From falling prey to expectations to taking advice from friends, an understanding of our cognitive evolution helps us avoid misperceiving the limits of our knowledge.

Question: Should we be careful about taking other people’s advice?

Laurie Santos: There’s lots of really old work in social psychology suggesting that the way other people act can have a really strong influence on us. So there are a set of studies back in the '50s, about conformity so they typically would go something like this: You’re in a big group of people, you’re asked to make a decision about something really arbitrary that you should know, like which line is longer, this line or this line. And what you’re faced with is a group of people who are all saying the incorrect answer. And what you find is that a striking number of subjects won’t go against what the group norm is suggesting. Sometimes so strongly that it actually overrides what you actually thought yourself.

So the presence of other people and what other people express as their preferences or their knowledge and so on can affect us in a really deep way. Again, you know, typically for positive aspects, these are probably things that allowed us to develop rich cultures and so on. But they also have a negative aspect as well. So I think the implication is that we really just need to realize that this bias is there. Realize that we are affected by these things and hopefully that will let us get better about it.

And often a lot of the biases that we study and other psychologists study, the real problem with them isn’t necessarily that they are there, or that we make errors or we show these illusions and so on. It’s that we really have a strong feeling that we’re not affected by them. So, when you show these kinds of biases and errors and demos in class, students who succumb to them are shocked and students who just hear about people succumbing to them kind of laugh like "I wouldn’t show that bias." So, I think one of the big problems with this work is actually convincing people, "No, no, no, you will fall prey to these things even though it really feels like you won't."

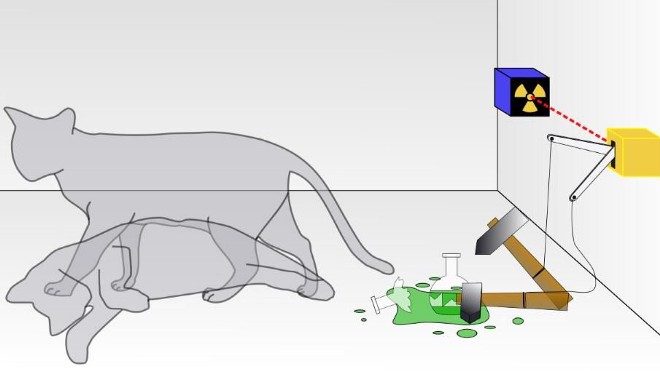

So, the hope is that the monkey work shows that if these biases are really that old, maybe they’re more powerful then we thought. Maybe we really should pay attention to how they’re affecting our behavior.

Question: How do our expectations shape our decisions and experiences?

Laurie Santos: We really are affected by our own expectations. So what we taste when we’re eating a particular meal or drinking a particular wine is really based not on the actual taste of the thing, but our expectations about what we know from the past. So there is, you know, a series of studies in the economics literature showing that if you think a wine is actually worth $100 but it’s really worth $10, it actually tastes differently to you based on your expectation because you know something about, you know the fact that, or you’d like to think that $100 wines taste better than you know, $10 wines or they would charge that much, and so on.

So our expectations actually shape the way we experience things. It’s not just what we expect, but our real subjective experiences. So realizing that perhaps can actually allow you to focus more on your subjective experience and maybe overcome that bias down the line.

Question: What can our cognitive evolution teach us about investing?

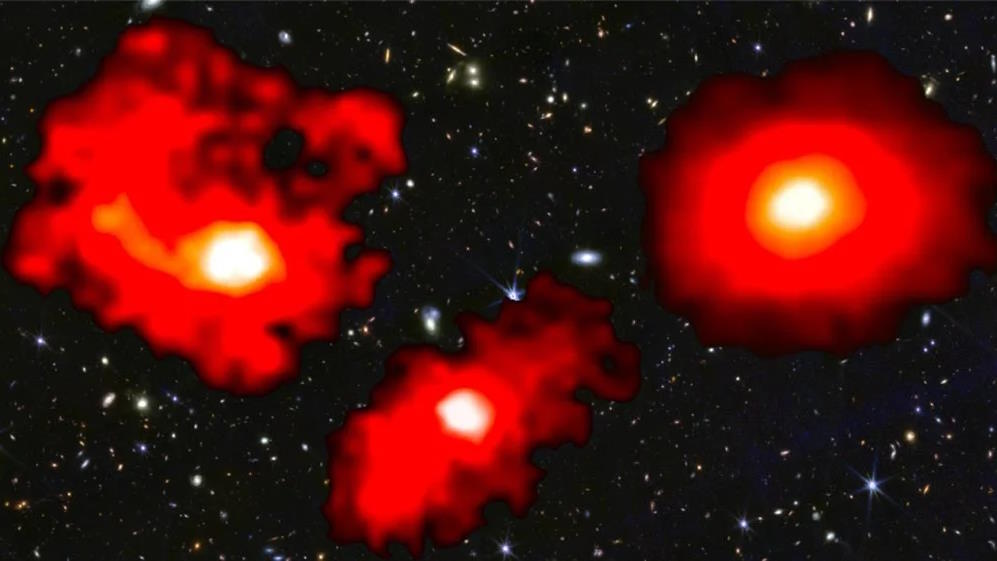

Laurie Santos: The information we pay attention to tends to be very local and it tends to be very relative. And that can... a lot of times our decisions are so based on that that it forces us to ignore really relevant historic data. So, one of my favorite examples of this is that people typically invest more in bonds than they should for their rate of return. They should be investing more in stocks. So, if you look historically over the last 100 years, there is on average about 7% extra boost that you get to your investment by investing in stocks rather than bonds. However, people don’t pay attention to investment over 100 years. They look locally and stocks have... you know, the unfortunate thing is that they often go up, but they’re volatile. You know, sometimes you see that the stock goes into the red and that’s an extremely salient but very local and very relative situation. Yet it affects our behavior a lot. So much so that a Nobel Prize-winning economist who won a Nobel Prize for actually coming up with an algorithm for how you should put stocks and bonds together. When folks looked at his own portfolio, he didn’t do that. He actually invested more in bonds than he should have too. So, you know, even people who should really know better, you know, who should have the historic approach looking over long time skills aren’t, they too are falling prey to these really local, really relative kinds of comparisons.

Recorded May 21, 2010

Interviewed by Andrew Dermont