Winners and Losers in a Superpower-less World

What will the world look like without a single superpower setting the rules? That’s the question that Ian Bremmer, the political risk expert, tries to answer in his new book, “Every Nation for Itself“. Bremmer’s focus is as much on politics as economics, but I think he has some useful insights about our future prosperity.

For starters, he has excellent timing for a book about the global power vacuum. One of the biggest lessons from the recent financial crisis was that no country had the economic formula exactly right. Attempts at unfettered capitalism ran into problems just as attempts at pure socialism did. That the world knows this is already a big change from the Cold War, where the two economic systems competed to prove their superiority. It’s even a big change from the immediate post-Cold-War era, when capitalism’s victory seemed complete.

In Bremmer’s previous book, “The End of the Free Market“, he identified state capitalism of the kind practiced in China, Saudi Arabia, and many other countries as the next great competitor among economic systems. But in “Every Nation for Itself“, Bremmer sees an absence of global leadership as the balance of political power and economic might diffuses around the world. Now, nations are freer to choose their own way, mixing and matching pieces of economic systems to fit their interests – or at least their leaders’ interests.

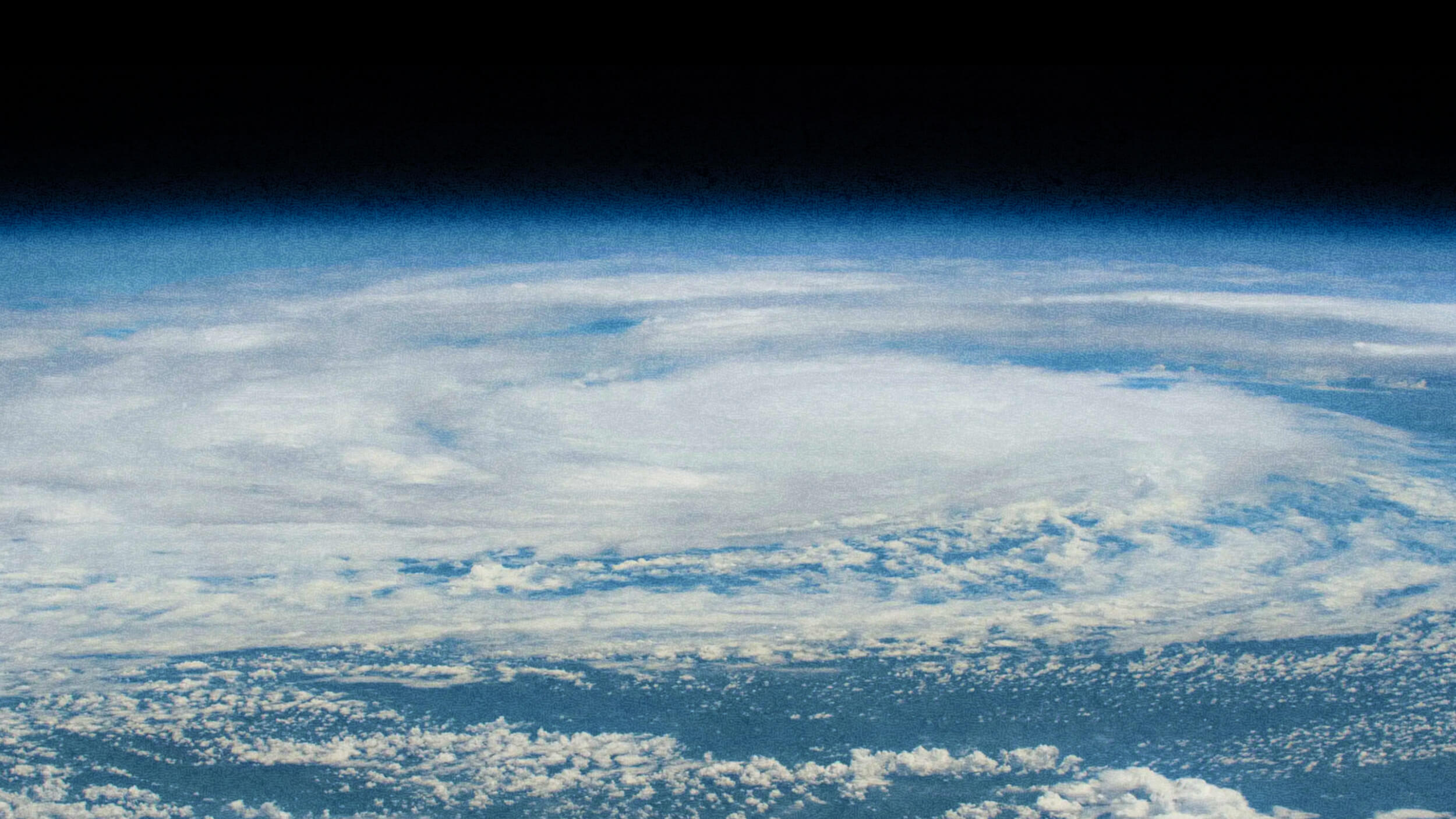

This flattening of the global power structure, paired with the disappearance of superpowers pushing economic systems backed by opposing ideologies, truly has left every nation to fight for itself. As a result, Bremmer says, forming coalitions to address problems such as climate change will be especially difficult. When these problems get out of hand, new conflicts may occur, raising the cost of doing business around the world.

Bremmer identifies the countries that will be most and least able to take advantage of the new flexibility in global power structures. The winners will be “pivot states”: regional powers like Brazil that bigger powers want engage with economically, but that can still maintain their independence. The losers are “shadow states” like Mexico, so closely linked to a bigger power that they can’t set their own paths into the future of the global economy. Bremmer also points out the kinds of companies that will be able to adapt to the new reality, and those that won’t.

It’s not news that coalitions are hard to form, or that Brazil is the global economy’s sweetheart. But Bremmer is offering much more here: a blueprint of the world’s new political architecture that will have profound economic consequences. Global investors, take note.