A conversation with the author of “Predictably Irrational” and professor of behavioral economics at Duke.

Topic: Defining behavioral economics

rnrn

rn

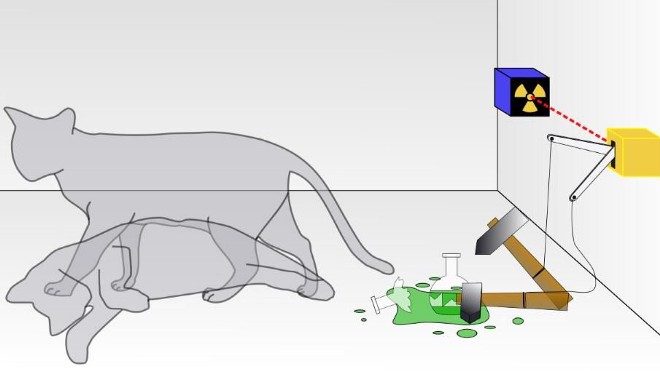

DAN ARIELY: Behavioral economists are interested in the same topics that economists are interested in: why people buy, how we make decisions, what are the right mechanisms in the market, and so on. But the starting point is different. Rather than assuming people are rational and then taking the implications of that, we have no prior beliefs. We say, let’s just see how people behave. Let’s put them in a situation in the lab, in the field, let’s see how they behave, and then as a consequence let’s make the implication, and because in those situations people often don’t behave rationally, the implications are often very different from the implications from standard economics.

rnrn

Topic: Humans are out of control.

rnrn

Dan Ariely: So there’re many, many examples for irrationality. There’s one way to be rational and many ways to be irrational. We exhibit lots of those. A good way to think about it is to think about emotions. So think about it. Imagine if you were in the jungle 20,000 years ago and you saw a tiger, what do you want? You want a human being in that situation to stop, to pause, to think, to take out their little Excel spreadsheet and calculate: What should I do? Should I run? Should I stay? What’s the cost, what’s the benefit? Of course not. What you want is to create a situation in which this person runs as fast as they can the moment they see the tiger, and that’s basically how emotions work.

rnWhen we see something that puts us in danger or had to do something with our sexual behavior, we turn our cognition off. It’s not that we think and we feel, we just feel. Emotion takes over and then they just execute the command, say, run as fast as you can, don’t think, don’t calculate, don’t do anything. Now, emotions still work in the same way these days even though we don’t have tigers, but now they’re evoked by other things. Somebody cut in front of us in the highway, we have some anger towards somebody, somebody in customer service upsets us, all kinds of other things happen. Emotions just work in the same way, even though nowadays they’re not as relevant to those situations.

rnQuestion: Can we train ourselves to act rationally?

rnrn

Dan Ariely: There is hope, and I think that hope basically has kind of multiple legs to it. The first thing is that I’m hoping that when people see a mistake that they know about it they might be able to fix it. So for example it turns out that “free” is a very big allure, when we see something that is free we often go for it even if it’s not good for us. But it turns out that if it wasn’t free, if it was costing us a penny, or 10 cents, or a dollar, we will not have the same allure to it.

rnSo one of the suggestions I have to people is, when something is free, ask yourself, would I still do the same thing even if it was costing me a penny, or ten cents? It’s a range of those things. There’s a range of things in which we can read a paper, or book, or kind of have an idea about what are some irrational behaviors of other people are exhibiting and of course it’s always easy for us to see what other people are exhibiting irrationalities, and then use it as a mirror, and say, oh I can see this behavior. I see that when I date, I juggle too many options; I see that when I shop I make this mistake. I see when I make these mistakes and let me think about how to prevent it. That’s the first hope.

rnThe second hope is for things that we would do, that would prevent us from getting into this mistake. So for example; have you ever gone to lunch when you were vowing to be on a diet and then the waiter comes with a chocolate soufflé, and you say, today I’ll have the chocolate soufflé. Of course we all do it, we all do it repeatedly, surprisingly how repeatedly. Have you ever had a situation in which you said I’m going to only practice safe sex, I really don’t want any STD’s? And then you come to the moment of temptation and the thought about condom, going to get it, and so on is just not high on your priorities, happens very often.

