Howard Sosin’s Plan to Return Insolvent Banks to Financial Health

“The problem isn’t just toxic securities, its toxic banks.”[1]

I. INTRODUCTION

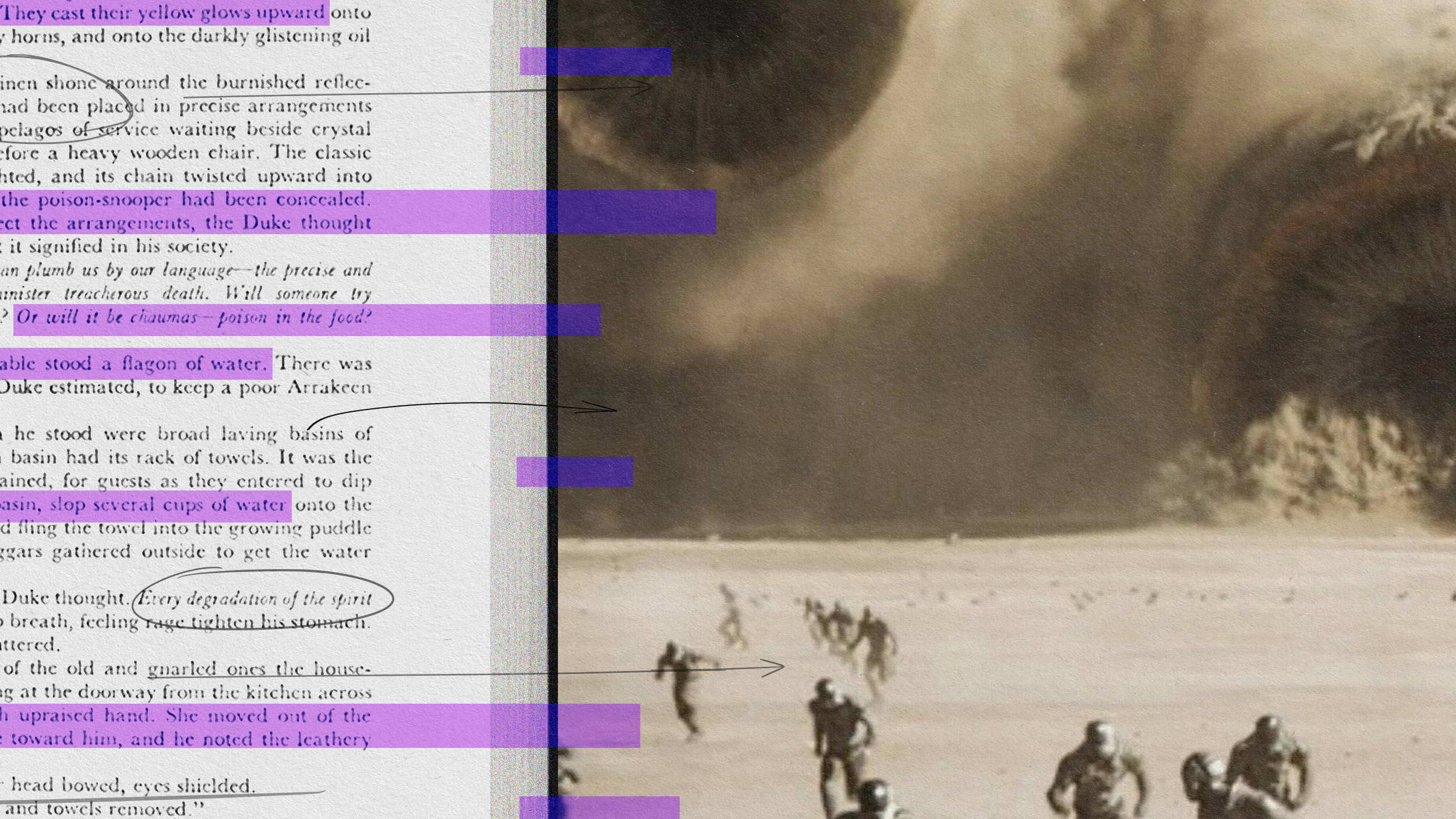

Banks have suffered serious losses in virtually all of their activities. A problem that was first diagnosed for mortgage backed securities has spread to credit card and auto receivables. Even more troubling, the problem has also infected traditional banking activities – commercial and industrial loans, and CRE Loans. And, losses from derivatives and outright speculation have added to the problem.

