Why A Greek “No” May Be No Bad Thing

Markets shuddered when George Papandreou, Greece’s prime minister, said he would call a referendum on the latest bailout package being offered by Europe’s economic powers. What scared the markets most was apparently the possibility that the Greeks would choose according to their own interests, not those of the euro zone as a whole. The distinction may be a false one.

Greece has brought most of its problems on itself. Its people have a history of evading taxes, and its government fudged the books for many years. But Greece isn’t the only country to blame. The other members of the European Union probably shouldn’t have let Greece join the euro zone; in their eagerness to create a common currency covering as many members as possible, they either missed or ignored the fiscal shortcomings that would have disqualified Greece.

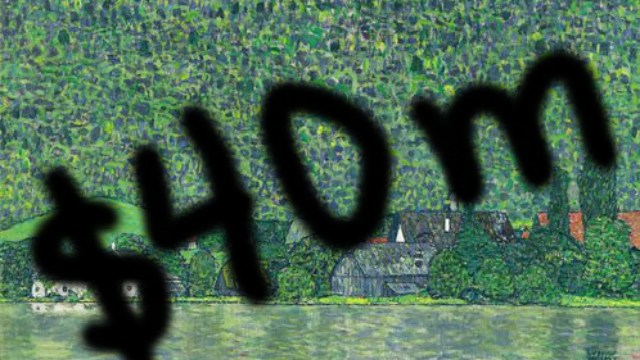

Now the possibility that Greece will reject the bailout – whether by referendum or otherwise – and default on its debts is menacing banks and bondholders across Europe. In the bailout, these creditors would accept something like a 50 percent loss on the face value of Greek bonds, but their action would be conditional on Greece raising taxes and making more budget cuts.

You could certainly understand if some Greeks felt they were being asked to sacrifice excessively in order to reduce the pain elsewhere in Europe. Of course, you could also argue that they should sacrifice for others’ benefit, given their responsibility for the current state of affairs. It’s not clear that this would lead to the best outcome, though.

At the moment, the political situation in Greece is extremely adversarial, and the pressure from the rest of the euro zone is only making it worse. After all, it’s easy to protest against austerity measures when it seems like they’re being imposed from abroad, and it’s easy to lose faith in a government that seems to be kowtowing to foreign powers. If the Greeks had to go it alone, they might take a more constructive attitude.

What if Greece were outside the euro zone, with no chance of a bailout? It would probably start by printing a lot of money. Doing so would devalue its currency and spur exports. But it wouldn’t help Greece to regain the confidence of the credit markets and the ability to borrow. For that, austerity measures and a commitment to budgetary discipline would indeed be required. Yet the Greeks would be able to calibrate the timing and extent of these policies on their own, which would make popular support – or at least acceptance – more likely.

So is the right strategy just to let Greece go? An exit from the euro might tarnish the common currency’s image in the short term, and this is clearly a major concern for big members like France and Germany. But if the decision to drop Greece were accompanied by firm rules about how countries can enter and exit the euro, the currency would be much stronger in the long term. Right now, these rules are missing, creating uncertainty that hurts investment in euro-denominated assets. Officials in Brussels have sent conflicting signals, some saying that Greece can only exit the euro by quitting the union altogether, and others saying that the euro zone is completely prepared for a Greek exit.

I think an orderly exit for Greece could be better for Greeks, the rest of the euro zone, and markets around the world. Putting an end to the string of ineffective bailouts and placing Greeks firmly in control of their own destiny would help to contain the problem, making it more about Greece and less about the euro. In fact, the effect might be quite the opposite of the domino effect France and Germany seem to fear; other fiscally unstable countries, like Italy, might take the Greek exit as a signal to get their houses more in order.

In the meantime, the European Union’s leaders need to recognize that the euro has been a grand experiment that is not quite complete. Its founders failed to take seriously the possibility that a country would leave the common currency, and today’s leaders are falling into the same trap. It’s time to stop denying that this will happen, whether with Greece or another member. Regardless of how Greeks vote, the euro will need new rules for the future.

Photo Credit: Insuratelu Gabriela Gianina / Shutterstock.com