rnNow in those cases, it’s not something you could at the moment fix. You can’t see the chocolate soufflé or be sexually aroused and say, oh let me, let me fix that. I understand this is an irrational behavior. So in those situations what we need to do is to think “ex ante” and try to prevent ourselves from doing that, and there’s a whole range of those things. We could say: I know that I don’t like to exercise, so let me create appointments with friends, so that they will force me to go. I know I have a tendency to have unprotected sex, let me have condoms with me even if I don’t think it’s necessary, or let me tell the waiter at the beginning of the meal, let me ask them not to show me the dessert tray.

rnrn

rn

Question: Are businesses rational?

rnrn

DAN ARIELY: But there’s a general assumption that businesses are smarter. That they know better, and I have to say that as long I was in kind of, academia with no connection to business I assumed the same as well. But in the last two years I had some instances where I got to observe companies. I got to see what they’re doing and I think companies are actually much less rational than people, and it’s not because they’re bad. It’s because they are working in a more complex environment. Imagine that you don’t know if you like brussel sprouts or not. How difficult would it be for you to test it out, quite easy right? You spend a dollar fifty, you try it out. Imagine that business doesn’t know if one of their business processes is optimal or not. How will they test it out? Very, very tough. Not only that, but they’re testing depend on how consumers react to it.

rnSo when they change something it’s not only that they change something, the competitors could be changing something as well. So it’s a very, very hard environment to learn something about. So we as individuals have a relatively easy time to vary things in our lives. You know, sometimes we tell this joke we see if people laugh, sometimes we tell that joke, we see how people react to it, we see what works. Businesses actually have a very hard time; they work in a competitive environment, static environment. They have a very hard time doing any experiments and because of that businesses are mostly stagnant, they’re mostly doing the same thing over and over, and they mostly work on intuition. On top of that they do one of the things I hate the most which is to use focus groups. In which part of your life would you invite 12 people that have no idea about the question in mind, to come and tell you what they think and then adapt to a decision? Would you ever do it in any domain of your life? Of course not! It sounds crazy, but for businesses it’s their way of operation, and they do it because it’s so hard to do. So, businesses I think have a huge problem, and I wish they would do more experiments.

rnrn

rn

Question: How can companies use behavioral economics to their advantage?

rnrn

Dan Ariely: So I think businesses are starting to learn something about behavioral economics. I can tell you a couple of examples. Procter and Gamble for example is facing a very interesting dilemma. They tried to create more and more concentrated laundry detergents. It’s good for everybody, it’s less plastic, it’s less shipping, it’s less space, easier to carry. But if you have this big bottle, with 90 loads, or this little bottle that’s supposed to be 90 loads, people are just not willing to pay the same amount for it. Technology is different; it’s actually more complex to do and so on. But you see this little bottle and you say, well I used to pay the same amount for this big bottle, I’m not willing to do it for the little bottle, and that’s really about consumer perception, and their association of size with value and their inability to do it. So Procter and Gamble had just started doing all kinds of experiments to try and figure out how they overcome it.

rnAnother company is Express Scripts, they basically send you your medications in the mail and they try to get people to take generic rather than take a branded medication and to get people to be compliant with the drug and so on, and they have done recently a very nice experiment. So we know a lot about the power of default. If you had a particular way in which you’re doing something, deviate from that is going to very tough, right. If you basically saving a thousand dollars a month and I say, why don’t you settle for a thousand and ten and here’s a form for it. You’re not going to do it. So what happen is, people have branded medication and you said, you want to switch, they say no, right. It’s good for everybody, it’s good for the patient, it’s good for the company, it’s good for the insurance company but people don’t do it.