One solution would be to have the FDIC take over troubled institutions and liquidate them. This route has been followed for smaller institutions. However, it has not been used for ones considered “too big to fail” because there is a fear that the damage caused to the “system” by a liquidation could dwarf the costs of an intervention to save the troubled bank. Instead, the Government has utilized, or is proposing to utilize, its mandate under TARP in two ways. First, the Government has made “investments” in the preferred stock of troubled banks, hoping to shore up their capital bases. And second, the Government is poised to make direct purchases of “toxic” assets through PPIF’s.

In section II, I develop a simple model of a troubled bank that can be used to analyze the impact of alternative Government interventions that are intended to return banks to health. In section III, I use this model to examine the impact of TARP preferred stock purchases and the potential impact of PPIFs. I conclude that while these strategies may help some of the “walking wounded,” we should not be surprised that purchases of preferred stock have not resurrected “zombie banks,” nor should we expect purchases of toxic assets to win the day. The breath and depth of the losses at zombie banks are truly staggering which means that band aids, even very large ones, won’t be sufficient to return them to health in a meaningful time frame, if ever. Furthermore, as currently structured, TARP programs benefit the existing unsecured creditors and equity holders of banks at the expense of taxpayers.

Increasingly there is talk that the Government should temporarily take over large troubled banks, insulate them from their bad assets, and recapitalize them. In Section IV, I discuss some general issues associated with a Government takeover of troubled banks.

In Section V, I use the model developed above to illustrate how a Good Bank/Bad Bank Take-over might work. I conclude that, in contrast to TARP and PPIF’s solutions, a Good Bank/Bad Bank Takeover can rescue a zombie bank and that the rescue can be designed to repay taxpayers before the unsecured creditors and equity holders. However, the inability to draw a sharp distinction between good and bad assets, and the fact that bad assets will require significant on-going management means that this is an inefficient solution.

In Section VI, I describe a take-over solution that incorporates the benefits of the Good Bank/Bad Bank Solution without its pitfalls. It is a solution that is guaranteed to work – literally. I propose that the Government guarantee the performance of all of assets of a troubled bank, with the proviso that the guarantee would come into play only after the book value of the unsecured creditors and equity holders is wiped out by realized losses on assets held by the original bank on the date of the takeover – hence the name, the Backstop Guarantee Takeover.

Like a Good Bank/Bad Bank Takeover, a Backstop Guarantee Takeover can be structured to give the unsecured creditors and equity holders a chance to participate in an economic recovery without giving them priority over taxpayers. Additionally it is a simple and efficient solution that does not requiring an artificial division of good and bad assets or the creation, staffing and management of a superfluous entity (the Bad Bank).

In Section VII, I discuss some of the ownership and management issues that arise after a temporary takeover of a troubled bank. Section VIII is a brief summary and conclusion.

II. A SIMPLE MODEL OF A TROUBLED BANK

Throughout this paper I will use the balance sheet of the “bank” shown on the left side of Table 1 to analyze alternative Government interventions. To simplify the analysis, I have assumed that all assets of the bank are “loans,” all unsecured creditors are “bondholders,” and there originally is only one class of equity.[2] To simulate a very troubled bank, I have further assumed that the aggregate market value of the bank’s “bad” loans is significantly below their book value (or original cost), and, for the sake of argument, has been “estimated” to be 15.

Market-value-based solvency measures reveal that this bank is economically insolvent. That is, as shown on the right side of Table 1, marking the bank’s assets to market wipes out the general unsecured creditors of the bank (or bank holding company) – the “bonds” – and the equity holders (in fact, it would create a negative equity account).[3] If this bank were taken over by the FDIC and liquidated, then the bond and equity holders would get nothing, and 10 would be paid by the Government, via FDIC insurance, to keep the deposit holders whole.[4]

Takeover and liquidation would limit the Government’s loss to its payment under FDIC insurance (i.e., 10) but would fail to account for the systemic damage that could arise immediately and, over time, as a result of letting this bank (and others like it) fail. It is the fear that these systemic losses may be very large that has driven the Government to adopt different strategies.

III. THE TROUBLED ASSET RELIEF PROGRAM, “TARP”

Under the Bush Administration, TARP was allocated $700 billion and went from being a troubled-asset purchase program to an equity investment plan. Under the Obama Administration, TARP continues as an equity investment plan, but once again is being considered as a means to purchase troubled assets. As discussed below, neither of these strategies will solve the underlying problems of zombie banks, and, furthermore, these strategies are inequitable because they favor unsecured creditors and equity holders over taxpayers.

