Google Wants to Change the Way We Shop For Mortgages

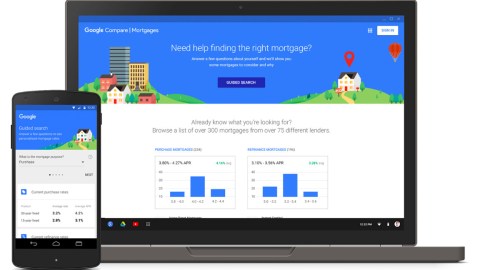

Google is evolving again. The company just released a new version of a tool that allows homebuyers to compare mortgages online. Google says that it is trying to address the issue that half of all borrowers don’t shop around for their mortgage. The tool is an expansion of a mortgage calculator that Google made available earlier this year, and for now it’s only available in California. However, a similar service has been offered in the UK for several years now.

The mortgage search product falls under Google’s Compare tool, which already compares auto insurance. To create its new product, it partnered with the companies Zillow and LendingTree, who are already established in the housing niche.

Not surprisingly Google’s decision could be having an impact on the broader market. Quicken Loans shared on Tuesday that it will begin offering “Rocket Mortgage,” which is supposed to allow customers to obtain a full mortgage approval in eight minutes — the same amount of time it takes a space shuttle to reach orbit.

Are we seeing a new kind of housing market arise? Perhaps the next phase of America’s housing boom and bust will have to do with technology products that facilitate mortgage access in new ways. Positive applications could include making mortgages more understandable, while negative ones could include eventually replicating some of the forces that caused the last housing market downfall.

Google is no stranger to releasing new products and leading markets. The company has over 1.4 billion active Android users each month and operates in almost every market of the world. But some wonder whether Google will be able to maintain its market dominance in an increasingly post-desktop world. The relevance of its fundamental search engine function (and the ad revenue that the company generates from it) is decreasing. The next iteration of Google, potentially with products such as Google Now, will have to find a new way to earn money off customers who may be driving or otherwise on the go and not available to read ads.

Whether the mortgage comparison application is just an experiment or here to stay, there’s no denying that everyone still looks to Google to see what’s coming next.

—

Stefani is a writer and urban planner based in Oakland, CA. She holds a master’s in City and Regional Planning from UC Berkeley and a bachelor’s in Human Biology from Stanford University. In her free time she is often found reading diverse literature, writing stories, or enjoying the outdoors. Follow her on Twitter:@stefanicox