rnSo instead of basically tempting people with switching, they said, it’s over. We don’t asking you if you want to switch. Your prescription is over, now we asked you want to go for the branded at this price or for the generic at that price? So no way you could do is just keep only what you had, you had to fill a form and you had to make a decision. They call this active choice, and they increased dramatically the number of people who are using generic medications.

rnSo in one of our experiments we found out that when people sign an honor code in a beginning of the test they don’t cheat. But if they sign at the end of the test, it’s kind of too late, they finished cheating, and you can think about your taxes, right, if you sign in the beginning of your taxes you might think, ‘ooh, how do I want to be, how important is honesty.’ If you finished filing all your taxes and now you’re signing something, you’re not going to go and change what you’ve cheated. You kind of made peace with it anyway. So we got an insurance company to mail people a letter asking them to report how many miles they drove last year. They do it every year, they mail these to people, but we changed the form, some people sign at the top, I declare that everything I say it will be the truth and then they reported the mileage, some people reported the mileage and then said, I declared that everything I’ve said here is the truth. The difference was 15%: the people who signed first reported to be driving 2700 miles more.

rnrn

rn

Question: How are behavioral economics detrimental to the economy?

rnrn

Dan Ariely: So, you know, think about this economic recession. There’s a question of what is really causing us this slowdown and part of it is real and part of it is psychological and there’s no question about that. So think about somebody like me, I’m a tenured professor. There’s a very little chance I’ll lose my job, my income is basically fixed. In fact, I’m more popular now than I was before the recession because all of a sudden people realized that irrationality is more central to our life than they thought before.

rnWhat I should be doing rationally speaking is spending more money, everything is cheaper. Vacations are cheaper, good wine is cheap, there are no lines at restaurants, right. It’s a good time for somebody like me to go spending, but that’s not what I do, and the reason I don’t do it is because of the emotional component. I worry, I’m concerned, like everybody, right. We open the news and the news are designed to trigger our emotions. Trying to tell us terrible stories about individuals who lost their homes and lost their jobs, these are really touching stories that they’re really terrible, and they touch our emotional part and that really changes our behavior.

rnSo we don’t say, “Statistically, where am I standing, what are my cost and benefits?” We look at our emotions, we’re frightened, we’re concerned, we’re worried, and we can’t bring ourselves to spend money and that basically escalates in getting the economy to become much worse.

rnrn

rn

Question: How is fear of layoffs affecting our society?

rnrn

DAN ARIELY: Now the other issue is of course with individuals and their fear about their jobs, and I think people are really afraid of losing their jobs. Particularly in times like these and this is not the ultimate loss aversion. Because of that people are just not doing anything interesting and you can ask whether there’s more herding behavior, whether people are doing more what the majority is doing, whether they’re do it, taking less risk, doing less interesting stuff, because they’re kind of in a stagnation mode, catatonic mode of kind of just fear and not wanting to lose their jobs.

rnrn

rn

Topic: More money, more problems.

rnrn

DAN ARIELY: People often think that people only work for money. Our model of labor is kind of, models of fretwork working in the cage. People hate to work, we have to pay them and we have to pay them more to work more. But it’s actually quite curious. Is this really the case? Imagine I took you and I locked you in a room, and in one case I paid you 1000 dollars a day, on another case I paid you 5,000 dollars a day. Would you produce more? Could you force yourself to focus more, to be more creative, to be more useful for me? Not really clear, and what’s the role of bonuses? How much value are they giving us compared to how much they costing us? All of those are basically unknown, people have strong intuitions about those but they don’t know.

