The Epileptic Economy: Why the Financial System Has Become Dysfunctional

Mark Roeder is an ex-senior executive of UBS Bank and the author of The Big Mo: Why Momentum Rules Our World. In this guest post, he explores what recent discoveries in neurobiology can tell us about the causes of the financial crisis – and how to treat it.

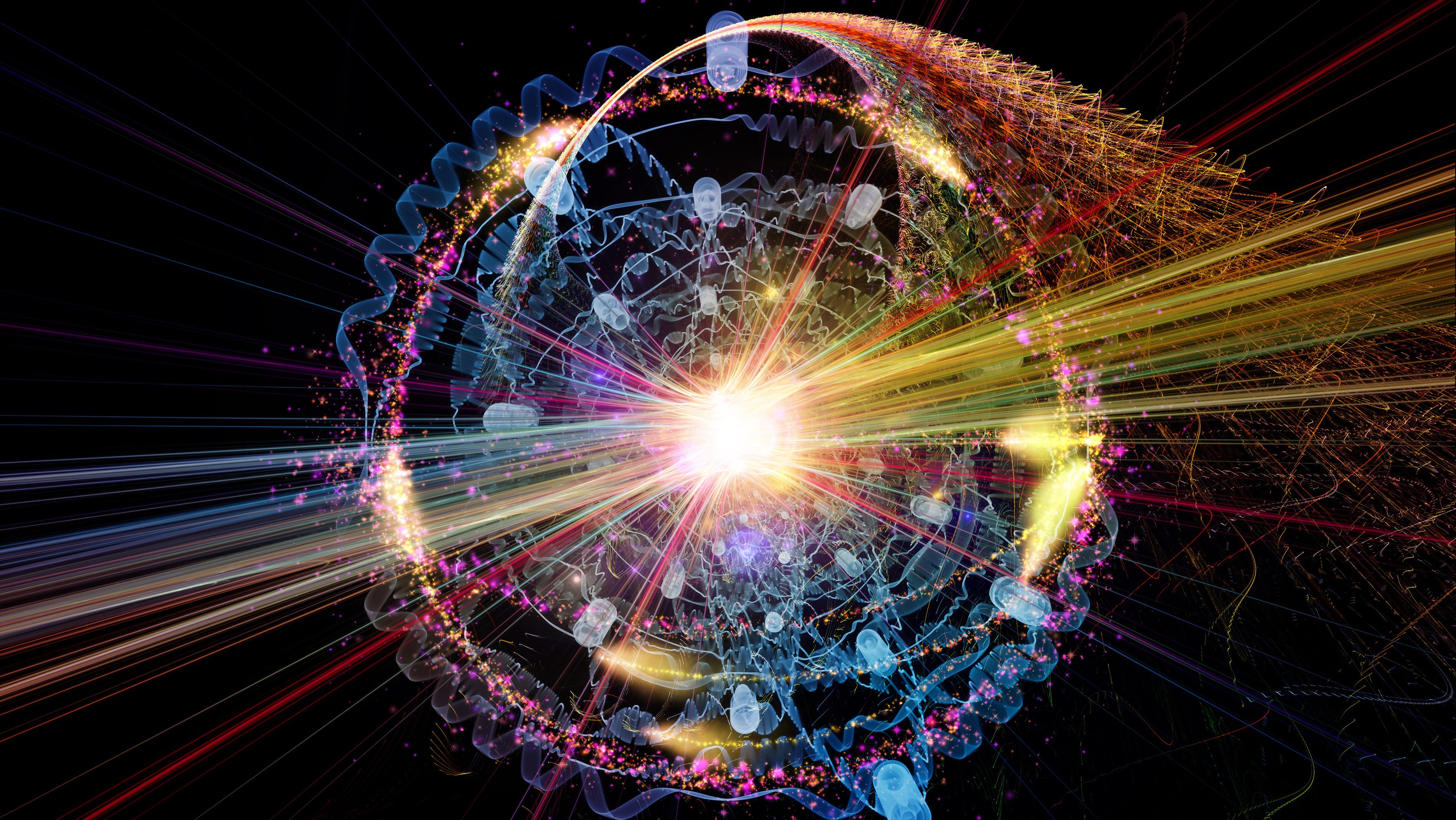

In March 2008, two researchers from the University of California’s Department of Anatomy and Neurobiology, Robert Morgan and Ivan Soltesz, discovered that when a small number of neurons in the hippocampus become highly connected, they develop into neural ‘hubs’, which begin to circulate and amplify signals to such a degree that they overwhelm the brain’s networks, leading to epileptic seizures.

This transforms a healthy brain into an epileptic one, which is more prone to fits. In effect, the hubs become the conduits for seizures in the network. ‘The structure of the epileptic brain differs substantially from that of a healthy one, and our discovery of this hub network offers insight into how epilepsy may develop,’ Morgan explained.

The similarities between the epileptic brain and the modern global financial system are disturbing and suggest that the emergence of a few highly connected and powerful banking hubs has made the system more prone to periodic fits and seizures.

The banking oligopoly has become even more concentrated since the global financial crisis in 2008, following shotgun takeovers like Bank of America’s acquisition of Merrill Lynch, Wells Fargo’s takeover of Wachovia and the JPMorgan Chase purchase of Bear Stearns, to name just a few. This increased concentration has, in effect, created the conditions for a financial version of a ‘grand mal’ seizure. Such a seizure occurs when the electrical system of the brain speeds up to such an extent that it triggers a massive convulsion.

