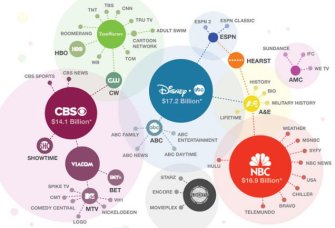

98 companies AT&T-Time Warner will own after the $85 billion merger

A federal judge ruled Tuesday that AT&T may purchase Time Warner, without any conditions, arguing that the $85 billion deal doesn’t violate antitrust law.

The six-week trial was a monumental win for corporate interests, likely clearing the way for other potential mergers like Disney and Fox, or T-Mobile and Sprint.

“A whole bunch of companies are all of a sudden going to get active,” Hal Vogel, CEO of Vogel Capital Management, told Fast Company. “The bankers have been romping around trying to figure out what they should do, if and when. Now that the decision is here, they’re going to move pretty quickly.”

AT&T argued that it needed Time Warner’s brands to survive in an increasingly competitive and consolidated media landscape.

“We look forward to closing the merger on or before June 20 so we can begin to give consumers video entertainment that is more affordable, mobile, and innovative,” AT&T General Counsel David McAtee said in a statement.

In November 2017, the Justice Department filed a lawsuit to stop the merger, saying it would bring less competition and higher prices.

Source: Gizmodo

Judge Richard Leon disagreed on all counts.

“The Government has failed to meet its burden of proof to show that the merger is likely to result in a substantial lessening of competition,” he wrote in his ruling. “If there ever were an antitrust case where the parties had a dramatically different assessment of the current state of the relevant market and a fundamentally different vision of its future development, this is the one.”

The Justice Department’s top antitrust official, Makan Delrahim, said the government was considering “next steps.”

“We continue to believe that the pay-TV market will be less competitive and less innovative as a result of the proposed merger between AT&T and Time Warner,” he said in a statement.

The ruling is significant because it ostensibly sets a precedent on vertical mergers, defined as the combination of two companies that produce the same product but at different stages of the production process.

“It’s open season for vertical mergers,” Chris Sagers, an antitrust law professor at the Cleveland-Marshall College of Law, told CNN Money. “The fact is that they’ve gotten a little easier, and we’ll see a big flurry of deals.”

One way the deal could hurt consumers is if AT&T decided that only subscribers to its services can access Time Warner content, like HBO shows and DC films. That might help AT&T-Time Warner keep customers from cutting ties with cable and flocking to Netflix, which has been preparing for this moment for years by producing a cache of in-house content, but some argue it will give the conglomerate more power to raise prices on content without providing better service, and render smaller streaming services less competitive.

While the ruling has spurred media executives and analysts to look into other high-profile mergers, Judge Leon cautioned against considering it a decisive precedent.

“…the temptation by some to view this decision as being something more than a resolution of this specific case should be resisted by one and all!”

Here are the companies AT&T acquired in the merger:

- HBO and Cinemax, as part of Home Box Office Inc.

- TBS, truTV, TNT, Studio T, and TCM, as part of Turner Entertainment Networks

- Adult Swim and Cartoon Network, as part of the TBS, Inc. Animation, Young Adults & Kids Media (AYAKM) division

- CNN and HLN, as part of CNN News Group

- The websites Super Deluxe, Beme Inc., and CallToons

- DC Entertainment

- DC Films, including all of the “Batman” movies

- Turner Broadcasting International

- Turner Sports, including the website Bleacher Report and the rights to March Madness and NBA playoffs

- The CW (50%)

- Warner Bros. Animation

- Hanna-Barbera Cartoons

- Fandango Media (30%)

- Warner Bros. Consumer Products

- Warner Bros. Digital Networks

- Warner Bros. Theatre Ventures

- Warner Bros. Pictures International

- Warner Bros. Museum

- Warner Bros. Studios, Burbank

- Warner Bros. Studios, Leavesden

- Warner Bros. Studio Tours

- Warner Bros. Pictures

- Warner Animation Group

- Warner Bros. Family Entertainment

- NonStop Television

- New Line Cinema

- Turner Entertainment Co.

- WaterTower Music

- Castle Rock Entertainment

- The Wolper Organization

- HOOQ

- Blue Ribbon Content

- Warner Bros. Television

- Warner Horizon Television

- Warner Bros. Television Distribution

- Warner Bros. International Television Production

- Telepictures

- Alloy Entertainment

- eleveneleven

- Warner Bros. Home Entertainment

- Warner Bros. Interactive Entertainment

AT&T had already controlled:

- Ameritech

- Ameritech Cellular

- Ameritech Interactive Media Services

- Ameritech Publishing

- AT&T Communications (2017)

- AT&T International

- AT&T Originals

- AT&T Alascom

- AT&T Business Internet

- AT&T CallVantage

- AT&T Computer Systems

- AT&T FSM Library

- AT&T GoPhone

- AT&T Information Systems

- AT&T Intellectual Property

- AT&T Intellectual Property I

- AT&T Labs

- AT&T Mexico

- AT&T Mobility

- AT&T Technologies

- AT&T Wireless Services

- BellSouth

- BellSouth Advertising & Publishing

- BellSouth Long Distance

- BellSouth Mobility DCS

- BellSouth Telecommunications

- Centennial Communications

- CenturyTel of the Midwest-Kendall

- Cricket Wireless

- Crunchyroll

- DirecTV

- Fullscreen (company)

- Illinois Bell

- Indiana Bell

- International Bell Telephone Company

- Michigan Bell

- Nevada Bell

- Ohio Bell

- Otter Media

- Pacific Bell

- Pacific Bell Directory

- Pacific Bell Wireless

- QLT Consumer Lease Services

- Rooster Teeth

- SBC Long Distance

- SBC Telecom

- Southwestern Bell

- Southwestern Bell Internet Services

- Southwestern Bell Mobile Systems

- Southwestern Bell Yellow Pages

- Unefón

- Univel

- Unix System Laboratories

- AT&T U-verse

- Wisconsin Bell

- Yellowpages.com

- YP Holdings