rnSo recently we tried to check it out. With all these issues about bonuses, we did an experiment and we created six different games and they games had to do with memory and concentration, and creativity and some mechanical tasks, like throwing balls at the target, and the whole task took about an hour, and we said to one group of people, look if you do these tasks, each of those very well, we’ll pay you for each of them for a total of basically giving you a day wages. So if you do these tasks well you’ll get a day wages, you do half of them well, you’ll get half a day wages and so on. Another group we said, if you do these tasks well, we’ll give you two weeks of wages, but more interesting offered them a big bonus and to a third group we said we’ll give you a six months bonus, right. So now, if we asked people “Which group do you want to play with?” You said the six months. We ask people “Who do you think will produce the best?” They said, the six months of course, so much money was on the line. But in fact what happened was that these people produced the worst. When we move from the one day to the two weeks there was no difference in performance, when we moved to the six months salary there was a big deterioration of performance. Some tasks reduce from 40% of the people solving them to 5% of the people solving them. Now why is that?

rnIt turns out that money is both a motivator and a stressor. I pay you more money, you want to do more but it doesn’t mean that you can do more. If I gave you 10,000 dollars to be funny in the next minute, could you do it? Or would spend this minute saying, ‘oh my goodness what joke is good enough, I can’t think of anything.’ It is a consequence of the stress actually does worse, and there’s an interesting link here to loss aversion.

rnrn

rn

Question: How do you let employees go while giving them the least amount of loss?

rnrn

rn

DAN ARIELY: It turns out that job loss is something that is very hard for people to get over and one of the reasons it’s very hard to get over because people have so much faith in their job, they relax for a long time and so on and all of a sudden when they lose their job, kind of the ground gets shaking underneath their feet and it’s very hard to create this trust again. When somebody has their spouses in affair, it’s very hard to trust other people after that, when bankers betray us, it’s very hard to trust other bankers after that. So, one of the things to help people is to explain to them that it’s not them, right. So, I know people break up, when they did; they say it’s not you, it’s me. But I think the same thing could happen when you say, “Look if it’s just you losing its one thing.” But if we give people a story, it helps explain what happened and they can make better sense out of it. There’s actually lots of research on that basically show that when people go through trauma, the process of writing about it or trying to explain to themselves or have somebody else explain to them, the reason for that actually eliminate much of the unknown. Think about something like crime. You walk down the street and somebody attacks you and steals your money.

rnWhat is better? To tell you it’s not your fault, it’s just random, it happens, or to say look, here is what happened: you were walking at night in a dangerous neighborhood. Now you could imagine that saying the random thing is better for you because it’s not your fault. But in fact telling you that it was your fault is more helpful because now you understand where it’s coming from and you can think about how you can deal with it next. So returning for people, kind of the center of control and ability I think is very important.

rnThere’s also an interesting thing. Some companies offering employees are saying what do you want? We can fire 20% of the people or we can reduce pay by 20%. In Renault’s case in France a few years ago they said we’ll cut the workweek from five days to four days together with the 20% reduction in pay. And in many companies people are opting for the general reduction. So I think people that work together actually care more about each other than companies realize and are often willing to sacrifice something for their team and for their morale, especially if it’s defined as a short, as a short term.

rnI’ve heard this story from somebody from a consulting company called Diamond Consulting. And the CEO there told me that when the internet bubble bursts, all the partners at the consulting company took a pay cut. And they had a big town hall meeting with all the consultants and they said look, all the bigwigs, all the people who are partners took this and this pay cut and so on. And basically everybody in the company wanted to take this pay cut as well; which is just incredible, right? We don’t think about employees as caring about the company but I think often they really do. I mean I definitely feel like this for the university and I think many people do. And there’s ways to actually use pay cuts to get people to be more motivated, and more committed to their company.

rnrn

Question - Why is it dangerous to make decisions in the heat of the moment?

rnrn

Dan Ariely: I don’t know if sexual arousal is the worst time because there’s a lot of things we’re not going to focus on at that moment. But clearly at the heat of the moment is an awful time. And you know the trust game; we have another version of it called the trust game with revenge. So imagine that you’re player A, you send the money to player B and player B took the money and went home. And I would say ‘Look, player A I’m sorry you lost all your money but here, I’ll tell you what; I know how to find player B. If you’ll give me money, for every dollar you give me I’ll find player B and take two dollars away from him. You give me one dollar, I’ll take two from him, you give me three I’ll take six, ten and twenty and so on.’ You can lose more money to get the other guy suffer more. Would you do it, right?

