New Study: Insurers Take Both Sides in the War on Obesity

The other day I pointed out the conflicting motives of corporations that sell soda, snacks and fast food: They promote “wellness” because they want manageable health-care costs, but they also promote their products. And those are linked to just those long-term “lifestyle” diseases that push health-care costs up. Now comes this study in the American Journal of Public Health, which documents the mixed motives of another set of corporations—companies that sell health and life insurance.

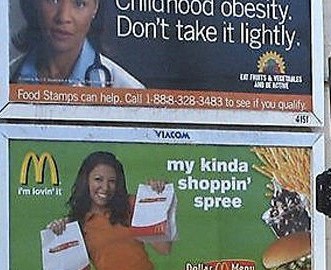

American insurance companies have invested $1.88 billion in the country’s five largest fast-food chains, according to the paper, by Arun Mohan and four colleagues at the Harvard Medical School. For example, Northwestern Mutual, which says it is “committed to promoting a wellness culture” for its employees, has $318.1 million invested in McDonald’s stock, according to this summary of the paper over at SciAm.

The issue here isn’t the food itself, but the marketing. Eating a Big Mac now and then won’t necessarily increase any particular person’s risk of diabetes or heart attack. But advertising has profound effects on the population as a whole. If you’re invested in ads for fast food, you’re invested in a product that causes people to eat more, and (perhaps, according to this study) to eat more quickly. So you’re making money by lowering the resistance of millions of people, some of whom are certain to be at risk (that would be the people your wellness campaigns exhort to eat better).

Pointing this out is a very clever move on the part of the authors: Without demonizing fast food or the people who eat it, they’ve managed to frame it as a less-than-wholesome businesses, like gambling and porn. Last year, when a similar study did the same number on insurers that own tobacco-company stock, some howled in protest. Northwestern Mutual, for instance, claimed its tobacco holdings were a tenth of those reported.

No matter how insurers respond to this new paper, the doctors have still won the media round. If the companies say it’s no big deal, they look like hypocrites. If they divest, or rush to say they aren’t invested that heavily, they’ve conceded that fast-food stocks are, like tobacco shares, the sort of financial instrument you wouldn’t bring home to mother.