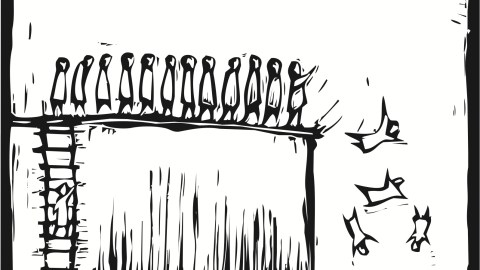

Has ECON 101 turned Americans into Lemmings?

It’s hard to know what leads lemmings to race willfully to their own demise. But I’ve come to believe that the suicidal tendencies embedded in American tax and fiscal policy arise directly from the teachings of modern economic theorists.

One of the first lessons of introductory economics is a simple truism: Savings is Deferred Consumption. It is intuitive and obvious. Wealth is value; when one obtains or creates wealth one can choose to either consume it today, or save it for the future.

What is less obvious, at least to me, is the leap of faith that economists take in building upon that truism. At what point and on what basis have modern economists concluded that savings requires and deserves government subsidy? Perhaps it is simply a puritan ethic that sees virtue in self-denial and deferred gratification? Whatever its rationale, I believe it represents group think and flawed dogma.

I have been advised that I will be unable to find a living economist anywhere who doesn’t believe that sound economic policy demands and deserves preferential tax treatment of savings over consumption. Initially I found it hard to believe that any three economists could find complete consensus on any common principle. I was incredulous at the idea that all economists could agree on a single principle. But now, having researched the issue at some length, I posit that universal agreement on a flawed proposition may be the proximate cause of our progressive decline.

On what basis have we decided that individual self-interest is not an adequate incentive to ensure that people prepare for the future? More pertinently, how have we come to construct incentives that seem so obviously to fly in the face of a key principle of both democracy and capitalism? The concept of equal treatment is so integral to democracy that it hardly requires elaboration; but fair and equal treatment is fundamental to the efficient workings of capitalism as well.

“Every man, as long as he does not violate the laws of justice, is left perfectly free to pursue his own interest his own way, and to bring both his industry and capital into competition with those of any other man or order of men.”

-Adam Smith (1723-1790), The Wealth of Nations

Mr. Smith was not advocating an unequal competition (of industry or capital) in which the wealthiest and most privileged among our society are subsidized with preferential tax rates. Yet modern economists who claim to be advocates of capitalism have flung the principle of equal treatment to the ground and are diligently attempting to stomp it to death. Who would have believed that a society governed by majority vote would over-burden its working middle class in order to provide tax preferences to its privileged elite?

But that is exactly what we do when we offer preferential tax treatment to investment income.

There are only two arguments available to justify preferential treatment of the already privileged: Power or Efficiency. Either the rich and powerful extract preferential treatment because they can, or society grants preferences to the rich in pursuit of a greater good. Giving modern economists the benefit of the doubt I am prepared to accept that many believe we are pursuing a greater good, but objective analysis of actual effect argues strongly to the contrary.

As a simple matter of cost benefit, cursory examination of America’s wealth concentration should make it obvious that the bulk of current tax incentives are wasted; an enormous tax cost is aimed at the portion of our population who least need it and whose behavior is least changed by it. Much of the preferential tax benefit of reduced rates on investments accrues to individuals who couldn’t possible consume all their wealth and income. 73% of the national wealth is held by the top 10% of our population; 35% is held by the top 1%. A combination of high income and/or ample accumulated wealth among this contingent means that the Rich and High Earners are going to save regardless. Are the Top 1%, or the top 10%, really going to spend down their assets if their marginal tax rate goes up? Of course not. What is the cost in reduced and deferred tax revenues that is allocable to a portion of the population upon whom it has no perceivable effect?

As importantly, the misguided incentives we build into our policies impose very serious distortions upon investment decisions. As a result, much of the capital that is accumulated is inefficiently deployed. We have inadvertently made tax avoidance and valuation manipulation far more profitable than productive enterprise, thereby destabilizing our economy. We justify preferential tax policies aimed at savings and investment because we say they will lead to productive activity – but we avert our eyes and ignore the fact that structural subsidies in the form of preferential tax treatment are diverting capital and energy away from productive enterprise. Intellectual capital runs to Wall Street and gambles on valuation manipulation (and over-compensated transactional extortion) and productive enterprise flows (largely unimpeded) offshore in a race to the lowest wage jurisdictions.

The tax preferences we intend to stimulate investments instead stimulate Asset Bubbles. We deplete our treasury and debase our democracy bribing the rich – to no productive effect.

I perceive a need for fundamental structural reform of our tax code – starting with critical examination of the misguided preferential tax treatment that over-burdens our working middle class at the same time it distorts investment decisions. It is easy to understand preferential tax treatment of investment income as self-interest among influential key campaign contributors who now hold sway over our political class – but I dispute it as sound economic logic. If it is not possible to justify preferential treatment of the already privileged as a matter of economic efficiency and thereby a greater societal good, and I believe it objectively is not, then the starting point for comprehensive tax reform should be examination and elimination of those preferences – at least among those for whom such preferences are an unnecessary subsidy, not an effective incentive.

There is of course merit in policies that encourage and assist our struggling working classes to save for the future. But today the benefits we shower upon our investment class require us to impose higher tax burdens upon our working class – thereby obstructing savings where they most need to be encouraged. If we equalized effective tax rates between labor and investments we could reduce both our budget deficit and the tax rate on earned income. Reducing the marginal tax rate on earned income and putting more discretionary income in the hands of laborers would be a far more effective method of stimulating savings where we most need it – than continuing to siphon money from the middle class into the hands of current wealth-holders.