rnAnybody who ever had a breakup or divorce or so would tell you that the feeling of revenge is incredibly powerful, right. That at the moment that we feel this we’re willing to lose a lot for ourselves to make the other party suffer even more. And it’s an incredibly devastating instinct. But this is what we have. So every time that emotions rule they can get the best out of us and get us to make lots of bad decisions; selling everything in the stock market, shooting emails, annoyed emails to your boss, fighting with spouses, lots of terrible things.

rnrn

rn

Question: What is procrastination?

rnrn

DAN ARIELY: Procrastination is basically a simple term for a deep problem with human nature and the problem has to do with time. We live in the here and now but what’s good for us is often long in the future. And we have plans in the future. We will save money, and we would eat healthily, and we would exercise and we would do this and we would do that and we will do all that. Today I just don’t feel like it. Today the chocolate cake is tempting, and the gym is far away, it’s oh too humid outside, and I really saw a new bike and I don’t feel like saving. So, procrastination is about the problem that we’re just not designed to think about the long term. Why would nature get us to think about what will happen thirty or fifty or sixty years from now? So we think about now and the now is much more powerful and the future doesn’t work.

rnrn

Question: How can you overcome it?

rnrn

DAN ARIELY: I was in the hospital for many years and one of the things that happened was I got Hepatitis C from an infected, infected blood that they gave me as a blood donation. And in the beginning they didn’t know it was hepatitis C they just said hepatitis and it would flare up from time to time and make my recovery much, much slower. And about six years later they identified the virus for hepatitis C and I knew what I had and then there was a treatment called interferon. Interferon is a medication that was developed for hairy cell leukemia. It’s an unpleasant medication. After each injection I would feel vomiting and sick and fever and so on. And I had to take this injection three times a week for a year and a half. So now I think about this problem, Monday, Wednesday, and Friday, I had to go home, measure the syringe in the injection, plunk it into my thigh and inject myself knowing that in an hour I will start vomiting and having fever and so on. It’s very tough to do, right. But that’s really the basic human problem. That if something is good for us in the future, I really don’t want to die from liver cirrhosis, but the steps that we can take now are incredibly painful to fix that. So we often don’t do that.

rnThis by the way brings us to the second issue about what do we do about it. How can we overcome it? When I finished this year and a half of treatment and the doctors told me that I was the only patient that they ever had that took the medications regularly. And you can wonder, you know, do I have more self-control than other people? But, you know, I don’t. I eat the same junk food and I do the same mistakes and I procrastinate just the same way. But I created a trick for myself.

rnAnd the trick is that I love movies. If I had time I would watch lots of movies. So I said I’m not watching movies any other time but Mondays, Wednesdays and Fridays and on those mornings I would go to the video store, I would rent two or three movies if I like. I would have them in my backpack for the whole day anticipating watching them. And when I would get home, I would inject myself, I would get a blanket for the shivering, I’ll get the bucket for the vomiting, and I would start watching the movie immediately. I didn’t wait until I would get sick. I basically tried to create a connection between the injection and something I loved. And I think that’s basically one of the tricks we can try and do to ourselves. We say we’re not designed to care about the future. We just can’t change that. We just can’t change the fact that we’ll think every day: what I do now will translate to 30 years from now. So instead of what we can do, is we can create other benefits that will be more in the present; kind of import new benefits for the present. So in my case it was movies.

rnrn

rn

Question: Does familiarity breed contempt?

