We’re Facing a Global Marshmallow Test

We’re facing and failing a global “Marshmallow Test.” Even if not individually, we’ve become systemically less good at making smart now-vs.-later decisions. And economics (=aggregated psychology, often oversimplified) isn’t helping. It advises “discounting” the future.

1. Walter Mischel’s “Marshmallow Test” assesses children’s self-control, testing their ability to resist one treat now to get two later. Kids who resisted longer do better as adults (life constantly needs now-vs-later decision, see also Plato’s pastry).

2. Steven Pinker generally agrees with Mischel, self-control is a “single capability,” measurable in childhood, that’s evolutionarily adaptive, and stable for decades. (Aquinas included it, as temperance, among the “natural virtues,” now better called rational life skills).

3. Mischel favors two metaphors: (a) Hot-vs.-cold brain systems pit self-command against impulsiveness. (b) Self-control is like a muscle (trainable, depletable). But Mischel notes Pinker’s “single capability” can mean strong “willpower in one situation, but not another.”

4. For economists now-vs.-later means “discounting” future utility = a “self-evident propensity to value more highly… an asset today… than the same asset… in the future” (Alan Greenspan).

5. Psychologists like Pinker say we rationally “ought to discount the future” (though not too steeply, or unhealthily).

6. But should all future assets be “discounted”? Is a future breathable atmosphere wisely discountable? Should our unavoidable future needs be lessened? Or given great weight in decisions? (See the logic of needism).

7. Future discounting’s most dangerous form is the “net present value” technique, now widely used in cost-benefit analyses. NPV uses a “discount rate” to calculate a current worth for a stream of future revenues. Seems rationally sophisticated? But it’s often only structured guesses plugged into a spreadsheet. Here’s a rare calculo-guesswork confession: Banks = “a collection of guesses.”

8. Short-term profit pressures constantly present business Marshmallow Tests (e.g. lower investment for the future = higher profits now).

9. Plus businesses can benefit by encouraging self-indulgence (=systemic pressure pushing customers to fail Marshmallow Tests).

10. Markets work by aggregating decisions, prudent or not. Nothing prevents them from aggregating imprudence (sometimes spreading its effects to even the prudent, e.g. unhealthy diets increase health insurance rates for healthier eaters).

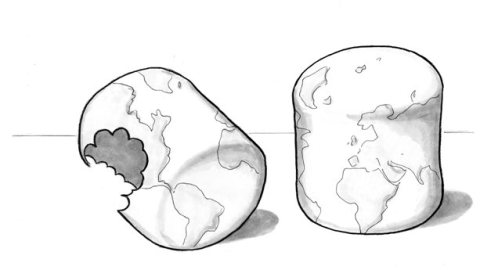

It’s time we got our time priorities straight. Cultures vary in their future-orientedness. But no culture that “discounts” its future needs has much future. If we don’t become systemically more future oriented, we’ll continue to let markets, the most powerful social forces on Earth, deplete that Earth. Anybody got a second marshmallow-Earth? (See also plot of Interstellar).

Illustration by Julia Suits, The New Yorker cartoonist & author of The Extraordinary Catalog of Peculiar Inventions