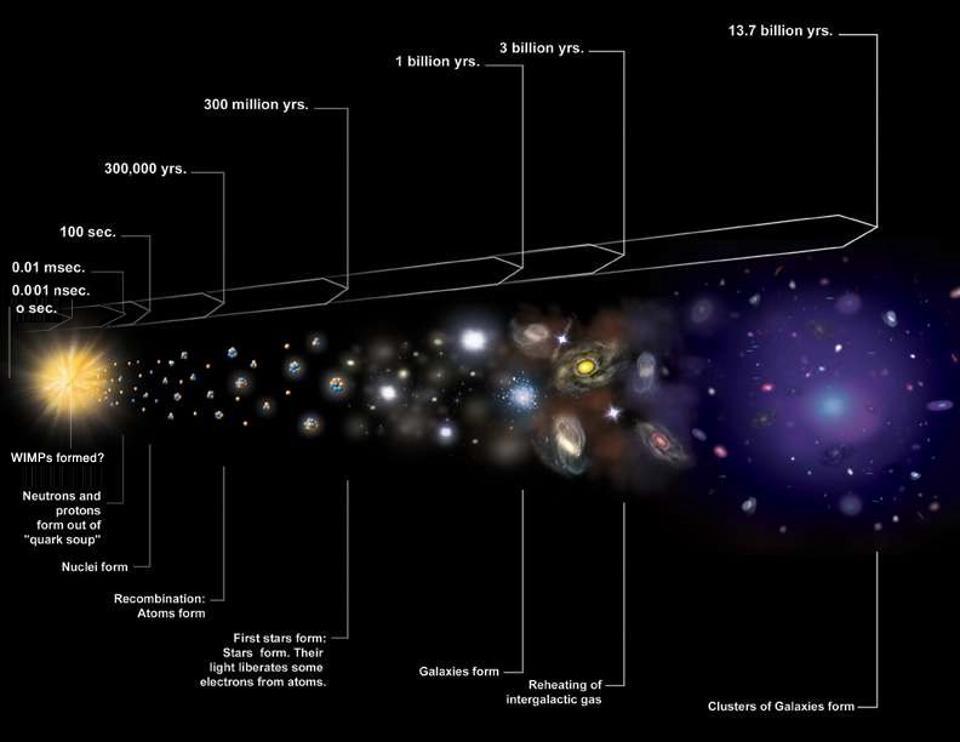

TARP as a Provider of Equity: For a healthy bank, new equity acts as “super money” – it has multiplier effect. For example, with a reserve/capital adequacy requirement of 10%, $700 Billion of TARP funds invested as equity in a bank could support $7 Trillion of new loans. But this multiplier also implies that for each dollar the bank loses it needs to shrink its asset base by $10. Alternatively stated, if a bank already has losses that are impairing its capital base, then these losses need to be made up before an equity investment can generate capacity for new loans.

The failure of TARP’s preferred stock purchase program could have been predicted by examining the balance sheet of our example bank before (Table 1) and after (Table 2) a TARP infusion of capital.[5] Here we consider an investment of 10 of preferred stock which matches the size of the bank’s original common equity. While this investment doubles book equity, it does not return the bank to solvency and no new loan capacity is generated. The net effect of this investment is to relieve the FDIC of its insurance obligation and to transfer that loss to the Government’s holding of preferred stock.

More Equity from TARP: If, as has happened with Citibank, the initial TARP purchase of preferred stock in our model bank turned out to be insufficient to return it to health, and market or political pressures subsequently cause the Government to purchase even more preferred stock (in our example, an additional 15), its solvency situation still would not be rectified. As shown in Table 3, although the bank now has a large amount of cash, its capital ratio is still inadequate (in fact, it is equal to zero). Therefore, the bank would be unlikely to make new loans. The most immediate result of the additional purchase of preferred stock by the Government would be to subsidize the liquidation value of the bonds.

To resuscitate our model bank, that is to bring its regulatory capital back to its original level (of 10), would require an equity investment by the Government equal to entire loss on the bad loans. In our example this would mean an equity investment of 50 which is five times the book equity of the bank. Clearly, the bond and equity holders would be thrilled if the Government made up the loss on all of the bad loans and let them continue to own and operate the bank. But I don’t think this is a course of action that taxpayers would consider appropriate.