rnrn

DAN ARIELY: So it turns out that there is a very strong correlation between how much we know about people and how much we like them. So our spouses, you know, there are all kinds of people that, our good friends, the people that we know very well and we like them a lot. And the question is what is this caused by? Is the liking driving knowing or the knowing driving liking? And what people intuitively think is that knowing driving liking. I learn a bit more about you I would like you more. I learn more about you I would like you more. But the reality is that more knowing actually creates less liking. And the reason is as follows: imagine I tell you that I like music. What do you think that I like baroque music? No. you probably, your immediate thought is to think that I like something that is like you. But then when you learn what I like, you realize we are not similar to each other. So when you describe things in vague terms, like when you go online and you fill one of those online dating sites profile, these things are quite vague. And when things are vague, they have lots of place for the imagination of the reader to fill the gap. And especially if you’re trying to date somebody, you’re looking for people who are great right? So you’re motivated to come up with great people they have something vague, you find out all these great things and then you get…you get crushed.

rnSo there is this sense in which vagueness allow our imaginations to run wild, to be overoptimistic, and then sadly we get crushed by. But now you can also ask, so why is it that we believe in this correlation? So how does it happen that our good friends, we know a lot about them and we like them as well? What happened is the opposite process. Imagine you go to colleges they want you to meet a thousand people. You say “Oh these 500 I don’t care about. These 500 I like, I’ll go and have coffee with them.” You go to coffee with them. Then 250 you say, “Ahh… so-so… 250…” you said “Oh I really like those, I’ll have lunch with them”. And have lunch with them and so on. And so what happened is that because you like people, you keep them as your friends for longer. So in fact in reality it’s the liking that is driving knowing. The more you like somebody the more they would stay with you and then you get more chances to learn more about them and know them better. But if you just take a random person and you just acknowledge it actually creates less liking.

rnrn

rn

Question: What are the benefits of placebos?

rnrn

Dan Ariely: One of the ethical dilemmas that I’m very interested in is the question of placebos. We’ve done research showing that when you give people a painkiller and you tell them it’s expensive it works better than if you tell them it’s cheap. And it turns out that placebos are real. So here’s what happened. You imagine that the medication is real, you get an injection from a physician and your body starts secreting Opiates. So you’re getting pain relief. You’re getting real physiological pain relief but it’s coming form in your body rather than outside of your body. So this is a notion in which our beliefs about the world change our physiology.

rnAnd now here is the dilemma: should we start prescribing more placebos in medicine?

rnShould we lie to people more frequently? Because if we told people this is a placebo it wouldn’t work. So we actually have to lie to them. But when we lie to them it also works. So imagine that you go now and you have a virus and you go to your physician and the physician knows it’s a virus. And he knows that antibiotics are not going to help. In fact, giving you antibiotics is going to get the mutation of the virus. It’s really bad for everybody. Should a physician start giving you sugar pill and say “this is the best thing against this. This is a new thing. It’s from Merck. It’s the new thing coming from it and it’s the best thing against this infection… infection you have”. It’s a curious dilemma because doing so will actually help you. So who is really suffering here? It’s clearly not true. But it’s clearly incredibly devastating.

rnrn

Question: What has been your biggest career mistake?

rnrn

DAN ARIELY: I was teaching a class in MIT and there’s another professor who scheduled a makeup session three weeks on top of my class. So eight students came to me and said ‘Look, we don’t know what to do. We have your class and we have his class and the makeup session and we don’t know what to do.’ And we asked him if he could schedule a different time and he said no. He said his accounting was more important than what I was teaching or whatever it is. And so I told his students ‘You know what, come every Friday.’ They could come for the first half of the lecture leave for the second half and I’ll give it back to you on Friday. So this happened one week, it happened another week; the third week, we’re taking a break and I walked by this other professor’s class and I just got annoyed, right? My emotions got the best out of me. I said look at this guy. He’s scheduled something, so inconsiderate, on top of my class, these students have to go, I have to give them again the lecture on Friday.

rnSo I walked into his class. He’s kind of in the middle of teaching. I walked in and said to him, “I’m a second year assistant professor.” He has no idea who I am; I said ‘Paul, I just want you to realize you scheduled your class over my class. I thought it was very inconsiderate, it’s very annoying. But that’s it. I told you what I think. This is the end of it.’ And I walked out. He was confused. He had no idea who I was or what I was talking about and so on. The next thing I get was a call from the Dean. And what he wanted me to do was basically to apologize in front of the whole, of the whole school. And the Dean at the time was a very good economist. So I said ‘Look, you’re a good economist. You understand signaling. So think about it – this was a bad incident. I agree there are some issues here. But what’s the chance that anybody will ever schedule their class on top of mine?’

