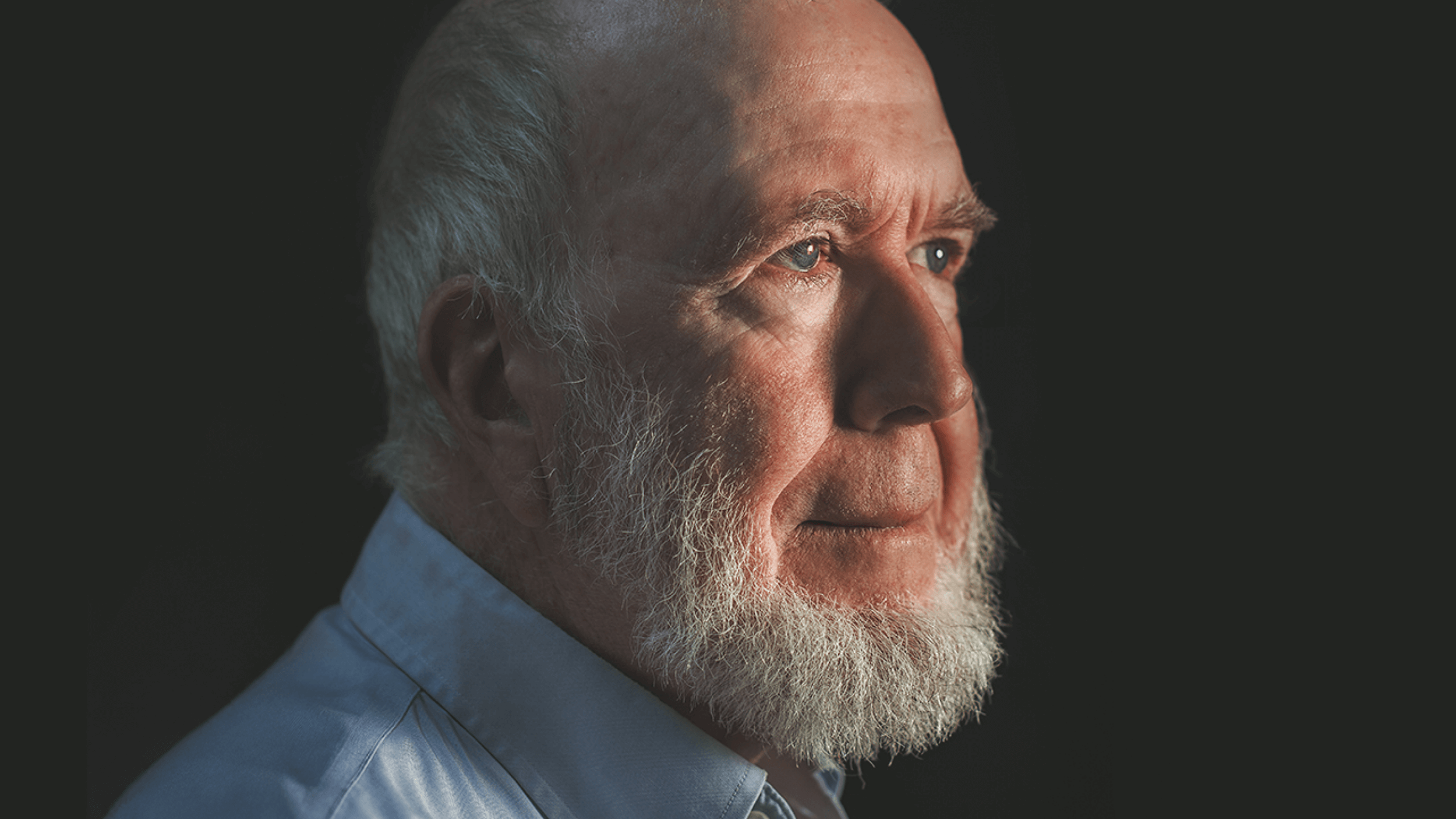

Recently, I had the chance to speak with Kevin Kelly, a prominent advocate for long-term thinking and behavior in business. And he made a very good point: not every organization should exist for the long-term. Part of the natural process of “creative destruction” in business means that, just like nature, organisms are ever evolving — and necessarily must die.

But for those organizations and businesses that do want to endure and play the long game, they need to make hard, but necessary changes, in order to survive. “For individual institutions and organizations, if they decide they want to be multi-generational, they need to assign resources to enable that long-term sustainability,” Kelly says.

He suggested that there are very few examples of long-term thinking on Wall Street, but not zero, suggesting Jeff Bezos bucked the trend: “[Jeff] would say two things: first, ‘no one’s competing on ten years; that’s where I’m working.’ Secondly, he would say, ‘I’m interested in what doesn’t change.’ He wanted to make money off what doesn’t change. What’s not going to change is that people want more choice and cheaper prices. And that will be true in ten years or twenty years. So, he banked on the things that don’t change.”

As we move further into this new era of business, I think we will increasingly focus on things that don’t change in order to ensure survival over whatever comes next. The focus on longevity, resilience, and sustainability will become paramount. Companies that succeed will be those that take a deliberate, thoughtful approach to growth. They will build strong foundations, design systems that can adapt to change, and align their missions with the long-term needs of society and the environment. This shift represents more than just a reaction to the failures of the past; it is an evolution in how we think about the role of business in the world.

Ultimately, the end of the “move fast and break things” era signals a broader cultural shift towards stability, quality, and thoughtful innovation. The companies of tomorrow will be those that take their time, measure their impact carefully, and understand success is not a sprint — but a marathon.

As this new mentality takes hold, we may look back on the chaos of the past decades as a necessary phase in the development of a more sustainable, resilient business environment. The next era of business will not be defined by how quickly companies rise, but by how well they endure.