A Citibank-Type Conversion of Preferred Stock to Common: The latest in the Citibank saga (at least as of March 1, 2009) is that the Government is converting its preferred stock to common equity and has “encouraged” other preferred stock holders to follow suit. If this same conversion is done in our model bank (after the two purchases of preferred stock totaling 25) and the conversion is done at book value, then the result would be as shown in Table 4.

In this transaction the Government gives up the priority its preferred shares have over the common equity. But to no avail – the bank is still economically insolvent. The old equity holders would favor the conversion (especially if it were done at book value and not market value) because it increases the probability that they will ultimately be paid something, and because it would allow them to avoid onerous dividend payments along the way. But why the Government is a willing participant is a mystery. The only rationale I can think of relates to market perception – by becoming a common stock holder the Government is signaling to the world that it is not prepared to let Citibank go bust, at least, not yet![6]

Cost to the Government: It is instructive to see how the Government’s now common equity investment in our model bank performs as a function of the ultimate value of the toxic assets. By plugging in various terminal values for the bad loans, and presuming that the remaining activities of the bank do not generate any income, it is possible to generate the payoff table shown in Table 5.

Even though it holds equity and not debt, the best the Government can ever do is to break even, and this occurs only if the bad assets regain all of their lost value! The Government loses money at all other terminal values of the bad assets. Between zero and 30 all proceeds realized from the bad assets go to subsidize the bond holders, until they are made whole. Only after that happens does the Government get anything, and then it must share receipts with the old equity holders 5/7th to 2/7th, reflecting the common equity ownership split (i.e., based upon book value). I doubt this payout function would be considered fair by taxpayers. It occurs because the unsecured creditors are paid off before taxpayers.

In summary, purchases of preferred stock may help banks that have small losses relative to equity – the “walking wounded.” However, TARP’s $700 Billion (and, in particular, the portion of that which remains unspent!) will be insufficient to meet the capital needs of all zombie banks. Furthermore, effective or not, spending TARP money to purchase equity in troubled banks benefits the existing unsecured creditors and equity holders at the expense of taxpayers.

TARP as a Buyer of Assets: The original intent of TARP was to purchase toxic assets from banks. It was argued that by removing bad assets from their balance sheets these banks would be in a position to lend to Main Street and could help foster an economic recovery.

The original plan proposed by Secretary Paulson was to have the Government own and manage the assets it acquired.[7] However, under Secretary Geithner, ownership would be shifted to PPIFs – Public-Private Investment Funds. The Government and the Private Sector are be 50/50 equity partners in each PPIF and each PPIF will be allowed to finance up to 85% of its toxic asset purchases with non-recourse borrowings from the Government.[8]

Although the stock market reacted positively to the idea of PPIFs, I doubt that PPIFs will be successful. In particular, I believe they will be plagued by issues related to price and fairness.

Price: Divergent interests of potential buyers and sellers explain why there has not been (and why I believe it is unlikely that there will be) agreement as to the appropriate price that should be used to remove toxic assets from the balance sheets of troubled banks and to place them on the balance sheets of PPIFs.

There are at least three “prices” to consider – Book Value, Market Value, and Inherent Value:

1. Book Value: This is an accounting concept. Ignoring write-downs, book value is original cost – what the bank paid for the asset (security or loan). After any TARP purchase, unless the toxic assets trade at book value, troubled banks would have realized losses (instead of what, for the most part until now, has been unrealized losses) and would need infusions of capital to make up the difference. While banks would be ecstatic to be bought out at book value, I do not hear any responsible party proposing it is a fair transfer price.

2. Market Value: This is an economic concept. Market value is the price the asset would trade at between willing buyers and sellers. Banks could be, but aren’t, selling toxic assets at market value. Perhaps the banks don’t want to realize losses, or maybe they think they will get a better price by holding on.[9]

3. Inherent Economic Value: This is a psychological concept. It relates to what Secretary Geithner, identifies as a distinction between the “basic inherent economic value” of troubled assets and the “artificially depressed value” that these assets command right now. While many pay lip service to inherent value, it has not been quantified and no purchase has been proposed at this price.

The Treasury’s plan for PPIFs makes reference to an auction process which would be used to determine the price for each toxic asset. It leaves unanswered difficult questions including: Will a bank be forced to accept the result of the auction or will it be allowed to forgo a sale if it believes the price is tool low? Will there be enough bidders at the auction of each asset to insure a fair price or will the uniqueness of each asset mean that bidders will specialize in certain assets leaving the other assets to other bidders?

