Will Robot Traders and Rogue Algorithms Take Down Wall Street?

We already know that supercomputers, sophisticated algorithms and mathematical models are at the very heart of the modern financial markets. Now, with l’affaire Knight Capital we’ve just seen how robot traders and rogue algorithms could potentially take down Wall Street. In a span of less than an hour, a rogue algorithm programmed to exploit market efficiencies by buying and selling stocks repeatedly for profit actually inverted the logic of Wall Street: instead of buying low, selling low, the algorithm began to buy high, sell low. All told, the rogue algorithm resulted in a $440 million loss for Knight Capital, causing many to question the state of our modern financial markets.

Have we given too much power to the machines?

To give you an idea of the scale of the problem: in the trading of a single stock, the algorithm was literally losing 15 cents on every trade, 2,400 times a minute, for 30 minutes straight. Knight, which saw millions of dollars hacked off its stock price in the course of days, was begging for a $440 million rescue package from creditors over the weekend. Rather than admit the scope of the problem – which affected trading in 148 different stocks – Knight refers to this as “a technology issue” – as if it were something that the office IT guy could fix.

Quite simply, a rogue algorithm could take down Wall Street because we no longer know exactly what’s inside all of these marvelous black boxes owned by companies like Goldman Sachs. Trades are executed in the blink of an eye, with computers zipping out of stocks multiple times per minute. Let’s just say that there are a lot of entries in the Encyclopedia of Weird Robot Trading Events. Until the Knight Capital fiasco, the best known of these was the Flash Crash of 2010, in which the market sliced through its circuit breakers and went haywire, resulting in billions of dollars in losses in just minutes. We still don’t know the exact cause of the Flash Crash, but one theory is that it was a single bad trade on derivatives linked to the S&P 500 that confused all the algorithms and black boxes out there, leading to a market rout.

If anything, the frequency of these bizarre trading events will only increase in the future. We like to think of “Wall Street” as being a bunch of floor traders on the New York Stock Exchange, making a semi-orderly market in stocks. (That’s what they used to show us on the nightly news, right?) Or, we think of Wall Street as a huge wall of electronic price quotes in Times Square. Even if things don’t always go our way in the markets, there’s something comforting about the notion that humans are still in control of the markets and can see what’s happening at any given time. But that’s actually no longer the case – the future of Wall Street is automated trading floors with rooms and rooms of super-cooled server racks, each of them filled with computers programmed to decide what stocks to buy, what stocks to sell. And these trades happen in a time that’s faster than the blink of an eye.

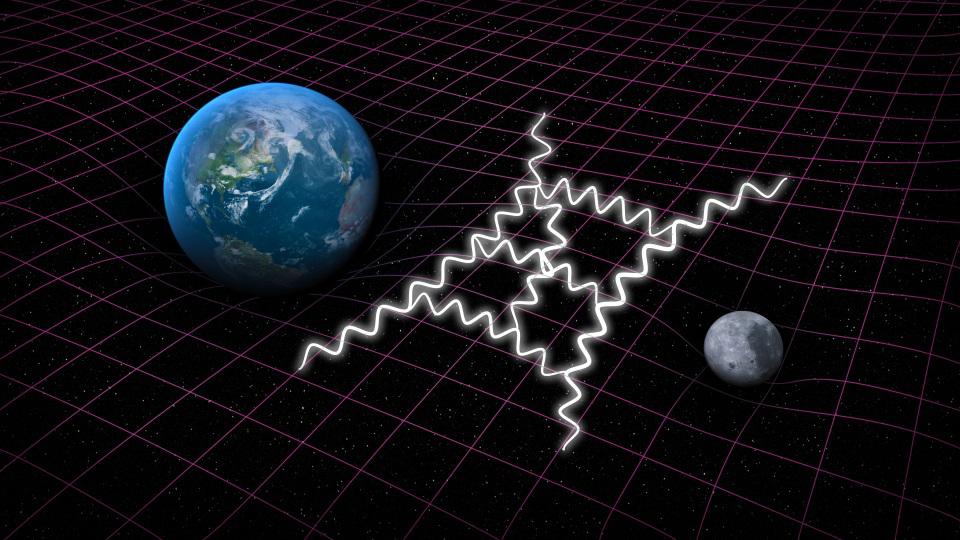

There are a host of different terms – algorithmic trading, quantitative trading and high-frequency trading – to describe roughly same phenomenon: the billionaires running Wall Street have figured out that algorithms, complex mathematical formulas and supercomputers are the way to make money. The markets are too efficient to make millions of dollars at one time, so they’ve decided to pick up dimes and nickels thousands of times per minute. In a 60 Minutes report, reporter Steve Croft asked how fast these computers were trading, and the answer was staggering in its implications: “We’re getting to the point that they can trade as fast as electrons can travel.”

Think about that for a minute. Computers are making decisions not only faster than their human masters can even ponder, but almost as fast as is physically possible. And even when humans put “speed bumps” in there to slow down the computers, the computers figure out ways around the problem. In the case of Knight Capital, the normal speed bumps that would have kicked in during the day never took effect because the first 15 minutes of trading were free of these safeguards. And the robot traders figured it out.

