The 200 highest-paid CEO rankings are out. And… cue pitchforks and kerosene torches?

Many of the 2010 Dodd-Frank Wall Street banking regulations that were intended to prevent another Great Recession a la 2008 are being repealed. The measures, approved by Congress and signed into law by the U. S. President today, raise the bar on which banks are considered “Too big to fail” — from $50 billion to $250 billion.

In response, here was what one organization Tweeted:

This morning, it was announced that America’s banking sector hit a new record high of $56 billion in net income in the first quarter of 2018.

This afternoon, the House is set to pass the #BankLobbyistAct to supposedly “provide relief” to the banking sector. What a shameful day. pic.twitter.com/OYNUc7FQf6— Public Citizen (@Public_Citizen) May 22, 2018

Even in the lead-up to the repeal of some Dodd-Frank rules, there was talk about how, during a time of rising bank profits, what's the point of this repeal?

For years, armies of bank lobbyists & executives have groaned about how financial rules are hurting them. But there's a big problem with their story – banks are making record profits. Congress has done enough favors for big banks – the House should reject the #BankLobbyistAct. https://t.co/x95rfTYBUL

— Elizabeth Warren (@SenWarren) May 22, 2018

However, one part of Dodd-Frank that did not get repealed requires publicly-traded corporations in the United State to disclose pay ratios and CEO salaries.

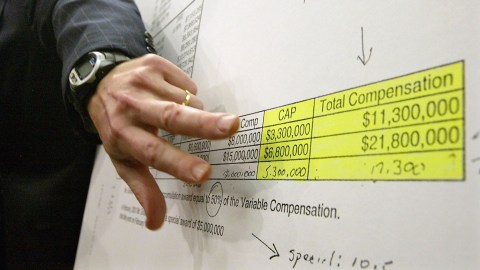

Here's the New York Times graphic featuring the highest pay; it lets you change what's displayed, so you can see ratios, median employee pay, etc. And… these are some staggering numbers:

The ratio of median employee pay to CRO pay is getting larger and larger, with some at 5,000 to 1 and even 6,000 to 1.

Where does that leave us?

Here's Jennifer Gordon, a law professor at Fordham University, with at least one answer: “The top layer of management live like kings and queens while the people at the bottom are scrabbling for a decent existence. We should not have that in a society where equality and fairness supposedly matter.”