An additional complication is the recent decision of the Financial Accounting Standard Board to loosen some of its mark-to-market rules. Not forcing banks to write downs assets to current market value will make them less willing sellers and will further undermine the PPIF program.

Fairness: An unstated reason to involve the public sector in asset purchases is that remaining TARP funds are insufficient to fund the scale of purchases that Treasury is contemplating, and asking Congress to expand TARP funding is probably not a viable option at this time. Fortunately (or unfortunately) the Government has almost unlimited capacity to provide non-recourse financing to PPIFs and can therefore proceed with a large scale asset purchase program without further Congressional approval. An additional reason to involve the private sector in these purchases is the belief that the private sector will do a better job of managing the assets than will the Government. While these benefits may be persuasive to Treasury, in fact, PPIFs create serious issues of fairness.

1. Non-Recourse financing: By its very nature non-recourse financing will limit the losses of investors in PPIFs to their initial investment – their “down payment.” This will put PPIFs in a “head they win, tails the Government looses” position. This will not be viewed positively by homeowners that have mortgages that do not allow them to simply walk away from their homes when a loss exceeds their down payments. Additionally, as Paul Krugman illustrated when PPIFs were first announced, non-recourse financing will artificially increase the price PPIFs should be willing to pay for toxic assets. If there is sufficient competition between PPIFs for each auctioned asset then this benefit will accrue to the selling bank. But if the auction process is not efficient, then some (or all) of the benefit of the non-recourse financing will accrue to the PPIFs. And in no case will the benefit accrue to taxpayers.[10]

2. Interest Rate: Banks are financing assets under various Government programs (i.e., TALF, etc.) at a rate that is virtually equal to zero.[11] Why should PPIFs have the same privilege? And if they don’t then how will they compete with the banks?

3. Liquidity: PPIFs are supposed to add liquidity to the market place. But how? Yes, the bad assets would be moved from the balance sheets of banks to the balance sheets of PPIFs. But, who are the PPIFs going to trade with that the banks can’t already trade with? Themselves? Hopefully not the banks (once they are relieved of the toxic assets)!

4. Management: PPIFs will supply their own managers for the toxic assets they purchase. But where will these employees come from? Will PPIFs be allowed to hire people away from the banks that hold the assets that are to be auctioned off (this would be a head hunters paradise!)? Won’t this create serious conflicts of interest? And, will the new employees, wherever they came from, get AIG-style guaranteed sign-on and retention bonuses in essence 85% financed by the Government? Finally, why should PPIFs do a better job at managing these assets than the employees of the banks that already own them? For better or worse, people at these banks have considerable experience with these assets – after all, they were involved in their creation and distribution, and once upon a time had active trading desks for them.[12]

PPIFs allow the Government to expand its asset purchase program beyond the funds that have been allocated to TARP. Additionally, PPIFs are a political expedient way to involve the private sector in the spoils of this potentially mega-purchase of toxic assets. But, beyond these “benefits,” I fail to see how PPIFs make economic sense for banks or taxpayers.[13]

IV. TEMPORARY TAKEOVER PLANS

When a bank is taken over and liquidated by the FDIC the unsecured creditors lose some or all of their value while the equity holders lose control of the bank and are wiped out. With TARP purchases of preferred stock or PPIF purchases of toxic assets the result is the opposite, the economic position of the unsecured creditors and the equity holders is bolstered and control has been traditionally left with existing management.[14]

Now consider an institution that is going to be taken over but won’t be liquidated and, in fact, will be restructured and kept as an ongoing entity because it is considered too big to fail. Who should own and manage the restructured bank and what should happen to the holdings of the unsecured creditors and equity holders? The answers to these questions are as much political as they are economic, and could come out anywhere between “change ownership and management” and “leave the existing ownership and management in control” for the first question, and “wipe them out” and “maintain their full value” for the second question.

My vote is for the Government temporarily to own the restructured bank. I would also have the Government find a new management team to run the bank. With respect to the unsecured creditors and equity holders, I would link the value of their positions to the subsequent performance of the bad assets, charging them with any losses, but allowing them to receive payments if enough of the bad assets don’t go bad. I will reflect these views in the analysis for Good Bank/Bad Bank and the Backstop Solutions presented in the next two sections and then provide additional rationales for my assumptions in Section VII.

