Big Think Chief Economist Daniel Altman explains the benefits and the difficulties of taxing so-called “externalities,” such as carbon emissions.

Daniel Altman: Australia’s government moved very close this week to adopting what’s called a carbon tax. What it essentially is, is a tax on companies who, during the production process of whatever it is they make, emit carbon dioxide and other noxious emissions. Now, these gases obviously are polluting and they cause a problem for all of us, but they’re not directly related to the production process. They are a side effect of the production process that affects people who are not part of that company. Economists call this an externality and this is an externality in production.

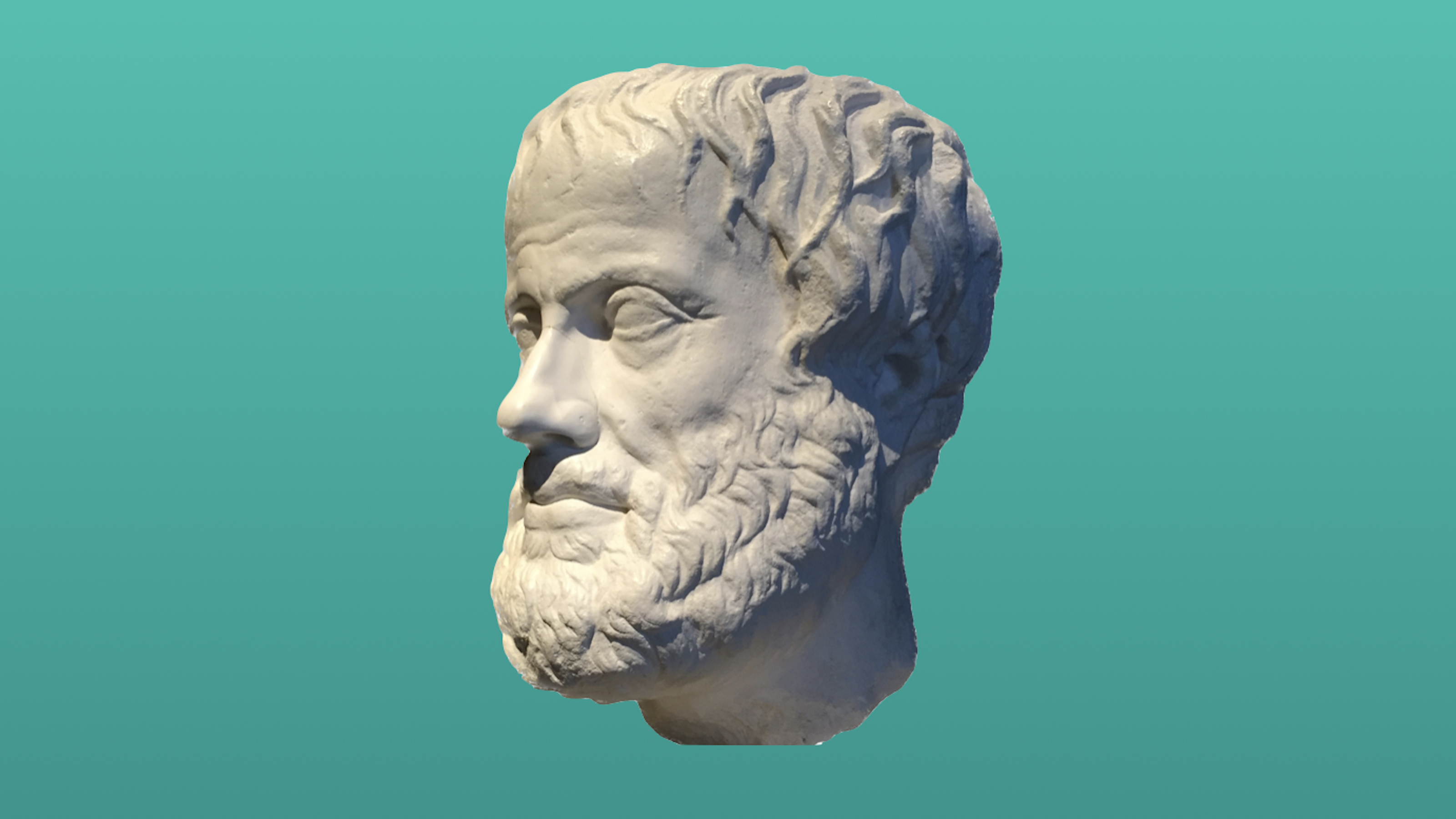

One of the ways that economists have proposed to deal with externalities like this came from A.C. Pigou, an economist in the early part of the last century who said, “Well, we could tax the externality by exactly the amount that it costs society.” And that’s what Australia is doing. They’re going to say that every ton of carbon emissions is going to cost the company 23 Australian dollars. So if you pollute 10 tons of carbon emissions a year, you’re gonna pay 230 Australian dollars a year for that. And as a result, your production is becoming more expensive and you will pull back on production perhaps to a level that would be more efficient for society and social welfare as a whole.

The idea is that, people who don’t have to pay for their externalities produce too much. So if you have to pay for them, you’ll pull it back to a level that’s more in line with society’s best interests. The problem is, if you’re trying to estimate the size of that externality, it could be quite different depending on what else is happening in your economy or how much emissions is actually going out of the factories in a given year. So you have to constantly re-estimate how big that tax should be. And that’s quite a difficult process that you’re going to need a lot of help with from economists and technicians, everybody every year. And it has a lot to do with what society actually cares about. You need to know how much your people are affected by pollution.

So this tax can be a very neat solution economically, but a very difficult one to implement as well.