Jockeying for Number One: Management of the NewSpace LargeCaps

Like many investors, NSG Analysts know that the management team is the most important criterion or “screen” to use when evaluating a company in NewSpace, and the stakes are high for the LargeCap NewSpace management teams. More than any product, market opportunity, or level of capitalization, smart management will more often than not determine the difference between a successful company, and a great idea that ultimately fails in the marketplace. That’s why when NSG Analysts evaluate a NewSpace company for inclusion in the NSG 100, NSG PTC, or NSG OTB indices, they value Management over all other company characteristics. And that is why NSG analysts prioritize Management as the first of the “NSG 4-Screens.”

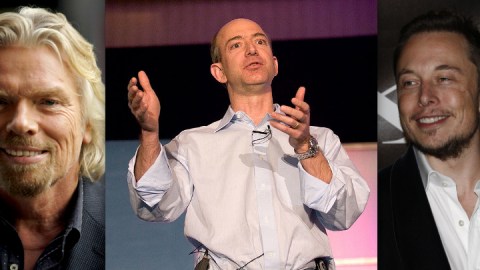

Savvy and experienced executives can often overcome deficits in the other three NSG screens: Market, Capitalization, and Technology. As many investors and entrepreneurs know, this may be true of all companies, in all industries, whether large or small, public or private. NewSpace LargeCaps, despite their emphasis on bleeding-edge technology, are certainly no different. And given that many NewSpace companies begin with a novel idea that has been developed and championed by an engineer (often with scant business experience) NSG Analysts recognize that sound management is even more important to the larger players of NewSpace. With this in mind, we will examine the management of three high-profile LargeCap NewSpace companies: SpaceX, Virgin Galactic, and Blue Origin, and the track records and roles of their respective founders, Elon Musk, Richard Branson, and Jeff Bezos.

As nearly every investment prospectus claims, “past performance is no guarantee of future results”; however, NSG Analysts pay close attention to the management history as the most influential factor in predicting future success. (Please see “Letter From The Editor” in the October 2012 issue of Thruster.) In evaluating a LargeCap company for the NSG indices, NSG analysts first look to the track record of the company’s management. Specifically, they focus on whether the NSG 100 or NSG OTB’s management has taken a previous company to IPO, acquisition, or cash cow. Although many LargeCaps have experienced management, that experience often comes from well-established aerospace corporations, military, academia, or government agencies, and is not readily transferrable to the far more challenging arena of entrepreneurial endeavors in NewSpace.

SpaceX, Virgin Galactic, and Blue Origin are all major players in the NewSpace industry. SET is poised to dominate the private orbital industry; VG seems positioned to thrive in the suborbital tourism industry; and BLUE inhabits a favored space that crosses both the orbital and suborbital industries. While SET and VG tend to be the media darlings of NewSpace, BLUE is a much more tightly-held company that, at this point, values secrecy over publicity, a veritable NewSpace skunkworks. (Please see “LargeCap Review” in the Premiere issue of Thruster.)

Space Exploration Technologies

SET may very well be the best-run LargeCap; this is why it currently occupies the top spot on the NSG 100 index. Recent successes and setbacks may or may not affect this ranking. For instance, the successful berthing of the Dragon spacecraft on its resupply mission to the International Space Station (ISS) despite an issue in one of the Falcon 9’s first-stage engines, which caused a failure of the Falcon 9’s secondary payload (Orbcomm’s OG2 Prototype satellite), caused SET’s NSG index score to drop by -1.32%. (Although, as reported in NewSpaceWatch.com, it is ORBC’s contention that had it been the primary payload, the OG2 satellite could have been boosted into the proper orbit.) (Please also see the “NSG Index Review” in this month’s issue of Thruster.) However, of more concern to NSG Analysts – and in line with this month’s theme – what will determine a larger change in their NSG rating and index position will be SET management’s reaction to this failure. The one-time failure of a company’s technology will not necessarily drastically alter the score and ranking on the NSG indices, but the ability (or inability) of management to address and rectify the failure most certainly will.