V. A GOOD BANK/BAD BANK TAKEOVER

Here an insolvent bank would be divided into two banks – a “Good Bank” and a “Bad Bank”. The Good Bank is left with only good assets and therefore can turn its attention to making economically sound loans that would benefit the economy. The bad assets are sequestered in the Bad Bank (“out of sight and out of mind”). Since PPIF purchases are unnecessary, market values of the toxic assets need not be determined. Finally, the toxic assets are kept out of the market place and allowed to run their natural course.

I will illustrate the mechanics of a Good Bank/Bank Takeover with the simple bank model from the previous sections. Here I will assume that the original troubled bank becomes the Good Bank by transferring its bad loans to a new entity, the Bad Bank.

In my example, a Good Bank/Bad Bank Takeover has four elements: a division of the assets of the Original Bank into “good” and “bad,” a conversion of all unsecured creditors and equity holders of the Original Bank to equity holders in the Bad Bank, a loan from the Government to the Bad Bank to complete the purchase of the bad assets, and an equity investment in the Good Bank.

The Division of Assets: The Original Bank is divided into two banks – a “Good Bank” that maintains its deposit base (and therefore the franchise value of the bank) and all of the “good” assets, and a “Bad Bank” that acquires (and sequesters) the “bad” assets. The Bad Bank “finances” its acquisitions by assuming the bond and equity liabilities of the Original Bank at book value. A transfer at book value is convenient because it avoids valuation, accounting, and taxation issues. It is appropriate because it forces the liability holders to bear the fruit of their original investments. These assumptions are reflected in Table 6.

The Loan: A quick glance at Table 6 reveals an obvious problem: the assets and liabilities of the two banks are not balanced. In essence, since the book value of the Bad Loans exceeds the book value of the unsecured creditors and equity holders, the Bad Bank has not paid enough for the bad loans.[15] In order for the balance sheets of both banks to “balance” the Bad Bank needs to pay the Good Bank an additional 25. The question is, where can it get the money? And the answer is that, on its own, it can’t. That is, by assumption, the bad loans are worth only 15. Here is where the Government needs to step in by lending the Bad Bank 25 that is secured by the bad assets, even though they are worth only 15.

To prevent an unwarranted windfall from going to the old unsecured creditors and equity holders, the loan should be structured to make the Government the highest priority claimant of the Bad Bank. This would be in sharp contrast to what happens with TARP equity investments where the Government stands in line behind the unsecured creditors of the bank. A neutral interest rate for the loan would equal the weighted average interest rate the Bad Bank realizes from the “bad assets.” The net result of the loan (as shown in Table 7) would be 25 of cash shown as an asset on the balance sheet of the Good Bank and a 25 loan shown as a liability on the balance sheet of the Bad Bank.[16]

One consequence of the division of the assets of the bank into a Good and Bad Bank is that the franchise value of the original bank goes to the Good Bank. One way to think about this is that giving up the franchise value of the original bank is the price the unsecured creditors and equity holders must pay in order to receive the loan necessary to finance the bad assets and to keep their prospects alive. Another way to rationalize it is that the franchise value would have been lost in liquidation. In other words, the unsecured creditors and equity holders should be grateful for anything they are given in the restructuring.

Converting Unsecured Creditors to Equity: An examination of Table 6 reveals that if the Bad Bank is unable to meet its interest (or principal) obligations on the bonds, the bond holders could force a reorganization or liquidation of the Bad Bank which could result in the untimely sale of toxic assets. Also, there could be payments to the bond holders before payments are made to the Government to meet interest and principal obligations on the loan. To prevent either of these adverse events from happening, it is necessary to convert the claims of the old unsecured creditors into some form of equity and to not allow any dividend payments to be made until the loan from the Government is fully repaid. These assumptions are reflected in Table 7.[17]

The New Equity Investment: Finally, the Good Bank needs to raise new equity to meet capital requirements of the 21st century (in our example, 10) with the result shown in Table 8.

The Result of the Good Bank/Bad Bank Takeover: When all is said and done, there would be two banks instead of one.

The Bad Bank looks robust when its balance sheet is viewed through the prism of book value. In reality, this bank is economically insolvent. But unlike the Original Bank, it can avoid an immediate bankruptcy, attempt to weather the economic storm, and try to wind down in an orderly fashion. If and when a bad loan defaults, the balance sheet of the Bad Bank will shrink, first decreasing and then wiping out its equity, and then impacting the Government’s loan. If enough “bad” loans turn out to be “good,” then the equity holders will recover some of their original investment.