Of course, the leading market participants will continue to tell us that everything’s OK, that it’s “just a glitch,” or it’s “just a technology issue.” But we are automating our lives away to computers. The financial markets are perhaps the most visible area of real-life where we have ceded control to the machines. Presumably, as long as the right people are making money off this, things will only go further in this direction. Technology has made it possible to execute trades lightning-fast and to exploit pricing inaccuracies and other inefficiencies much faster than humans can. But all the warning signs are there that things are slipping out of our control – from the tech glitches that accompanied the botched Facebook IPO to the flawed launch of the BATS electronic trading platform.

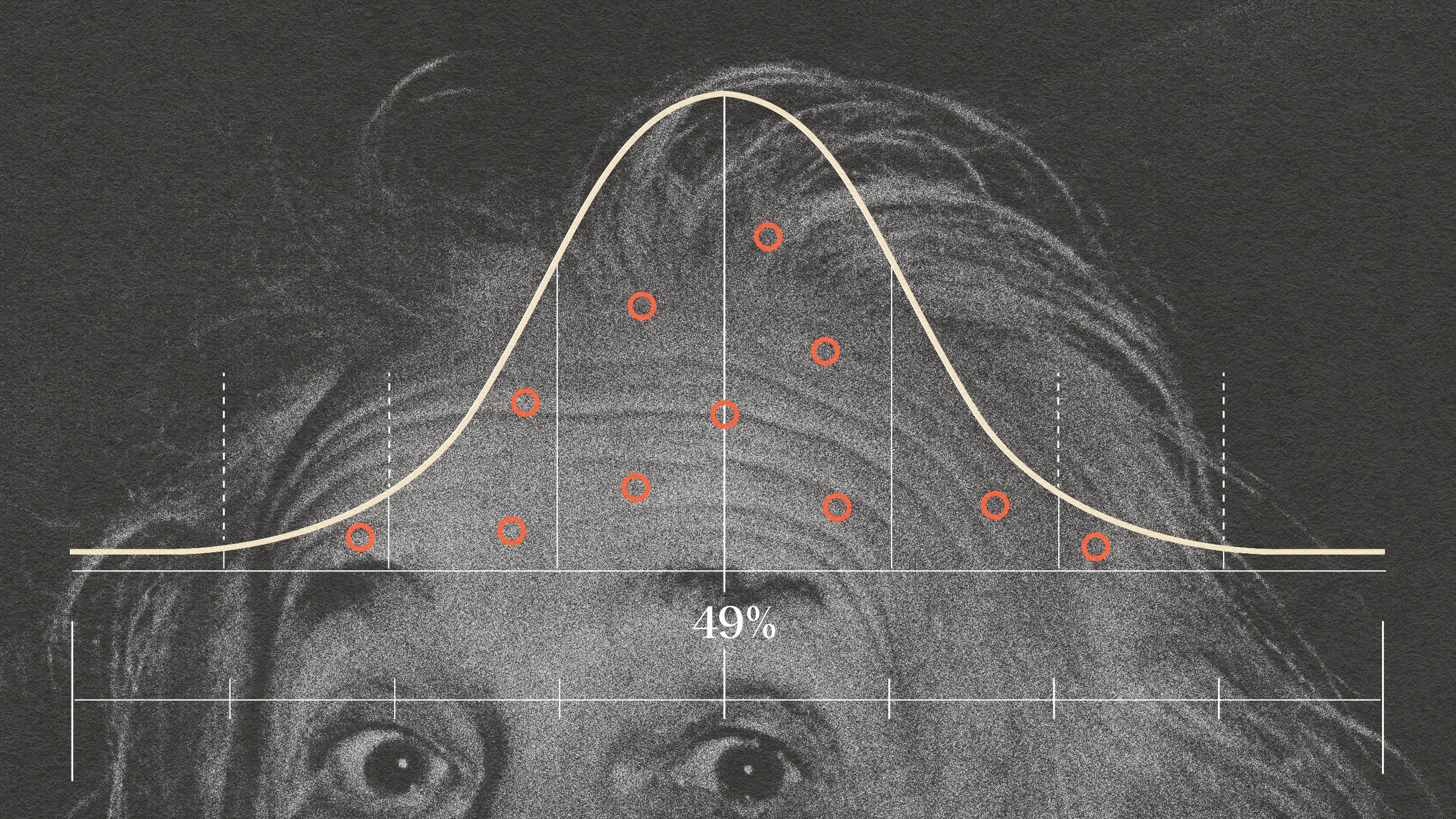

There’s an old adage on Wall Street – “Bears make money, bulls make money, pigs get slaughtered.” Well, the pigs today are the robot traders, using their algorithms to pick up coins in front of the advancing steamroller known as Mr. Market. The major financial participants are literally more worried about the speed of their algorithmic computers than they are the intelligence of the humans programming those machines. But isn’t there a hubris in assuming that we are able to reduce the financial markets to a series of blinking 1’s and 0’s, and that whoever has the fastest supercomputer wins?

image: Business Man With Stock Market Disaster / Shutterstock