Elon Musk, the founder and CEO of SET, has built the company from the ground up into a powerhouse that is currently the hottest NewSpace company in existence. With an unparalleled record of wins in NASA’s COTS, CRS, and CCDev programs, multiple successful launches of its Falcon 9 launch vehicle, two successful trips to the ISS by the Dragon spacecraft, and a multi-billion dollar backlog of booked business, both governmental and private, SET sits on top of the NewSpace world with Musk at the helm. (Please see “Public Policy in NewSpace” in this month’s issue of Thruster.) As impressive as SET’s technological achievements are, NSG Analysts have ranked SET #1 in the NSG 100 for nearly 12 straight months due to SET’s management team’s track record prior to launching the company. Musk has an impeccable business track record. He co-founded and grew internet giant PayPal, which was the first successful IPO in the post “dot.bomb” environment in February of 2002, and was later sold to eBay for $1.5Bln in October of 2002. Musk started SET in 2002 with $100Mln of his own money and has attracted private investment at every step of growth, including $20Mln from Founders Fund in 2008, $30.4Mln in 2009 from Draper Fisher Jurvetson and Scott Bannister, and $50Mln in 2010 from Musket Research Associates, Draper Fisher Jurvetson, and Founders Fund. (Please see “LargeCap Review” in the Premiere issue of Thruster.)

NSG sources indicate that SET is 80% vertically integrated – i.e. it builds its own spacecraft and launch vehicles, a rarity in the NewSpace industry. Furthermore, to achieve economies of scale in a traditionally inelastic market, Musk recently built a factory to mass-produce the Merlin engines that power SET’s vehicles – NSG sources tell us that Musk seeks to leverage Tesla Motors mass-production expertise in building the Merlin engines. (Please see “Down-To-Earth” in the April 2012 issue of Thruster.) In a Henry Ford-esque move to control all aspects of SET’s production and operations, Musk is currently seeking to build a SET-owned commercial spaceport from which to launch their non-NASA missions. (Please see “Spaceland” in the May 2012 issue of Thruster.) It is in this way Musk can price SET’s launch services to compete favorably against United Launch Alliance, the European consortium EADS, Russian giant RKK Energiya, and Chinese launch service provider, the China Great Wall Industry Corporation; this is a very impressive feat, especially in light of the willingness of the Chinese government to greatly subsidize WALL in order to keep launch prices artificially low. (Please see “Point-To-Point: Russia and Eastern Europe” in this issue ofThrusterand “Point-To-Point: Asia” in the October 2012 issue ofThruster.)

NSG analysts look at management’s business track record, not just cumulative time in the industry, as do others who focus on numbers of years in traditional space, e.g., NASA, Boeing, or another aerospace prime. Rather, as mentioned above, NSG analysts look at the track record of taking prior companies to acquisition, IPO, or cash cow status. It is here that Musk’s record shines. In addition to his IPO and subsequent sale of PayPal, Musk has a strong business record. In 2003 Musk co-founded Tesla Motors, a high-end electric car company. TSLA benefitted from Musk’s managerial excellence, raising multiple rounds of private equity funding, then launching its IPO on NASDAQ in June of 2010, raising $226Mln. It may be argued that TSLA is one of only a few successful IPOs since the 2008 economic meltdown, which is especially impressive in light of the Facebook and Groupon IPO debacles. (Please see “Investor Watch” in the May 2012 issue of Thruster.) Not content to sit back and rest, Musk co-founded Solar City, a green energy services company, where he currently serves as Chairman. Solar City has partnered with several leading US banks to fund its green energy projects and recently raised $280Mln through a Google investment vehicle to develop residential solar installations that will provide clean energy to communities. Additionally, Solar City has recently filed for a $201Mln IPO.