The Good Bank becomes “good” because it is able to “sell” its bad loans to the Bad Bank at book value (i.e., 65) and then raise additional capital (i.e., 10). Its balance sheet is pristine as measured by either book or market value (in fact, the two are the same). It is positioned to make economically sound loans that could foster economic growth.

Problems with the Good Bank/Bad Bank Takeover: While workable on paper, a Good Bank/Bad Bank takeover is flawed for two reasons:

First, for it to work we need to be able to distinguish “good” from “bad” assets. Unfortunately a bright dividing line does not exist. What was originally thought of as a problem limited to complex mortgage backed securities has spread to credit card and auto-backed securities, and more significantly, to ordinary commercial and industrial loans, consumer loans, and CRE loans. This means that with any asset division, the remaining assets of the Good Bank could subsequently go bad forcing yet another Government intervention. It also means that the equity holders of the Bad Bank could escape the economic consequences of the failure of assets that were acquired on their watch but left behind as “good” at the Good Bank.

Second, the belief that it is possible to simply put bad assets in a box and let them run off is naive. If bad assets were limited to securities, then perhaps the Bad Bank could be a passive player, accepting whatever payments come its way from the bad securities. But, as noted above, the problem extends far beyond securities. A troubled commercial, and industrial, or CRE Loan, especially when the troubled bank was the originator of the loan, is going to require active management. This means that the Bad Bank would need its own management team. Alternatively, it could contract with the Good Bank, or an outside firm, to manage it portfolio. Neither situation is ideal.

VI. A BACKSTOP GUARANTEE TAKEOVER

All of the benefits and none of the problems of the Good Bank/Bad Bank Takeover can be realized within the original bank using the Backstop Guarantee Takeover. It involves the following three steps:

The Backstop Guarantee: The Government guarantees the performance of all assets – the “Guaranteed Assets” – held by the bank at the time of the take over. However, this guarantee only comes into play if the Special Equity (see below) is wiped out.

Converting to Special Equity: All unsecured creditors and equity holders exchange their holdings for new securities – “Special Equity.”[18] These securities operate in the following manner:

1. The exchange takes place at book value.

2. Any loss realized on a Guaranteed Asset reduces the value of the Guaranteed Asset Account and simultaneously decrease the Special Equity Account by the same amount. Only when losses drive the Special Equity Account to zero is the Government called upon to honor its guarantee. In this case, the accounting entry would impact only the asset side of the balance sheet, decreasing the Guaranteed Asset Account by the size of the loss and increasing the Cash Account by the same amount with funds received from the Government.

3. The bank is given the option to repurchase the Special Equity at any time at its then remaining book value, but would be obligated to repurchase the Special Equity at its remaining book value either after a specified time frame or after a pre-determined percentage of the Guaranteed Assets have wound down.[19]

4. Special Equity would be paid (either currently or perhaps, more appropriately to protect the Government’s Guarantee, as an increase to their book value) a fraction of any income received from the Guaranteed Assets equal to the remaining book value of the Special Equity divided by the remaining book value of the Guaranteed Assets.[20]

The New Equity Investment: The Guaranteed Bank raises new equity.

Table 9 shows our example bank after a Backstop Guarantee Takeover. All of its assets are guaranteed, the old unsecured creditors and equity holders have become Special Equity Holders, and cash has increased by 10 to reflect the new equity. It is interesting to note that the balance sheet of this bank would shrink in size if any of its guaranteed assets default, but because of the Government’s backstop guarantee, the banks level of capital will remain constant. Like the Good Bank, this Guaranteed Bank would be in a position to make new loans that could foster economic growth and return the bank to profitability.

A Backstop Guarantee Takeover eliminates the two problems I identified for a Good Bank/Bad Bank Takeover. First, there is no need to make a distinction between good and bad assets. The Backstop Guarantee applies to all assets held at the time of the takeover and therefore the structure of the Special Equity puts the old unsecured creditors and equity holders in the position they would have had in the Good Bank/ Bad Bank Takeover, while giving them the added responsibility of absorbing losses on assets that were once deemed good (those that would not have been transferred to the Bad Bank) but subsequently go bad. And second, all of the assets stay at the original bank which eliminates the need for a duplicate set of managers.