There is no doubt that the ‘electrical activity’ of the global financial system has sped up in recent years. Technological advances have exponentially accelerated the velocity and scale of money flowing through the network. It has also become more automated, thanks to high frequency trading programs (HFTs) that utilize algorithmic formulae to trade in picoseconds – that’s one trillionth of a second.

As Andrew Haldane, Bank of England executive director, Financial Stability observed in a speech in August this year: ‘If supermarkets ran HFT programs, the average household could complete its shopping for a lifetime in under a second’.

Every so often, this warp speed system goes haywire, as we saw on May 6 last year, when the Dow Jones index crashed by nearly 1,000 points in a matter of minutes wiping out 900 billion dollars in value before bouncing back.

This ‘flash crash’ was blamed on HFTs, which have the effect of distorting the feedback loops in the trading system, so that small changes loop back on themselves, triggering much bigger changes, and so on, thus amplifying internal risks. Once again, the parallels with the epileptic brain are intriguing. A recent study by the Centre on Theoretical Problems in Physicochemical Pharmacology, at the Russian Academy of Science, suggests that abnormal feedbacks loop in the neural network play a key role in triggering epilepsy.

Apart from speeding things up and distorting feedback loops, these trading programs also exacerbate the problem of network concentration, which was described earlier. Although HFT firms in the US represent just 2% of the 20,000 firms that trade in equities, they now account for nearly 75% of all trades, according to figures from AiTe consultants. The trend towards greater concentration is similar in Europe and Asia, and not just for equities trades but also for options, futures, ETFs, and currencies.

Meanwhile the ‘neural’ connections between the markets are being significantly upgraded. Initial work has begun on the Hibernian Express, a fibre-optic link that will cross the Atlantic and operate six times faster than the existing Global Crossing’s AC-1 cable. It is no surprise that HFT companies and hedge funds are first in line to connect to the new system.

Another factor driving the hyperactivity of the financial system is the modern media, which magnifies the tiniest shifts in sentiment, prompting hordes of traders to reach for their BlackBerrys and Bloomberg screens. They do this reflexively and unconsciously – like neural cells – because they are so swamped with data that it’s easier to ride the trend, and amplify the feedback loops.

Some years ago, Paul Kedrosky, a senior fellow at the Kauffman Foundation, commented that the Internet has ‘created a giant jigsaw puzzle comprising a zillion pieces of information that are constantly and frenetically changing. All the relevant information is there, but there is no way to look at it in a way that makes sense.

The sheer abundance of financial information available online creates a smog of data. Even the most sophisticated financial analyst finds it difficult to grasp the whole picture…We are in the first financial crisis of the internet age. A crisis caused in large part by the tightly coupled technologies that now undergird the financial system and our society as a whole.’

In brain-speak, it is as if the cerebral cortex is no longer capable of processing the information it receives. Indeed, the more closely that the global financial system resembles a dysfunctional brain, in terms of its speed, structure and connectivity, the more frequently we can expect crises – seizures – to occur.

There used to be a gap of a few decades between financial crashes, as was the case between the 1929, 1966 and 1987 crashes, and the dot.com crash of 2000. But the recent global financial crash happened just eight years after the previous one, and it was a lot bigger. We can expect business cycles to be increasingly punctuated by massive convulsions that come without warning.

Despite this transition into an epileptic economy, there is an unwillingness by governments and regulators to acknowledge it. This is not surprising. Instead, regulators appear to be intent on propping up the system in its current form.

It is as if a patient, having barely survived the last seizure, is urged by his doctor to ‘Go back to your old habits and have some fun. You don’t need to make any serious lifestyle changes. Come back and see me after your next crisis. In the meantime, here are some antidepressants to boost the amount of serotonin flowing through your system o make you feel better.’

Governments these days prescribe ‘antidepressants’ in the form of huge injections of public money into the financial system, through initiatives such as quantative easing and bailouts. Anything to boost the feel good factor.

Yet they are loathe to force the patient to take the tough medicine, such as slowing down the frenzied hyper-activity of the markets through regulating HFTs and introducing circuit breakers; imposing transaction taxes on speculative trading; diluting the concentration of the global banks; and compartmentalizing the system so that if one part breaks down, it won’t contaminate the rest, via an updated form of the Glass Steagall Act (Paul Volcker, the ex-Chairman of the US Federal Reserve proposed this nearly two years ago).

Such medicine will be difficult to swallow. But we no longer have a choice. The great central bank pharmacies have almost run out of ‘antidepressants’. And as the ‘Occupy Wall Street’ demonstrations make clear, the public is becoming impatient – and angry – at the growing inequity in a society that they sense is exacerbated by an errant financial system.

Ultimately, every successful treatment for a medical problem begins with an accurate diagnosis. The sooner we face up to the fact that our financial system is suffering the equivalent of a neurological disorder, the sooner the real healing can begin.

This article has been revised to reflect the following correction:

Correction: October 25, 2011

An earlier version of this article erroneously referred to epilepsy as a “mental illness.” Epilepsy is in fact a brain disorder.