Paypal share price and historical events

Tesla share price and historical events

SpaceX share price and historical events

Despite this impressive resume, Musk cannot be everywhere at once. As a result, he has hired some impressive executives to run the day-to-day operations at SpaceX. Among Musk’s best management hires are Gwynne Shotwell and Tim Hughes. Shotwell, as SET’s President, manages the day-to-day operations and customer and strategic operations (and NSG sources indicate Shotwell also covers the vital but often overlooked HR department.) Prior to this, Shotwell was SET’s Director of Business Development and helped develop the Falcon launch vehicles. Shotwell came to SET from the Aerospace Corporation, where she managed a key study for the US Government on commercial space transportation. She has put this experience to use when managing the NASA/SET relationship.

NSG’s Richard David and SpaceX’s Tim Hughes at the SpaceX launch facility for the CRS-1 Falcon 9 launch

Tim Hughes is a Senior Vice president and General Counsel for SET, where he is responsible for the company’s legal, regulatory, and government affairs. Before he arrived at SET, Hughes was the Majority Counsel to the Committee on Science and Technology in the US Congress. It was here that Hughes drafted and helped to get passed several key pieces of legislation establishing the framework to allow and regulate commercial spaceflight in the US. Both Shotwell and Hughes played integral roles in making commercial spaceflight a possibility and are now playing key roles in making commercial spaceflight a reality. With the policy and regulatory expertise of the upper management, and Elon Musk’s combination of business experience, success, and vision, SET is a prime example of the effect that smart and experienced management, NSG’s first and most important screen, can bring to a NewSpace company. An NSG source attributes much of SET management’s success to the fact that “they are all great at sales” – a prime lesson for aspiring NewSpace entrepreneurs: SET’s management understands what it takes to make a business succeed and has the experience to carry it out.

Virgin Galactic

Richard Branson’s Virgin Galactic has been working for years at making space tourism a reality. While the first flights with paying customers are perennially “two years out,” VG has striven diligently toward this goal. Branson’s business track record is formidable. He sits over the Virgin empire of over 400 companies and is one of the wealthiest men in the UK. Branson began in the music industry in the 1970s with a chain of record stores, founded the Virgin Records music label, moved into broadcasting, travel, publishing, automobiles, telecom, and various other industries. In 2004, Branson founded VG to provide suborbital flights to tourists and for science experiments. Always looking for strategic partnerships, Branson/VG then partnered with Scaled Composites (which was purchased by Northrup Grumman for $100Mln in 2008.) (Please see “Letter from the Editor” in the March 2012 issue of Thruster.) VG recently bought out the original 30% owned by Scaled Composites in The Spaceship Company. VG now owns 100% of The Spaceship Company, which is the unit tasked with the manufacturing of the WhiteKnightTwo/SpaceShipTwo system.

VG’s Richard Branson, speaking recently at Warsaw University, revealed his frustrations concerning VG’s delays.

While Branson has a great business track record populated with IPOs, acquisitions, and cash cows, he does not run VG. That is done by George Whitesides, the CEO and President of VG, who came to VG from NASA, where he served as Chief of Staff; prior to this, he served as Executive Director for the National Space Society (NSS). Although Whitesides has the dedication, intelligence, and technical expertise to do great things, he lacks the vital business experience that NSG analysts look for when evaluating a company. By contrast, Branson does have such experience, but the knighted one only appears to have a “toe in” VG at this time and has elected instead to delegate such management duties to others like Whitesides. In addition, Ken Sunshine, the VG CFO, does have significant business experience, having come to VG with an MBA from the Wharton School and has previously served as CFO of MacDonald, Dettwiler and Associates Information Systems, CFO of Aurora Flight Sciences, and Senior Vice President of Finance at Orbital Sciences Corporation. It remains to be seen how VG will perform, since it is still in the experimental phase of development and has yet to send a paid customer to space (although it has reportedly taken over 500 deposits.) While Branson is a world-class promoter, unlike Musk, he is not involved in the day-to-day running of VG (if Branson were actually running VG, our analysis would be entirely different.) VG has a potentially capable upper management team, but are they capable of working the Branson magic and taking VG to IPO, acquisition or cash cow status? NSG analysts know that experience at government agencies, academia, or large corporations does not necessarily translate into success at a start-up, so VG’s future is indeterminate.