rnrn

Topic: The concept of “free.”

rnrn

DAN ARIELY: “Free” is kind of an incredibly tempting human hot button. And sometimes it’s great and sometimes it gets us into trouble. I’ll describe to you quickly the experiments we do. So in the experiments we do, we say “Okay what do you want, the Lindt Truffle for fourteen cents or Hershey Kiss for one penny?” Almost everybody says “Thirteen more cents for a better chocolate is a good deal because it could only take one of the other.” Everybody understands the value of the Lindt is high. Then we discount them both by one penny. Now, the difference and the qualities are the same – difference in price is the same – but now everybody goes to the free Hershey Kiss. And you thought about the transaction cause, you thought about all of those other explanation. The moment something becomes free, we go that trap. So think financially, I said “What would you like? You had two credit cards; one is nine percent interest rate and costs you hundred dollars a year, one is fourteen percent interest rate but it’s free.” People would basically go for the fourteen-free-cards and way from the other one and then consequence incur much more cost in average. Then they would otherwise. So we have this general tendency.

rnNow in the Internet we see through everywhere, right? People have huge value for free. Google is for free. Gmail is free; lots of services are free, now we see ads and we don’t think of them as pay but it’s free. Now because free to one penny is such a big barrier, what’s the chance we’ll pay 299 for another service? Very hard! And now the other problem is that it’s enough for one player to go free, that everybody has to. So imagine that you have lots of people doing email and every company charges you $5.99 a month. And now one company became free, right? Everybody would go there. There’ll be no way out of it. The moment you go into free is very hard to go back. One way to think about how bad this could be is to think about what happen with banking. So think about something like free checking, free ATM, all of those things. How do you think the banks give it to you? Is it because they’re nice people? Is it because they make enough money on the measly amount that you have in your checking account, to justify that? No! What happens is that in order to get free, they create a huge punitive system that comes on top of that.

rnSo here’s what happen; imagine that today is the end of the month and you have three dollars in your checking account and your salary is coming in today. So you go ahead and you buy a latte for three fifty and then you buy a book for 20 dollar and you buy another ice cream cup. And then at nights, they settle your account. Now they could first put your salary in and then charge you but they first charge you. They could first charge you for the small things and then for the big things but no, they charge you first for the book; for the big things. So as the consequence you’ve made three overdraft transactions; 35 dollars apiece would talk about 105 dollars just in penalties. And this is how the system works, right? To give the majority of us free checking. We penalize the poor individuals who don’t have enough money in their checking account - they are not on top of it- and get penalize repeatedly. There are very few people who got penalized occasionally; there’s a lot of people who basically pay a lot of money for these services.

rnrn

Question: Can online services ever charge again?

rnrn

Dan Ariely: It’s going to be very tough. It’s going to be very tough to take something that is free and get people to start paying for it. And one of the barriers is it’s very hard to figure out how much something is worth. So think about these videos that we’re making right now, right? How much are they worth? How much would you pay for it? What will be your reservation process? It turns out people are really bad at it. What we usually do is we get used to what the market told us the value of something is. Cup of coffee is two-fifty. Why? Is this really what we feel? No, this is what Starbucks told us. A can of coke is a dollar. Why? That’s what it says in vending machine not because of what we feel. So there’s a question of learning. It turns out that overtime we learn what the value of something is in terms of money. In this case we’ve learned it’s free. Free for money, it cost something in terms of ads but it’s free, free in case of money. And it’s very hard to change from that perspective. It’s easy to start charging, and charge different amount. Moving for free to charging something is going to be incredibly challenging.

rnrn

Recorded on: July 29, 2009

rn