The Fiscal Cliff Deal Hits the Rich the Hardest

Depending on what you’re reading, the deal Congress finalized late Tuesday night to steer us away from the fiscal cliff represents either a “complete rout for the Democrats” or a windfall for the rich at the expense of the working class.

How can the spin machines on the left and right make these mutually exclusive claims with a straight face? In a word: baselines. It all depends on which previous tax structure we’re comparing the new one to. Both sides are playing fast and loose with recent history.

Especially the left. Henry Blodget charges that the tax deal “will disproportionately help the richest Americans” while raising taxes on the little guy:

By not addressing the payroll tax, the Fiscal Cliff deal will also result in a tax hike for all working Americans, including those in the middle and poor classes. All income up to $110,000 will now be socked with a 2 point increase in the payroll tax, from 4.2% to 6.2%, which will pluck $2,000 out of the pockets of families making $100,000 a year.

Meanwhile, thanks to a deal on dividend taxes, the highest earning Americans have gotten a massive tax cut over the taxes that would have taken effect had a Fiscal Cliff deal not been agreed to.

Happily for liberals, this is (mostly) bunk.

It’s true that the payroll tax is going up, if you take the current rate of 4.2% as your baseline. But speaking more precisely, the rate is going back up to where it was in 2010, 6.2%, before President Obama pushed through a temporary cut to spur economic growth. And this return to the previous payroll tax rate hits everyone, not only those earning under $110,000. (It’s just that the tax applies only to the first $110,000 in income.)

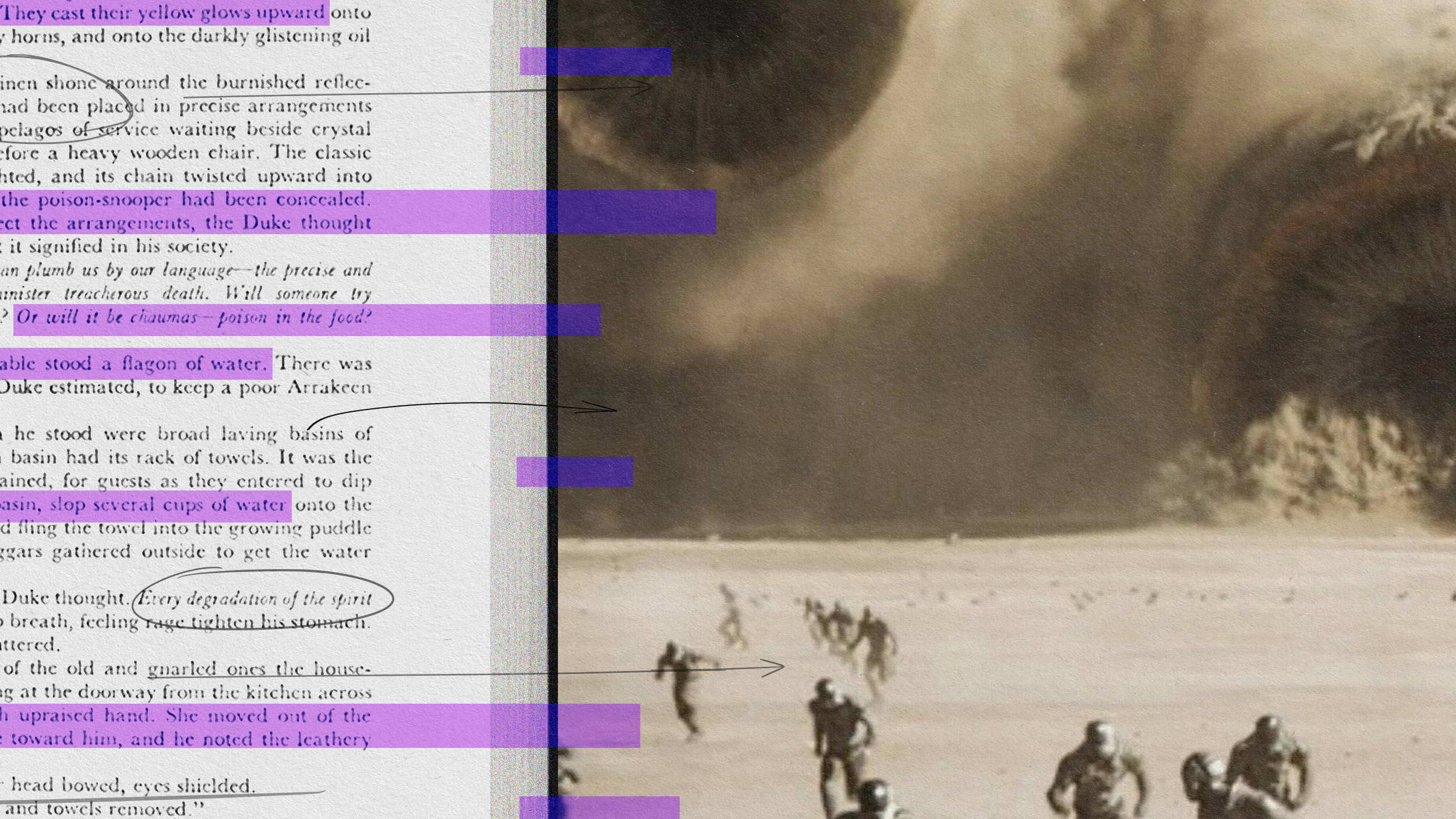

As for dividend taxes, we find another sleight of hand in Blodget’s alarmism. How could the agreement to raise the dividend tax rate to 20% from 15% on individuals earning over $400,000 a year result in “saving the richest Americans at least $20 billion in dividend taxes”? This math holds only if you take the year 2002, not 2012, as your baseline. As part of the series of tax cuts initiated by President Bush in 2003, the tax rate paid on dividends fell from ordinary income tax rates (at the time, up to 35 percent) to a flat rate of 15%, or lower for the lowest earners.

So yes, in 2013 high earners will be paying less in dividend taxes than they did under the 2002 regime, but they’ll be shelling out a lot more than they paid in 2012. A high earner who takes home $100,000 in dividends will pay $20,000 in taxes in 2013 rather than $15,000 under 2012 rates. That is a meaningful increase in taxes on the very wealthy.

If Blodget were to take the Clinton-era taxes as his baseline across the board, he would find the fiscal cliff resolution a lot more palatable. Moving back to the income tax rates of 2000 for everyone would usher in a huge tax increase on the poor and middle class:

Compare these rates to the rates going into effect this month as a result of the fiscal cliff negotiations:

Tax BracketSingle Filers 10% Bracket $0-$8,700 15% Bracket $8,700 – $35,350 25% Bracket $35,350 – $85,650 28% Bracket $85,650 – $178, 650 33% Bracket $178,650 – $388,350 35% Bracket $388,350 – $399,999 39.6% Bracket $400,000 and above

Taking these numbers to heart, it is not only “the richest Americans [who] have dodged a big tax bullet” as a result of this deal. Low-wage earners dodged the bullet of seeing their tax rates rise from 10% or 15% to significantly higher rates.

A New York Times graphic confirms that the highest earners will pay the biggest premium:

The upshot? Yes, taxes are going up on everyone. But the wealthy will bear a larger share of the burden. As Jordan Weissman writes in the Atlantic, “the top 1 percent could end up paying more overall in federal taxes next year than at any time since at least 1979.” The deal is no panacea, but it’s no liberal nightmare.

Follow Steven Mazie on Twitter: @stevenmazie