When Plenty of Fish in the Sea Leads to Very Little Money in Bank

I always say, there is nothing sexier than a man with a lot of credit card debt. Let the other ladies have the husbands who have made smart financial decisions, when I stand at the alter and say “I do” I want to know that the man in front of me has as accumulated as much debt as possible.

A new, and much touted, psychology paper argues that when men outnumber women they accumulate more debt, and save less, in the heated competition to attract a long-term mate. And they find evidence to support this theory as well. Using data from 120 U.S. cities they find a positive correlation between the ratio of single men to single women and the level of debt of the population as a whole.

In theory this sounds like a reasonable argument. After all, in the animal kingdom when the males outnumber the females, competition for those scarce females ensues. That competition leads males to allocate more time and resources to securing themselves a mate.

There are two problems, however, with applying this theory to the behavior of men and women in a modern economy particularly when you want to argue that the pursuit of marriage is the driver.

The first, and most obvious one, is that unless they have the ability to store food animals do not accumulate wealth. Women might be impressed with high levels of conspicuous consumption in short term relationships, but for long term relationships that conspicuous consumption doesn’t matter if the suitor is just accumulating debt as a result. What matters for long-term commitment is wealth.

Think of it this way: is the female squirrel going to choose to cuddle up for the winter with the male squirrel just because he has given her nuts all summer? No! She is going to want to know that he also has a big pile of nuts hidden under a tree somewhere.

The second problem is, when the men outnumber women many men have little hope of ever marrying. This may sound a little silly when we are talking about U.S. cities since they are little open economies on the sex and love market with no real barriers to trade. But in China and in India the gender imbalance has closed off the possibly of ever marrying to literally millions of men.

If one of the reasons why men accumulate wealth, for example, by investing in a home, is in anticipation of one day having a wife and family, then the probability of that ever happening is significantly lower when the incentive to save is gone.

I think that what the empirical evidence in this paper is picking up on is not increased spending as a result of male completion for a marriage partner, it is picking up on reduced savings in response to poor marriage prospects and increased spending in the pursuit of short-term sexual partners, where wealth really doesn’t matter.

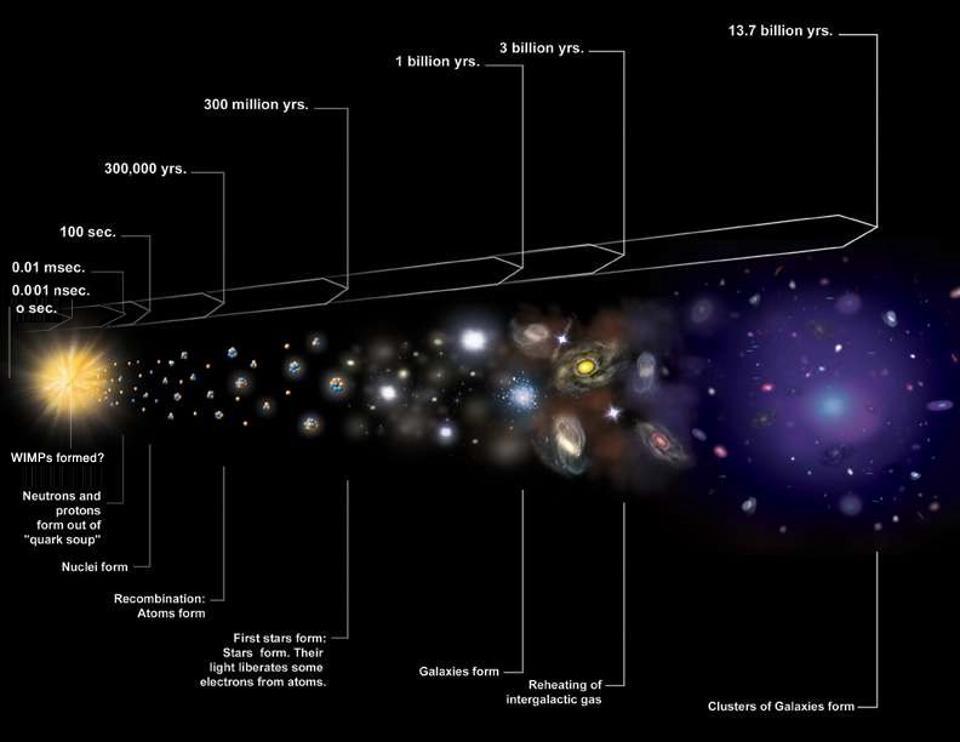

Having said that, I am not trivializing the importance of this research for the following reason: investment in the U.S. has for many years been reliant on the enthusiasm with which private households in China save. If the predictions of this research are correct, then in the face of sex ratios that disfavor men on the marriage market we should expect household savings to fall in China as a result of increased competition for women.

But we haven’t seen that, and in fact, the empirical evidence suggests that just the opposite is true. Increased competition for women has increased household savings in China as families have grown their wealth in the hope of finding a wife for their sons.

A paper, published in the Journal of Political Economy last year, found that the gender imbalance accounts for about half of the increase in the household savings rate in China between 1990-2007.

One possible explanation for the difference between China and the U.S. is, speaking frankly, that if a man in China never marries he has a very low probably of ever getting laid. There is little incentive to spend heavily to attract short-term partners in a society in which pre-martial sex is heavily discouraged. By extension, this suggests that promiscuity could be to blame for the low savings rates in the U.S..

One final thought. As an economist, I really have to wonder why it is that these marriage markets in the U.S. are not clearing. If two cities within the same state differ in that one has an excess demand for women and the other has an excess supply of women, they why are these two cities not exploiting the gains from trade?

If you think you have the answer, I would be happy to hear it.

References:

Griskevicius, Vladas and Joshua Tybur, Joshua Ackerman, Andrew Delton, Theresa Robertson, Andrew White (2012). “The financial consequences of too many men: Sex ratio effects on saving, borrowing, and spending.” Journal of Personality and Social Psychology, Vol 102(1): p.p. 69-80.

Wei, Shang-Jin and Zhang, Xiaobo (2011). “The Competitive Saving Motive: Evidence from Rising Sex Ratios and Savings Rates in China” Journal of Political Economy Vol 119(3): p.p. 511-64