Dealing with Derivatives: Derivatives (in particular swaps) present a unique challenge because they can switch from being assets to liabilities as market conditions change. The derivative markets should welcome the Good Bank or the Guaranteed Bank as a counterparty to transactions because of its improved credit standing. But, if this turns out not to be the case, then it may be necessary for the Government guarantee to extend to pre-existing derivative positions.

The Cost of the Takeover: Table 10 presents the cost of a Backstop Guarantee Takeover (a Good Bank/Bad Bank Takeover yields virtually the same results) to the Government as a function of the realized value of the bad assets. It is interesting to compare this table to the cost of the TARP equity investment presented in Table 5. In both instances the Government’s maximum exposure is 25. But, under the temporary take-over plans the Government has the first right to all payments from the bad assets, while under TARP the bonds are paid off before the Government receives its first payment, and then the Government is forced share any residual with the old equity holders. Under either temporary take-over plan, the toxic assets need only appreciate from their estimated value of 15 to 25 for the Government to be made whole, while under TARP they must return to full value (i.e., 65). This is an important benefit of the takeover plans when compared to TARP, one that greatly reduces the expected cost to taxpayers.

VII. OWNERSHIP AND MANAGEMENT OF THE RESTRUCTURED BANK(S)

New equity is issued in either takeover strategy which raises the questions: who should own the equity, and who should manage the restructured bank(s)?

Ownership: One possibility is for the Guaranteed Bank (or the Good Bank) immediately to engage in an IPO, selling off new equity to the public. In this case, the new shareholders would control and appoint management for the bank. While theoretically possible, I believe that there are practical and political reasons to postpone an IPO until a later date.

Practically: It may be difficult, or impossible, to generate public demand sufficient to satisfy the capital needs of one “Citibank,” let alone multiples of that which might be required to cover the capital needs of the many banks that may ultimately be subject to temporary takeovers. In this very uncertain environment, the Government holds all the cards – it is the rule maker, the lender of last resort, and the stimulus provider. Until the Government’s programs are fleshed out and fundamental questions are answered (like, is the Government going to bail out the automotive industry?), it will be difficult for the public to value any new equity issuance.

Politically: Given the size of the Government guarantee under the Backstop Guarantee Takeover, or the size of its loan under the Good Bank/Bad Bank Takeover, taxpayers may expect (and perhaps have a right to demand!) that the Government initially be in control of the restructured bank. And, taxpayers will expect a fair return for the risk their Government is taking. The easiest way to insure that these expectations are met is to have the Government own all the equity initially, but for the Government to have a publicly stated goal to restore the bank to private ownership as soon as possible.[21]

Management: After the bank is restructured its ongoing operations will need to be managed. Two questions arise: To what end? And, by whom?[22]

To What End? This is the important question, but one I will not attempt to answer here. Instead I will provide a few follow-up questions: How can we prevent this crisis from recurring? What should be the role of an institution in our society that is able to use Government guaranteed deposits to fund its operations? How big should a bank be allowed to become so that it is efficient, but not too big to fail? What is the purpose/role of speculation at a bank? Should we re-establish the split between investment and commercial banking? What new role should regulators play? And, etc. Only by answering questions like these can we set a rational course for banks that are taken over, one that will benefit the economy while returning the banks to profitability. And, answering these questions is the key to making a temporary takeover in fact temporary.

By Whom? I believe that this question has a simple answer, once the “To what end?” question has been adequately addressed. Clearly the historical performance of existing (or recently departed) senior management makes them inappropriate to manage the restructured bank. Additionally, the Government should not appoint “one of their own” to make minute to minute decisions for the bank as they lack appropriate experience. Luckily, America has a wealth of executive talent. Given the right mandate and correct incentives, I firmly believe that the senior management roles at banks that are temporarily taken over will be easy to fill with qualified people.

VIII. CONCLUSION

Our financial system is in crisis. Even though mind boggling amounts of money have been deployed, steps taken to date under TARP have been ineffective. Additionally, the Government’s response has been viewed by the public as inequitable – Wall Street is seen to have benefited at the expense of Main Street, with “we the citizens” footing the bill. Something different is needed, and that is a temporary takeover of troubled banks by the Government. A Good Bank, Bad Bank Takeover is one option, but a Backstop Guarantee Takeover is even better.

I want to thank Barry Goldman, Mark Holtz, Mike Prell, Ron Rolfe and Clifford Sosin for helpful comments. I take full responsibility for the contents of this paper.