Blue Origin

Jeff Bezos, founder of Amazon.com, arguably the first dotcom success story, has built an online empire with his Amazon group of properties, with 2011 revenues of $48Bln and a current market cap of $110.7Bln. Since AMZN was launched as an online bookseller, it has branched into all types of retail: clothes, groceries, music, and serving as the online vendor for countless other companies. AMZN has dominated book sales, and has caused the demise of many traditional booksellers. Since it successfully IPO’d in 1997, raising $54Mln, Bezos has acquired dozens of online properties and companies to add to the AMZN empire. Bezos is widely considered the number one online retailer, and his track record is second to none. A lifelong aspiring NewSpace entrepreneur, Bezos founded Blue Origin to provide both suborbital and orbital launch services. In fact, NSG sources indicate that Bezos – a former PhD candidate in Physics at Princeton University – may have actually started BLUE as a “bank” to capitalize his real lifelong passion: NewSpace.

Blue Origin’s Jeff Bezos

However, Bezos holds Blue Origin’s cards very close to the chest. NSG sources indicate that Bezos owns 100% of BLUE and that employees hold no equity in the company (which is key to morale at a start-up) because Bezos believes that he gave up too much AMZN equity to early employees. Compare this to SpaceX, where many of the engineers have stock in the company and have seen the value increase 10x on the secondary market over the past two years. (Please see Figure 1 above). Very little is known publicly of the structure of the company or the management, but NSG sources tell us that Bezos has intentionally avoided hiring management with significant business experience. NSG sources also tell us that Bezos may replace existing BLUE management with AMZN management, because of his high opinion of the latter, whether they know space or not. Several years ago, in fact, BLUE hired a manager from NASA because, according to NSG sources, he wanted to train the new manager in the “Amazon Way” to facilitate the transition. Like Branson, Bezos appears too to have merely a “toe in” the BLUE waters. NSG analysts speculate that until Bezos “comes out of the NewSpace closet,” BLUE’s progress will be limited.

Successful NSG 100s and NSG OTBs are not magical enterprises destined to democratize the heavens, but are real businesses operating in an idiosyncratic and heavily-regulated industry. In the three NewSpace LargeCaps we’ve looked at, each was founded by visionary leaders with strong desires to shape the future; however, in two of the companies, with a few exceptions, the management teams do not possess proven track records and real-world business experience prior to running these NewSpace startups. What differs between SpaceX, Virgin Galactic, and Blue Origin is the day-to-day involvement of the business minds of Musk, Branson, and Bezos. Musk is far more dedicated to SET than Bezos and Branson are to BLUE and VG; and Musk can bring his experience and track record to bear, while Bezos and Branson instead have hired others with limited success in business. This difference is reflected in the relative NSG index rankings of the three companies. Currently, SET is #1 on the NSG 100, while BLUE is ranked #7 and VG is ranked #12. NSG analysts believe that because of this, SET is far ahead of BLUE and VG because of the limited business experience of their management team vis-a-vis SET, regardless of the nature of their respective technologies.

The investment world knows this implicitly. In order to attract the type of capitalization required to successfully grow a business, the management team needs to inspire in a prospective investor a high degree of trust that the team will be prudent with the investment, make sound decisions, and have a reasonable chance of achieving a sufficient return on investment to justify the risk. This is especially true when dealing with LargeCap NewSpace companies. Because the NewSpace industry is relatively young and largely untested, it is imperative to take a long, hard look at the management; this is especially true when one considers that this industry, in the act of maturing, must rely heavily on investment capital to grow and to thrive. NSG understands this and has prioritized Management as the 1st of the “NSG 4-Screens.”

To put it another way, Space Angel Network Founding Member David Rose, with more than 80 angel investments in his portfolio, likes “betting on the jockey, not the horse.” (Please see “Investor Watch” in the October 2012 issue of Thruster.) And for that horse to be a winner, the jockey must be in the saddle, not in the grandstands cheering it on.

Marc Fusco is a space policy and commerce consultant, and an Editor and Senior Contributor to Thruster.