China: The Descending Dragon

What is the Big Idea?

China’s growth is slowing. Its economy expanded at 8.1 percent during the first quarter, which is significantly slower than the previous quarters and a disappointment compared to the last decade of double digit growth.

There are two main reasons for the cool down. Domestically, demand is decreasing and the construction industry has been hampered by policies that were aimed at curtailing breakneck expansion. Also, overseas demand for Chinese goods has weakened.

This trend, however, is not common among booming economies, according to Ruchir Sharma, author of Breakout Nations: In Pursuit of the Next Economic Miracles. Developing countries hit a “middle-income trap” and stop catching up to rich countries when the per capital income reaches $5,000 to $15,000, says Sharma. While they may continue to catch up, the rate of their growth slows down. Japan in the 1970s, Taiwan in the 1980s and South Korea in the 1990s all slowed from 9 percent to 5 percent growth, because the bigger the economy the harder it becomes to maintain rapid growth.

While it sounds like bad news for China, what this really means is that China is no longer a poor country, says Sharma. Watch this video to hear his take on what this means for the rest of the world.

What is the Significance?

Chinese demand for commodities like oil and iron ore have driven up prices. A slowdown could stave off demand, bring prices down and prompt the exploration of alternative energy sources. It could also mean more jobs shifting back to U.S. soil.

Research from The Boston Consultant Group claims that by 2015, wages and benefits for the average Chinese factory worker will jump between 15 percent and 20 percent, leaving U.S. manufacturers with less incentive to ship jobs overseas.

“As companies think through their plant networks, many will see the benefit in building new plants in the United States to serve the U.S. and western export markets, while retooling plants in China to make goods for the Chinese and Asian markets,” Sirkin and Zinser write in a summary of their research.

Still, some experts think this is an overly rosy assessment of China’s slowdown.

“Those reports are a bit optimistic,” Victoria Lai said to International Business Times. “In fact, China is still taking up more market share in more sectors of manufacturing exports than it did before.”

Rising wages would only prompt manufacturers to take jobs to cheaper destinations like Vietnam and Bangladesh, says Lai.

“The question remains: Do we want the manufacturing of things like iPads to move back to the United States, or do we want more of the design engineering, the sales and the higher-value services jobs that don’t require midnight manufacturing shifts?” Lai said.

Join the debate. Do you want manufacturing jobs to return to the U.S.? Or would you rather see the U.S. focus on innovation and higher skilled jobs? Tell us what you think in the comments section.

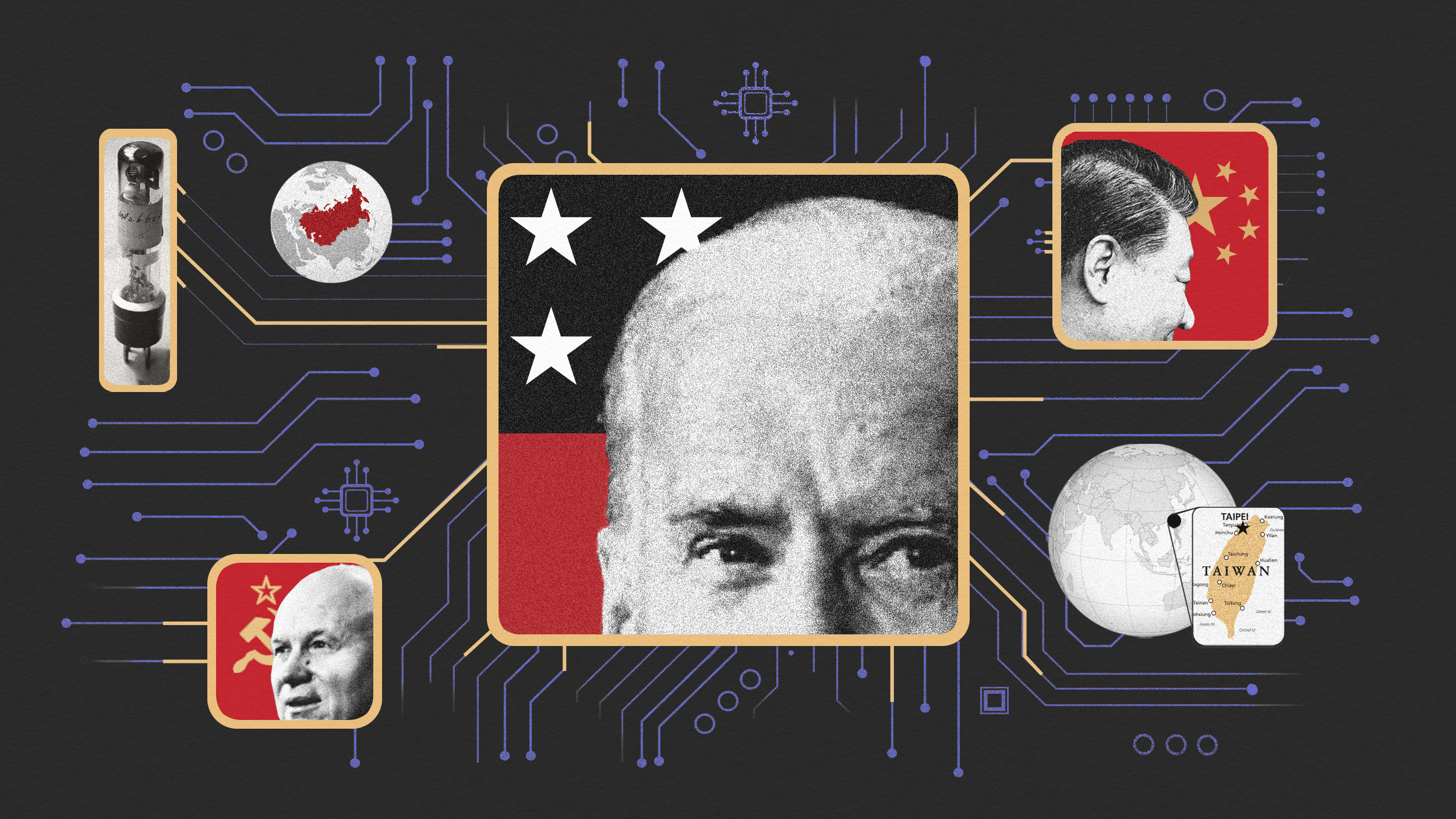

Image courtesy of Shutterstock.com/Cvetanovski